What to know:

- Ah, behold! Strategy’s preferred stock, STRK, flaunts a dazzling 9% dividend yield, all while being less volatile than MSTR or even that wild beast, bitcoin! 🐴💸

- And wait, there’s more! STRK comes with a 10-to-1 conversion option, just in case MSTR decides to play nice and hits $1,000. Dream big, right? 🌈

- But hold your horses! That hefty $21 billion ATM issuance might just rain on STRK’s parade, much like it did for MSTR’s common stock. ☔️

Preferred stock, like our dear STRK, is a curious creature—a blend of equity and debt. It grants its holders a more generous slice of the dividend pie than those common stock folks, and a better claim to the company’s assets if things go south. STRK is a perpetual issue, lacking a maturity date (like equity) and paying a fixed dividend (like debt). Talk about commitment issues! 😅

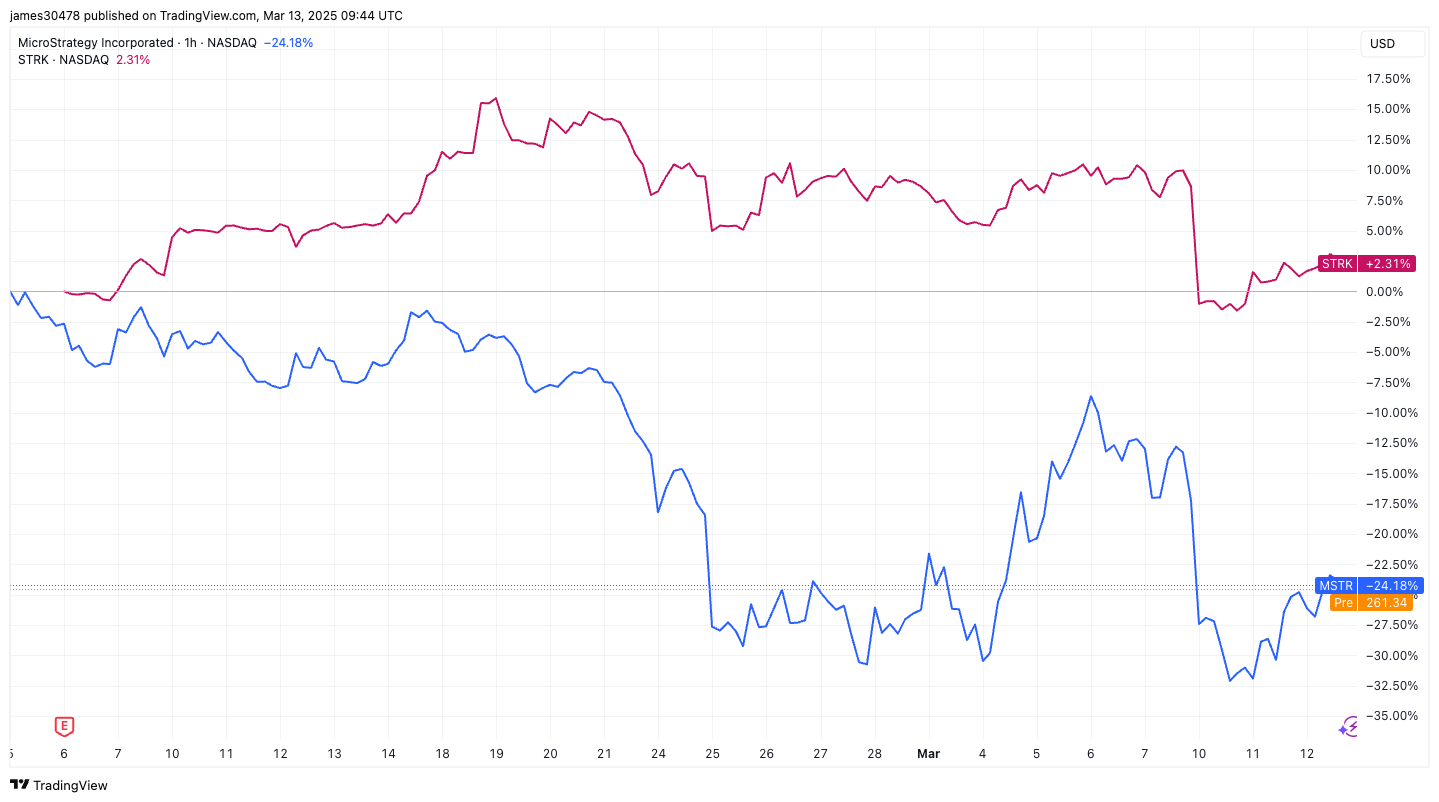

These traits make preferred stock less volatile than common stock. And STRK? It’s strutting its stuff with a 26% correlation to MSTR and a slightly negative -7% correlation with bitcoin (BTC). Less volatile at 49%, compared to bitcoin’s wild 60% and MSTR’s rollercoaster ride exceeding 100%. 🎢

Last week, Strategy announced a jaw-dropping $21 billion at-the-market (ATM) offering for STRK. They’re ready to sell that amount at the current market price over time. If they sell it all, the annual dividend bill could hit around $1.68 billion. Yikes! 💸

To generate that kind of cash, the company might have to sell common stock through an ATM offering—unlikely, given the recent share price slump—or rely on cash from operations or convertible debt. Talk about a financial juggling act! 🤹♂️

STRK offers an 8% annual dividend yield based on its $100 liquidation preference, and at the current price of $87.45, it’s effectively around 9%. Just like with debt, the higher the STRK price, the lower the yield, and vice versa. It’s a twisted game of financial limbo! 🎉

STRK also has a nifty feature allowing each share to convert into 0.1 share of common stock, at a 10-to-1 ratio, when MSTR hits or exceeds $1,000. Strategy stock closed at $262.55 on Wednesday, so it better appreciate significantly for that option to become viable. Fingers crossed for some serious upside! 🤞

As a product that generates income with lower volatility, STRK is like the calm in the storm, offering stability with a hint of potential upside. But beware! That massive ATM offering could throw a wrench in the works, just like it has for the common stock’s performance. Buckle up! 🚀

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

- Basketball Zero Boombox & Music ID Codes – Roblox

- How to use a Modifier in Wuthering Waves

2025-03-13 14:55