What to know:

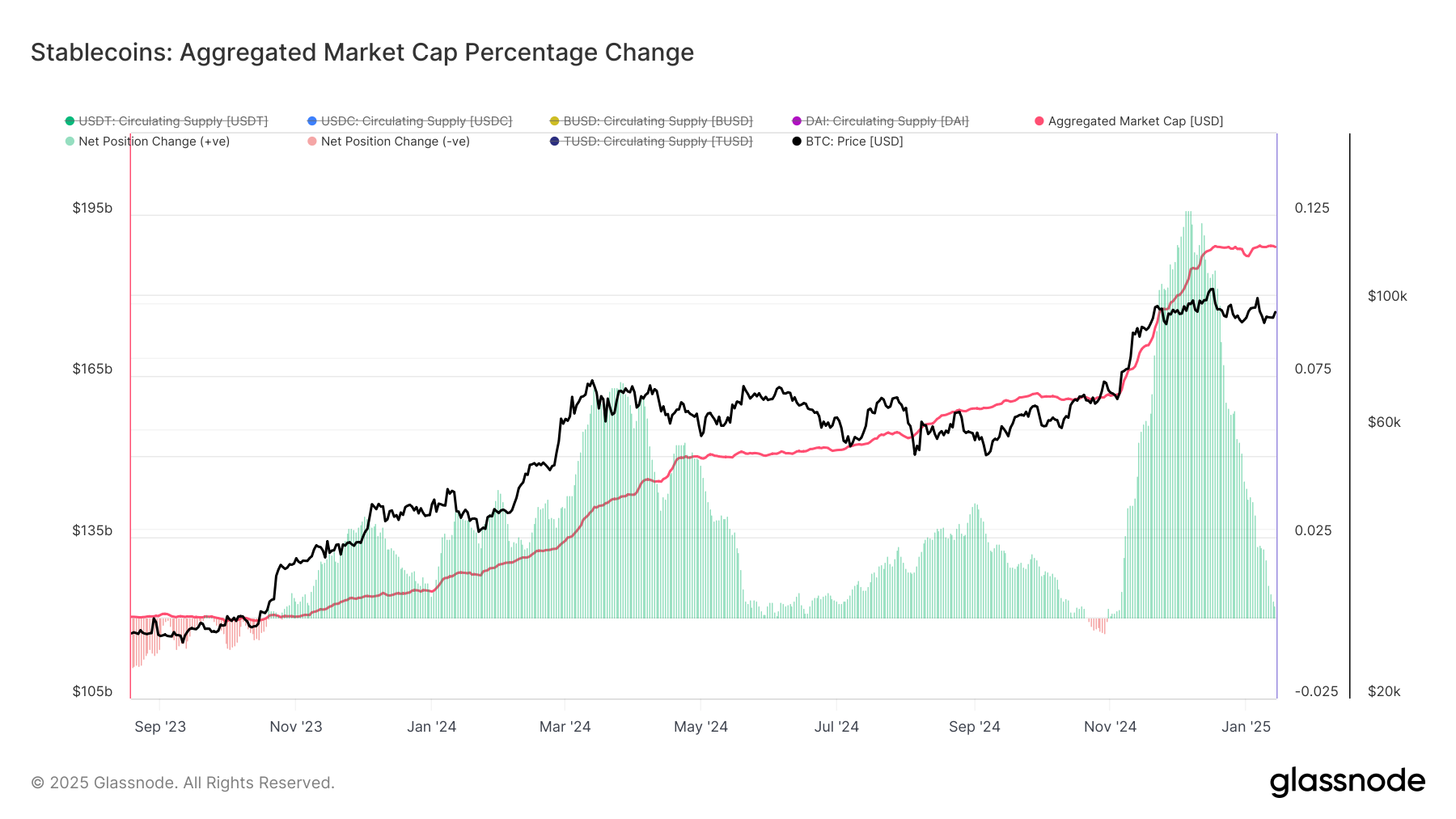

- The combined supply of top four stablecoins has stabilized with barely any change over the 30-day period.

- That starkly contrasts the liquidity deluge observed during the November-December rally.

- Drying up of new stablecoin liquidity raises the risk of renewed downside volatility after U.S. CPI report.

Bitcoin’s (BTC) quick bounce back from around $90,000 since Monday suggests a bullish outlook. Yet, there’s one element that questions the longevity of these increases, implying potential for substantial price fluctuations if the upcoming U.S. inflation figures on Thursday exceed expectations and show higher-than-anticipated rates.

The steady level of major stablecoin supply, at approximately $189 billion, suggests that new investments into the market are minimal, as indicated by a 30-day increase of only 0.37%. Data from Glassnode shows this trend.

In simpler terms, Stablecoins are digital currencies that hold their value steady by being linked to real-world assets, such as the U.S. dollar. These coins are commonly utilized for buying cryptocurrencies and have served as a secure option when markets drop during a bear trend, like in 2022.

The recent decrease in new stablecoin influx indicates a potential weakening market for purchasing, as it occurs just before the U.S. Consumer Price Index (CPI) release. This is noticeably different from the growth of stablecoin liquidity that was seen during the November-December rally and at the start of last year.

Glassnode stated in a Telegram message, “It’s clear from the 2024 late rally that nearly twice as much capital was needed for a smaller price increase to occur, which highlights the speculative demand and market momentum driven by liquidity that has since subsided.

13:30 UTC on Wednesday, data is anticipated to reveal that the cost of living increased by 0.3% compared to the previous month in December, maintaining the same pace as November. The yearly growth rate is projected to be 2.9%, an increase from the 2.75% recorded in November. The core figure, which excludes the volatile food and energy costs, is predicted to show a 0.2% monthly increase and a 3.3% yearly rise.

A stronger-than-anticipated headline or key figure is likely to strengthen worries that the central bank may be less eager to reduce interest rates than predicted. These worries, fueled by last Friday’s robust jobs report, played a part in Bitcoin dropping below $90,000 on Monday.

recently, the shortage of stablecoin liquidity, which was previously viewed as a reserve ready for crypto investments, stands out in sharp contrast to the massive inflows of $27.3 billion observed in November and December, contributing significantly to the Bitcoin price surge from around $70,000 to over $108,000.

During the first quarter of 2024, there was a smaller influx of $14.68 billion into stablecoins compared to other periods, as prices increased by around 70% and surpassed $70,000.

Or simply: In Q1 2024, the inflow of stablecoins was less than usual, with prices climbing nearly 70% to over $70,000.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-15 11:25