Stablecoins Take Over: 9 of 10 Banks Jump on the Bandwagon! 😱💸

Once considered mere experiments, stablecoins now surge into the heart of global finance — faster, clearer, more ready than ever. Truly, the transformation is so rapid, one wonders if the world has gone mad, or perhaps just woke up to the brilliance of digital change— or maybe both. 🤔

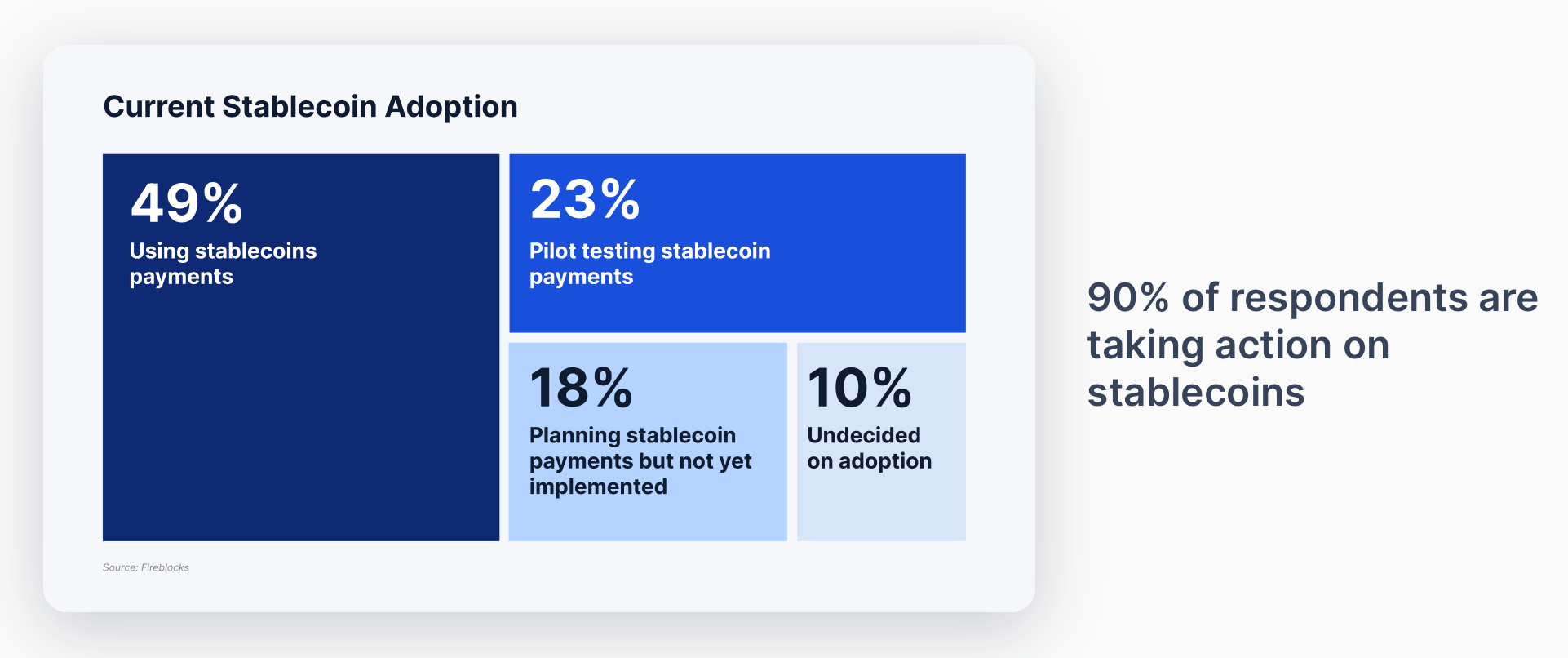

Fireblocks’ Survey: 90% of Firms Have Stablecoin Initiatives Underway

The report, based on a survey of 295 financial executives, reveals that a staggering 90% of firms are actively implementing stablecoins. Nearly half of all transactions on Fireblocks are now involving these shiny digital tokens in 2024. Banks and payment providers process over 35 million stablecoin transactions every month—because nothing says “trust” like digitally escaping the laws of physics and overhead delays. Cross-border payments, especially for B2B in emerging markets—because who doesn’t love a good delay and high fee drama?—are now dominating. Clearly, traditional rails are clogging up, and the digital cavalry is here, kicking up a storm. 🚀

Speed and liquidity—those are the real kings now. 48% shout, “Faster settlement is everything!” because waiting feels like eternity when you could be sipping mojitos instead. Ironically, it’s not cost savings that drive this frenzy; it’s the revenue, naturally, as institutions scramble to reclaim market share and conjure new corridors out of thin air. Regulatory worries? Pfft! Fewer than 20% complain about compliance—down from 80% last year—likely because regulators finally got the memo, or maybe they just got bored. Either way, clarity reigns, and institutions are jumping in like kids in a candy store. 🍭

Adoption varies wildly—from Latin America leading with 71% using stablecoins cross-border, to Asia eyeing expansion, while North America lingers with 39%. But worry not! 88% of North American firms see regulations turning friendlier, and Europe, always cautious, demands safety first — with 37% demanding safer rails, perhaps to prevent the horror of losing their investments in a digital Titanic. ⚓️

Infrastructure is the backbone—86% say they’re technically prepared, but scalability remains the monster lurking under the bed. Fireblocks warns that only enterprise-grade solutions will do; otherwise, chaos ensues. Security? Still a concern for 36%, because who doesn’t love a good villain in the story? Partnerships like Zeebu, which processed a monstrous $5.7 billion in telecom settlements using stablecoins, show that scalability isn’t just talk; it’s real and happening. 💥

In the end, the report declares: stablecoins are no longer optional. No, sir. With competition fierce, use cases exploding—from instant settlements to programmable money—adoption is now a strategic must. Those who invest wisely, securing compliance and security, will lead the next chapter of this strange, digital revolution—perhaps even to salvation, or at least financial salvation. 🚀

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- How to use a Modifier in Wuthering Waves

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Ultimate Half Sword Beginners Guide

- Mistfall Hunter Class Tier List

- Watch Mormon Wives’ Secrets Unveiled: Stream Season 2 Free Now!

- Fountain of Youth

2025-05-16 21:59