What to know:

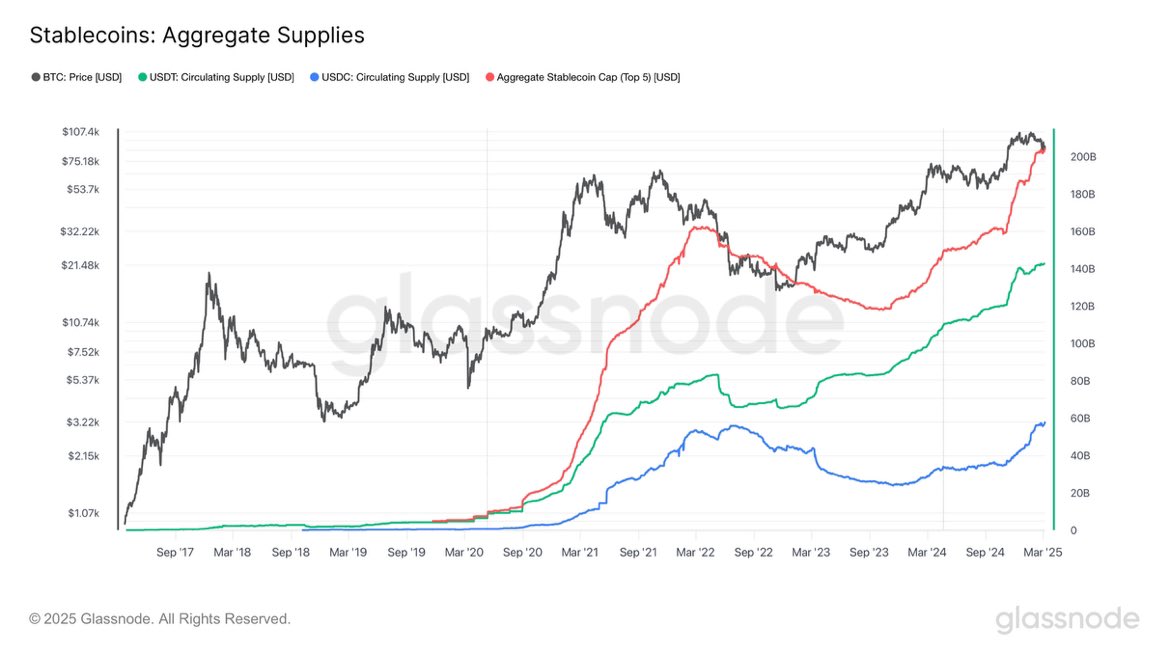

- Well, would you look at that! The stablecoin supply has galloped past $200 billion.

- USDC is strutting close to a $60 billion market cap, gaining a whopping $25 billion since the last election—talk about a political boost!

- Tether, bless its heart, is still clutching onto those 3-month U.S. Treasuries while China and Japan are tossing U.S. paper like yesterday’s news.

In a twist that would make even the most seasoned gambler raise an eyebrow, the combined market cap of the five biggest stablecoins has crossed the $200 billion mark for the first time. This comes after Treasury Secretary Scott Bessent declared on Friday that these digital assets would help keep the good ol’ greenback as the world’s reserve currency. Ain’t that a hoot? 🤠

According to the wise folks at Glassnode, the market cap of these coins, which are as stable as a three-legged mule, climbed as high as $205 billion. Investors, bless their hearts, are flocking to these coins like moths to a flame, seeking refuge from the plummeting values of cryptocurrencies like bitcoin (BTC) and ether (ETH). 🥴

Since President Trump rode into office, the stablecoin market cap has swelled by $40 billion. With cryptocurrencies and U.S. equities floundering like fish out of water, stablecoins have emerged as the clear winners. Who would’ve thought? 🤷♂️

Market leader Tether’s USDT has been holding steady at around $140 billion since December, while its sidekick USDC, issued by Circle, is inching closer to $60 billion—an increase of $25 billion since the election. Talk about a financial glow-up!

At the Digital Asset Summit, Bessent proclaimed, “We are going to keep the U.S. the dominant reserve currency, and we will use stablecoins to do it.” Well, bless his heart, he sure knows how to make a statement! 😏

His remarks shed light on the worries over macroeconomic and geopolitical uncertainty, which could lead to a dip in foreign demand for U.S. debt, pushing treasury yields higher than a kite in a windstorm. Over the past year, Japan and China, the two biggest holders of U.S. Treasuries, have been trimming their holdings like a gardener in spring.

For the dollar to keep its crown as the world’s reserve currency, there must be a steady demand for U.S. debt. The administration has identified stablecoins as the perfect partner in this grand scheme. By holding U.S. debt as reserves, stablecoins can help lower Treasury yields while simultaneously expanding the global reach and dominance of the dollar. It’s a win-win, folks! 🎉

Stablecoins need to have dollars on hand to repay investors looking to cash out. And wouldn’t you know it, Tether is already one of the largest holders of three-month U.S. Treasuries. Ain’t finance a funny business?

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

- Basketball Zero Boombox & Music ID Codes – Roblox

- How to use a Modifier in Wuthering Waves

2025-03-10 13:09