🚀💸 “Stablecoin Frenzy: 3 Secrets to Raking in the Dough 🤑”

As the stablecoin market bursts forth like a Russian spring, its total market capitalization swelling by 90% since late 2023, surpassing the $230 billion threshold, one cannot help but wonder: how can the humble retail investor partake in this grand feast? 🤔

In this era where stablecoins have become the belle of the global finance ball, experts have deigned to share with us mere mortals the arcane secrets of profiting from this trend. And who better to guide us than the illustrious Patrick Scott, a sage of decentralized finance (DeFi)? 🙏

Unveiling the Mysteries of Stablecoin Prosperity

According to the erudite Mr. Scott, there exist three primary stratagems for investors seeking to bask in the radiance of the stablecoin boom. And, in his own inimitable style, he elucidated thus:

“There are 3 ways to play the stablecoin boom: 1) Chains stablecoins are issued on 🔄 2) Stablecoin issuers 📈 3) DeFi protocols stablecoins are used in 🤝,” Scott explained with the clarity of a summer’s day.

Scott’s counsel? Invest in the blockchains that host stablecoins, specifically those projects that issue stablecoins with investable tokens (because, who doesn’t love a good token? 🤑), and participate in DeFi protocols where stablecoins are the life of the party.

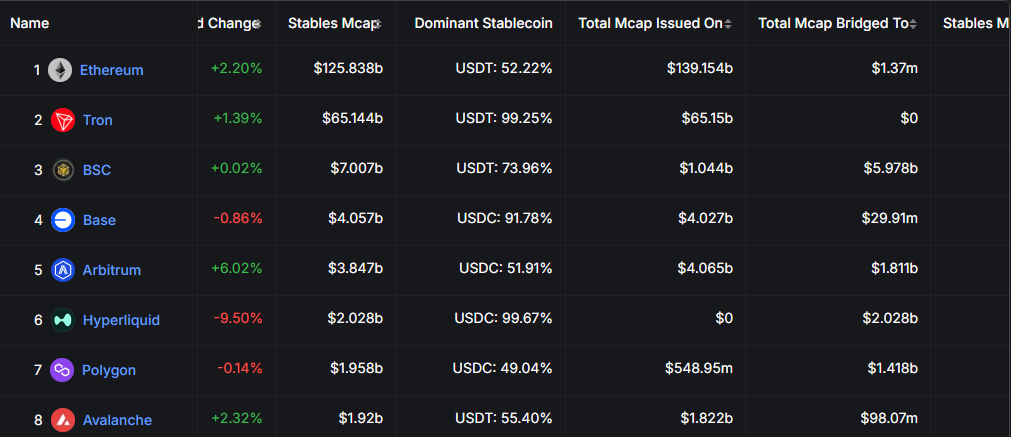

And what of the foundational blockchains, you ask? Ah, yes! The stalwarts of the stablecoin ecosystem. Ethereum (ETH) and Tron currently reign supreme in the stablecoin supply, with Ethereum hosting a whopping $126 billion in stablecoins, while Tron (TRX) follows closely with $65 billion. Both have achieved all-time highs in stablecoin circulation, because records are meant to be broken, aren’t they? 🏆

Tron’s ascent, driven by its widespread adoption of peer-to-peer (P2P) transactions, particularly in developing regions, is a testament to the power of stablecoins in bridging financial gaps. 🌎

As stablecoin adoption continues its relentless march forward, investing in native tokens like ETH and TRX could prove to be a veritable goldmine for investors seeking to ride the stablecoin market’s expansion. And, as analyst DCinvestor so astutely observed:

“…within a few years it will be obvious in hindsight that the best way to invest in the coming stablecoin boom was simply just to buy ETH where the most stablecoins are and will be settled and ultimately a key beneficiary of the economic activity which emerges around them,” because hindsight is always 20/20, isn’t it? 🔮

Alas, the leading stablecoin issuers, Tether and Circle, remain privately held, leaving no direct investment opportunities for the retail investor. Fear not, dear reader! Emerging projects like Ethena (USDe), USDY (Ondo), HONEY (Berachain), and crvUSD (Curve) offer governance or utility tokens, allowing investors to partake in their growth, complete with voting rights or revenue-sharing mechanisms, because who doesn’t love a good perk? 🎁

The Irresistible Charm of Stablecoins in DeFi

Stablecoins, the lifeblood of the DeFi ecosystem, facilitate liquidity, lending, and yield generation with the ease of a spring breeze. Leading DeFi protocols, including Aave, Morpho, Fluid, Pendle, and Curve, beckon investors to provide liquidity or engage in lending and borrowing activities, promising returns as attractive as a siren’s song. 🌊

And, as the stablecoin universe expands, even the big players are taking notice. Bank of America has dipped its toes, while Fidelity Investments is reportedly crafting its own stablecoin, because in the world of finance, you either evolve or perish. 🦖

Wyoming, ever the pioneer, has unveiled its state-backed stablecoin, WYST, and World Liberty Financial has introduced USD1, backed by the full faith and credit of US government treasuries and cash equivalents, because what could possibly go wrong, right? 😳

Yet, amidst this optimism, whispers of caution emerge. The specter of a financial crisis, akin to the 2008 bank run, looms large. Should investors rush to redeem their stablecoins during market turmoil, issuers might be forced to liquidate their reserve assets, potentially triggering a wider financial maelstrom. 🌪️

Fear not, dear investor, for regulatory efforts, such as the GENIUS and STABLE Acts, aim to mitigate these risks, ensuring issuers maintain fully backed reserves, because a safe stablecoin is a happy stablecoin. 🙏

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to watch the South Park Donald Trump PSA free online

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- 50 Goal Sound ID Codes for Blue Lock Rivals

2025-03-27 10:27