What to know:

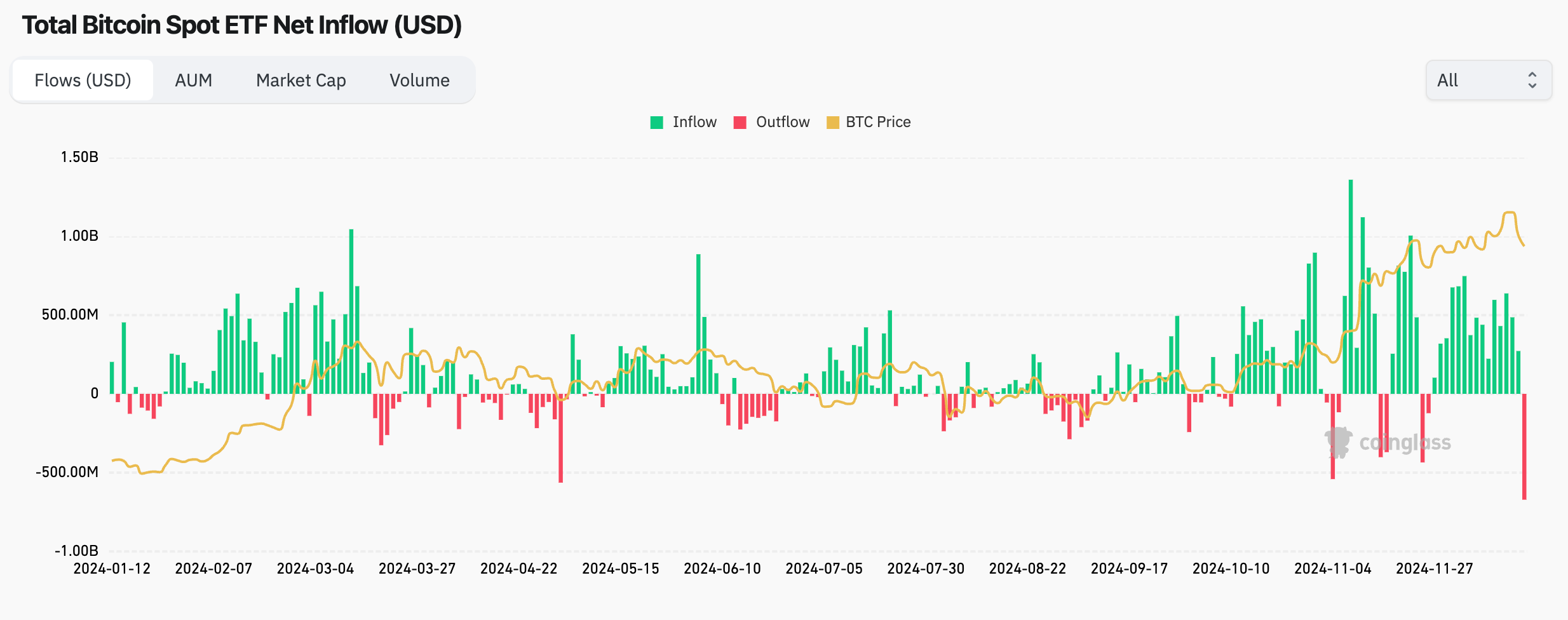

- Investors pulled a record $671.9 million from the 11 spot bitcoin ETFs on Thursday, snapping a 15-day winning trend.

- The annualized premium in one-month CME futures dipped below 10% in a sign of waning short-term demand.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen numerous bull and bear runs, market bubbles, and corrections. The recent events unfolding in the Bitcoin ETF market seem to echo some familiar patterns, albeit with a unique twist given the digital asset’s nascent status.

Yesterday saw unprecedented withdrawals from U.S.-based Bitcoin ETFs (Exchange-Traded Funds), and the price gap between Bitcoin futures traded on the Chicago Mercantile Exchange (CME) and spot Bitcoin decreased to single digits, indicating a possible decline in immediate interest for Bitcoin.

As a researcher, I observed a significant shift in the investment trend today. After a 15-day streak of inflows, investors decided to withdraw a substantial amount of approximately $671.9 million from eleven ETFs. This is the largest single-day withdrawal since these ETFs were established on January 11th, based on data compiled by Coinglass and Farside Investors.

As an analyst, I’m observing a significant trend: Fidelity’s FBTC and Grayscale’s GBTC are leading the way in outflows, with a combined loss of approximately $400 million over the period. Other funds have also experienced outflows, and notably, BlackRock’s IBIT recorded its first zero in several weeks, suggesting a potential decrease in investor interest.

On Thursday, the price of Bitcoin continued to decrease following its recent losses due to the Federal Reserve’s announcement, dropping to around $96,000 – a decline of almost 10% compared to its record peak of $108,268 hit earlier in the week.

The bearish sentiment was mirrored in the derivatives market, where the annualized premium in the CME’s regulated one-month bitcoin futures fell to 9.83%, the lowest in over a month, according to data source Amberdata.

A decrease in the price difference between an ETF and its related futures on the CME means that cash-and-carry arbitrage bets are less profitable now compared to before. Consequently, ETFs might experience reduced interest or low demand for a while.

ETher Exchange Traded Funds (ETFs) experienced a withdrawal of approximately $60.5 million recently, marking the first such occurrence since November 21st. Ether has seen a decline of around 20% since it was trading above $4,100 prior to the Fed’s decision made on Wednesday.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-20 12:52