Ah, Solana! The darling of the crypto world has been strutting its stuff lately, with its native token staging a comeback worthy of a West End revival. Let’s dive into the juicy details, shall we?

SOL ETFs: Canada’s Newest Export 🇨🇦

Earlier this week, Eric Balchunas, the Senior ETF analyst at Bloomberg, dropped the bombshell that the Ontario Securities Commission (OSC) has given the green light to several spot Solana exchange-traded funds. These will be the first of their kind in Canada, with a launch date set for April 16. The issuers? Purpose Investments, Evolve ETFs, CI Global Asset Management, and 3iQ. Quite the ensemble cast, wouldn’t you say?

These products will invest in long-term holdings of Solana in physical form, track different indices, and even dabble in staking activities to earn rewards. Meanwhile, across the border, VanEck, Grayscale, 21Shares, and Canary Capital are queuing up to launch SOL ETFs in the United States. According to Polymarket, the odds of approval before the end of 2025 are a tantalizing 82%. Place your bets, ladies and gentlemen!

OpenSea 2.0: Solana Joins the Party 🎉

OpenSea, the leading decentralized marketplace for NFTs, has recently opened Solana token trading on OS2 (that’s OpenSea 2.0 for the uninitiated). The initiative is currently available to some closed beta users, with a wider rollout expected in the coming weeks.

“This is a big milestone in our multi-chain journey. Solana has some of the most passionate users and builders in Web3,” OpenSea declared, with all the gravitas of a Shakespearean soliloquy.

Price Outlook: A Rollercoaster Ride 🎢

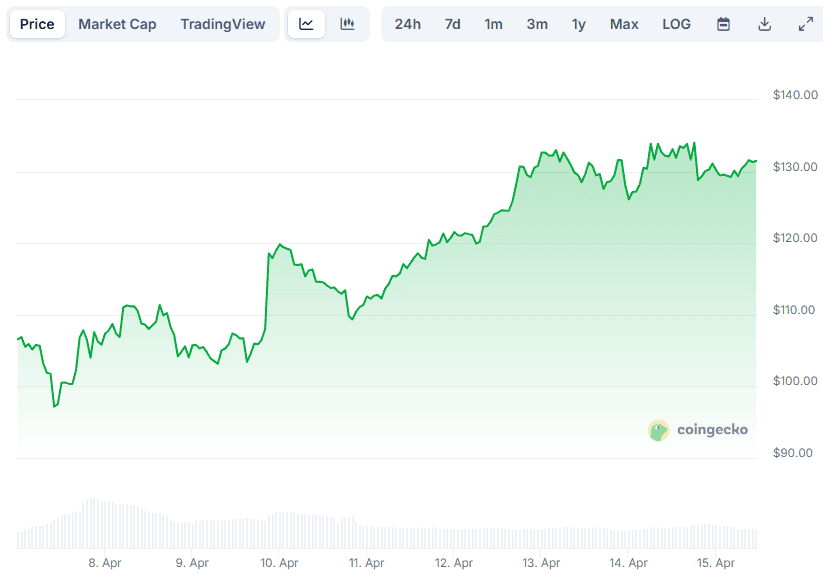

Earlier this month, Solana’s native token briefly crashed below $100, prompting some analysts to predict a continued freefall. But lo and behold, the bulls charged in, and SOL experienced a significant revival. As of this writing, it trades at around $131, a 35% increase from the local bottom.

Numerous industry participants believe the asset has much more room for growth. The X user BitBull claims SOL “is setting up for a massive move in 2025” and could repeat Ethereum’s performance from 2021. They’ve set a target of over $300. Meanwhile, Crypto Tony is “back long on Solana” above the $125 support zone. The drama never ends!

TVL on the Rise: Lock It Up! 🔒

SOL’s total value locked (TVL) – a key metric referring to the total value of assets locked in DeFi applications operating on the Solana blockchain – has been on the upswing. The figure stood at around $6 billion on April 9, but over the weekend, it surged above $7 billion.

When SOL TVL goes up, it generally means that more capital is being locked into Solana’s DeFi apps, showing rising user activity, trust, and ecosystem growth. However, it’s worth noting that the indicator is measured in USD, so if the price of the underlying token heads north, TVL automatically increases even if the same amount of SOL remains locked. Clever, isn’t it?

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lucky Offense Tier List & Reroll Guide

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Should You Save Vidar Or Give Him To The Children Of Morrigan In Tainted Grail: The Fall Of Avalon?

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

- Every House Available In Tainted Grail: The Fall Of Avalon

- Tainted Grail The Fall of Avalon: See No Evil Quest Guide

2025-04-15 12:23