So, Solana [SOL], bless its little digital heart, has been causing quite the stir. Apparently, there’s been some increased transaction activity on-chain, which sounds impressive, but mostly just makes me think of tiny robots frantically pushing buttons. Anyway, this has, for some reason, propelled prices above $120. 🎉

But hold your horses! (Do people still say that? 🤔) There’s this “strong supply zone” hanging around $140, which I imagine is like a bouncer at a very exclusive club, making it tough for the bulls—yes, apparently, they’re called “bulls”—to initiate a “true long-term recovery.” Whatever that means. 🤷♀️

Now, here’s where things get interesting. Solana, in its infinite wisdom, has apparently outpaced Ethereum [ETH] on multiple fronts. I didn’t even know that was a competition! The SOL/ETH pair made “new highs,” which I assume is a good thing, and SOL saw “elevated inflows” compared to Ethereum. It’s like watching two toddlers compete for the same toy, except the toy is digital money, and I’m not sure who’s winning. 👶

Increased Buying Pressure Gives SOL Investors Hope (or Delusion?) 🤞

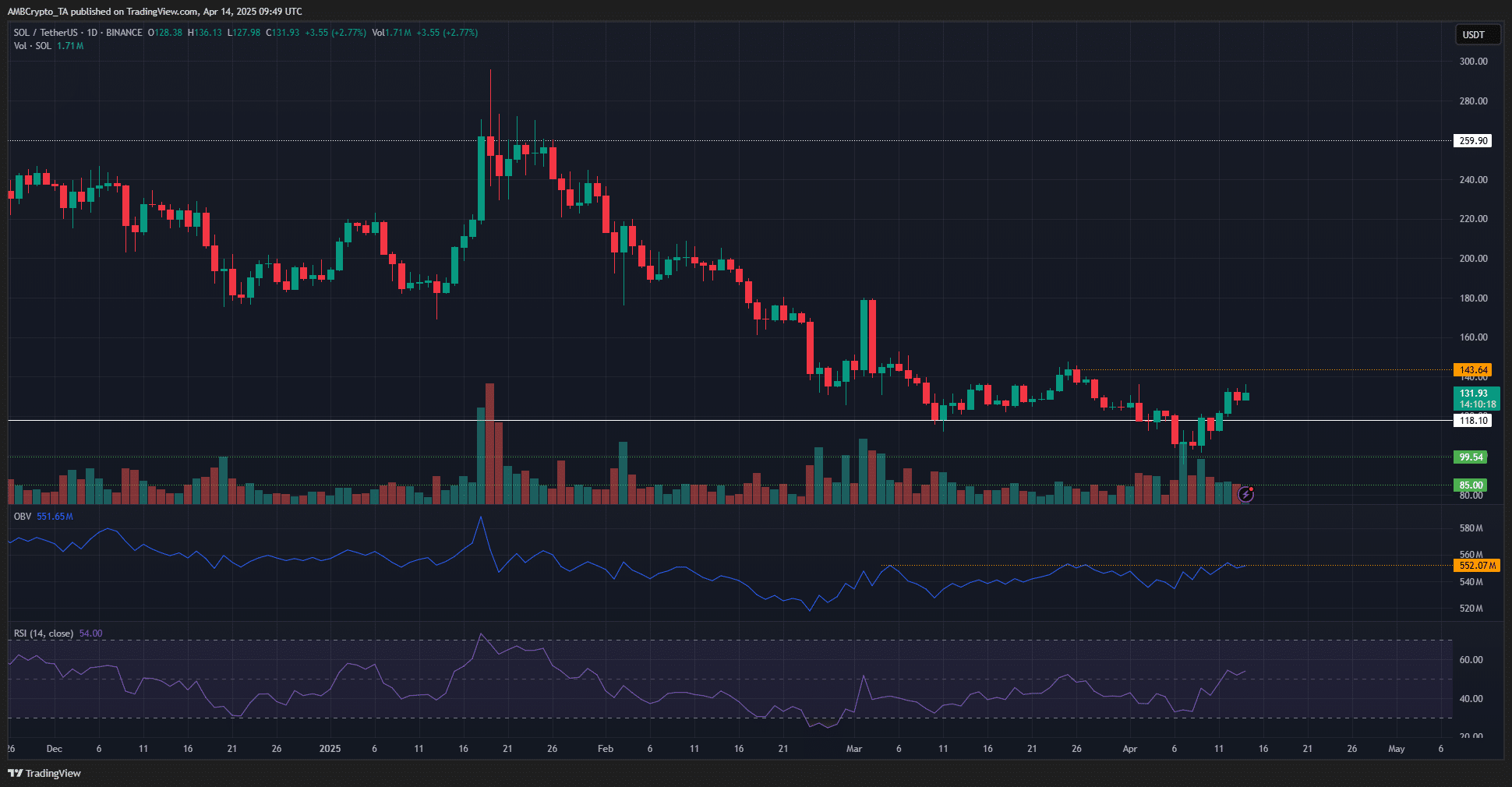

Apparently, the $143 level is super important because it marks the “lower high of the downtrend.” Sounds like something from a depressing poem. If they breach this level—and I’m not entirely sure what “breaching” a level entails—the 1-day market structure might flip bullishly. Fingers crossed! (But also, maybe don’t bet your life savings on it.) 😬

The RSI—no idea what that is, but it “climbed above neutral 50.” So, yay? It’s been above 50 for three days, which is apparently the longest period since January. We’re setting records here, folks! Also, the OBV—still clueless—is “challenging the highs set in early March.” It’s like a soap opera, but with cryptocurrency. 🎭

Back then, Solana was around $180. This “indicates rising buying pressure,” which could send prices beyond $143. But until it does, the article advises traders and investors to “remain cautious.” Which is basically the financial equivalent of “look both ways before crossing the street.” 🚶♀️

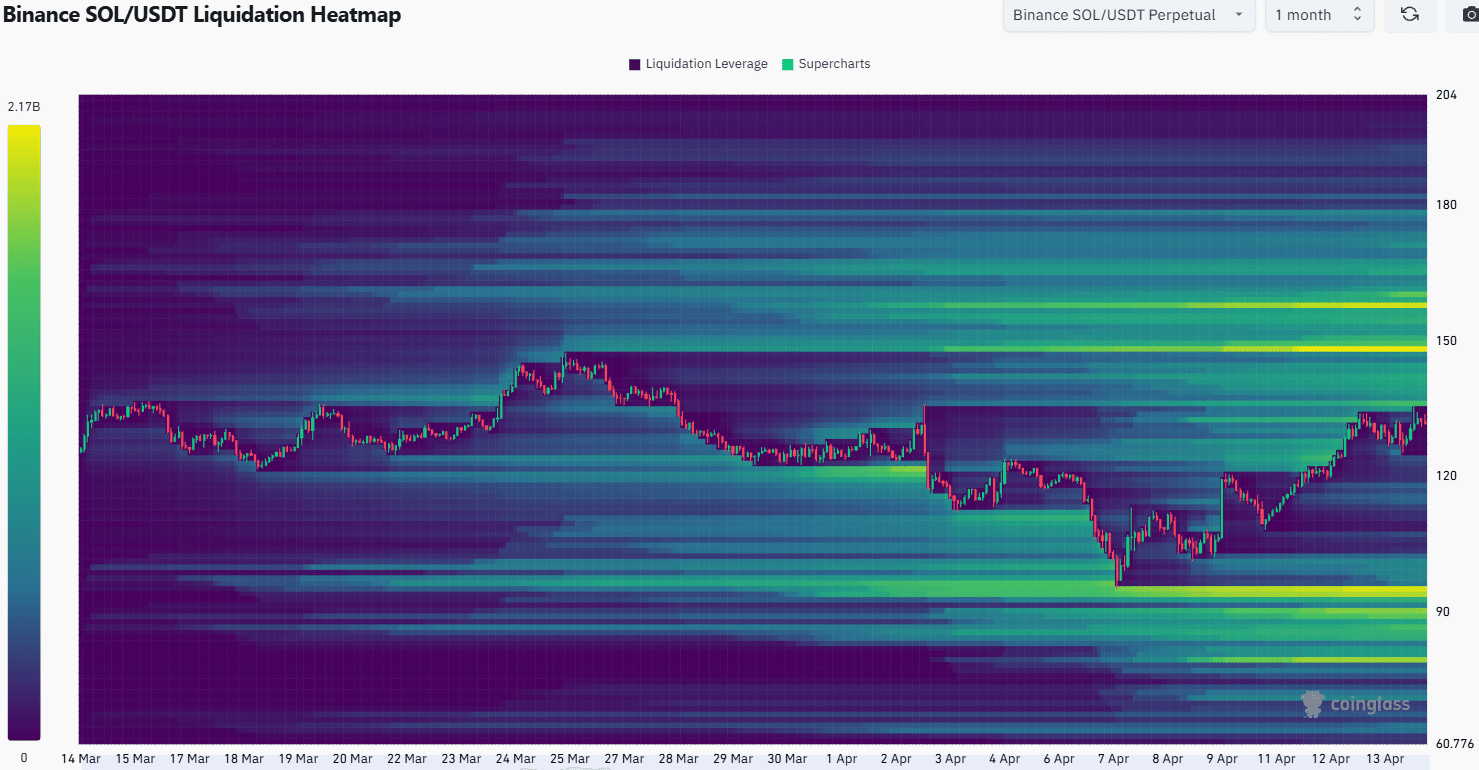

Now, for the fun part: liquidation heatmaps! Apparently, $150 and $158 are “magnetic zones” with over $2 billion in liquidations. It sounds like a very expensive game of tag. The $136-$142 range is also a “liquidity cluster,” which sounds like something you’d find in a science lab. 🧪

Further down, there’s a “liquidation pocket” at $95, but it’s too far away to be a short-term target. Based on all this jargon, the article suggests a move toward $150-$160 is “probable.” But remember, folks, nothing is certain except death and taxes (and maybe Solana’s volatility). 💀

Whether the “bulls” can hold the $140 level as support remains “uncertain.” I’m starting to think “uncertain” is the theme of this entire cryptocurrency saga. 🤷♂️

Success at this level could signal the start of a “bullish trend,” but only if Bitcoin [BTC] recovers and there’s “positive sentiment” in the crypto market. So, basically, it all depends on a bunch of things that are completely out of our control. Sounds about right. 👍

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- Lottery apologizes after thousands mistakenly told they won millions

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

2025-04-15 00:09