What to know:

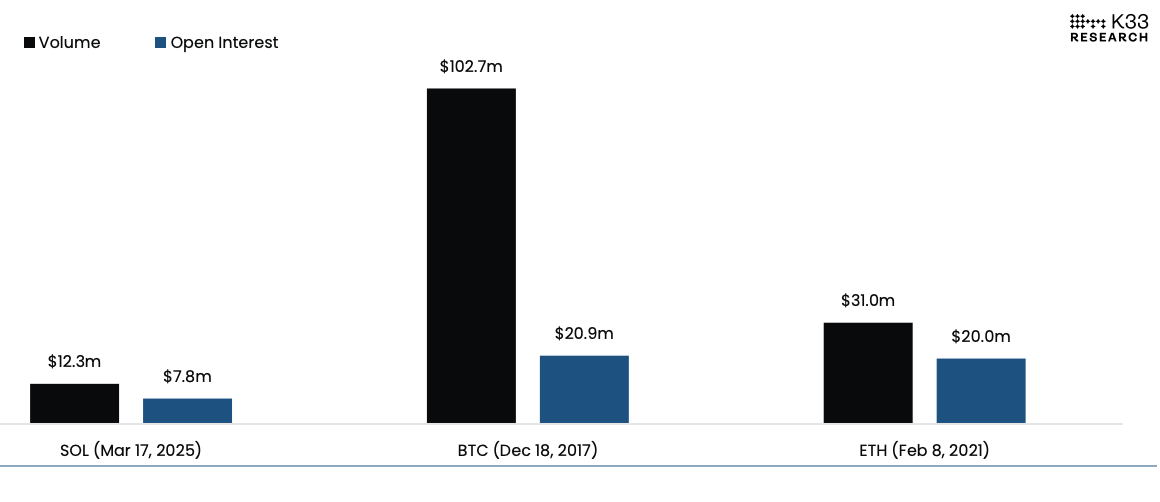

- On a rather unremarkable Monday, Solana’s SOL futures made their grand entrance on the Chicago Mercantile Exchange (CME), boasting a notional daily volume of a mere $12.3 million and $7.8 million in open interest. A far cry from the roaring debuts of bitcoin (BTC) and ether (ETH) futures, I daresay!

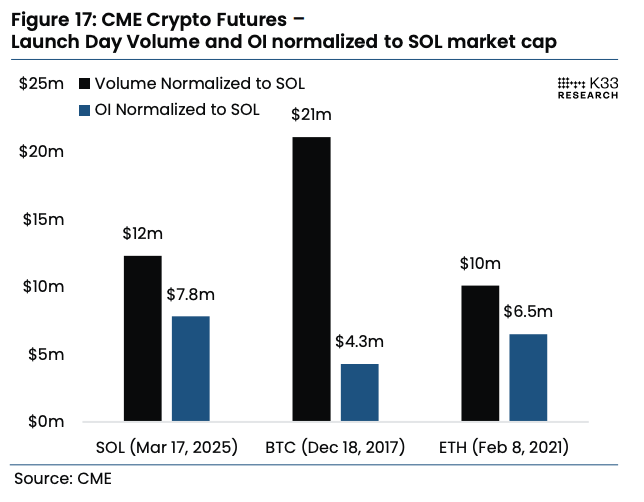

- However, when one adjusts for market value, it appears that SOL’s first-day figures are not as dismal as they seem, according to the ever-astute K33 Research. Who knew numbers could be so forgiving?

- In a market that resembles a damp squib, the launch of CME SOL futures provides institutions with fresh avenues to manage their exposure to this token, as noted by the ever-optimistic Joshua Lim of Arbelos Markets.

If you happened to blink, you might have missed it: Solana’s SOL futures began trading on the CME, the preferred playground for U.S. institutions. Unlike the grandiose debuts of BTC and ETH, this one was met with a resounding silence, perhaps a polite cough or two.

On its inaugural day, the product managed to scrape together $12.3 million in notional daily volume and closed with $7.8 million in open interest. For context, BTC futures burst onto the scene in December 2017 with a staggering $102.7 million first-day volume and $20.9 million in open interest, while ETH futures made their debut in February 2021 with $31 million in volume and $20 million in open interest. Quite the comparison, wouldn’t you agree?

Under the weight of a collapsing memecoin bubble, bearish crypto trends, and even a botched commercial, SOL plummeted approximately 10% from its weekend high, trailing behind BTC’s and ETH’s more modest declines of 4.5% and 3.8%, respectively. A true spectacle of underachievement!

While SOL’s debut may appear lackluster in absolute terms, K33 analysts Vetle Lunde and David Zimmerman suggest it aligns more closely with BTC’s and ETH’s first-day figures when adjusted for market value. On Monday, Solana’s market capitalization hovered around $65 billion, a mere fraction of ETH’s $200 billion and BTC’s $318 billion at the time of their CME launches. Ah, the sweet taste of humility!

Timing, as they say, is everything. Solana’s CME launch coincided with a rather unfortunate market climate, as K33 pointed out. Bitcoin’s CME futures arrived at the zenith of the 2017 bull market, while ETH’s debut was perfectly timed with the early stages of the 2021 altcoin rally and Tesla’s BTC purchase announcement. In stark contrast, SOL futures began trading amidst a bearish market, devoid of any hype or significant catalyst to spur immediate demand. “It seems institutional demand for altcoins may be rather shallow,” K33 analysts mused, noting the risk-off environment.

Derivatives trader Josh Lim, the founder of Arbelos Markets (recently acquired by prime broker FalconX), remains undeterred. He asserts that the CME product opens new avenues for institutions to manage their exposure to Solana, regardless of the tepid first-day demand. FalconX executed the first SOL futures block trade on CME on Monday with financial services firm StoneX. A valiant effort, indeed!

“There’s enthusiasm for this new CME product launch,” Lim declared in a Telegram message. Liquid funds will now have the opportunity to manage their SOL holdings, including those who acquired locked tokens during the FTX liquidation process. Furthermore, ETF issuers with plans to introduce SOL products could very well start with CME futures-based ETFs. A veritable buffet of options!

“People are missing the big picture on the new CME products,” Lim continued. “It’s going to revolutionize the access hedge funds have

Read More

- Lucky Offense Tier List & Reroll Guide

- Indonesian Horror Smash ‘Pabrik Gula’ Haunts Local Box Office With $7 Million Haul Ahead of U.S. Release

- Best Crosshair Codes for Fragpunk

- League of Legends: The Spirit Blossom 2025 Splash Arts Unearthed and Unplugged!

- How To Find And Solve Every Overflowing Palette Puzzle In Avinoleum Of WuWa

- Unlock Every Room in Blue Prince: Your Ultimate Guide to the Mysterious Manor!

- Ultimate Half Sword Beginners Guide

- Russian Twitch Streamer Attacked in Tokyo as Japan Clamps Down on Influencer Behavior

- Madoka Magica Magia Exedra Tier List & Reroll Guide

- Unlock the Ultimate Barn Layout for Schedule 1: Maximize Your Empire!

2025-03-18 23:10