- Solana buyers and sellers in the derivatives market have recorded equal losses – it’s a standoff!

- Market activities are aligning with a hopeful bullish narrative. Could Solana finally turn the corner?

Well, well, well, the rollercoaster ride of Solana’s [SOL] losses has stirred quite the conversation. With a 14.56% rise over the week and a modest 6.50% gain in the last month, it seems Solana’s journey is anything but boring. But hold your horses, folks—there’s more to this story than meets the eye.

AMBCrypto’s eagle-eyed analysts still seem to think the buyers are holding the reins—so perhaps the next big move might just be the one the bulls have been waiting for.

SOL’s Dilemma: A $13 Million Liquidation Tango

In the latest 24-hour stretch, it’s a battle of the titans: long positions and short positions split the liquidation pie right down the middle. Coinglass has the numbers—each side took a $6.5 million hit. This, my dear reader, screams of exhaustion and confusion on the trading floor. And what do you get when traders are caught in a tug-of-war? That’s right—muted price action. Just 0.7% up on the day, really.

When the liquidations are so perfectly balanced, the market teeters on the edge, unsure of where to go next. But AMBCrypto, ever the optimists, suggest that the bulls are still ever so slightly in the lead. If momentum dares to stick around, well, who knows?

Key Activities Hint at Bullish Momentum

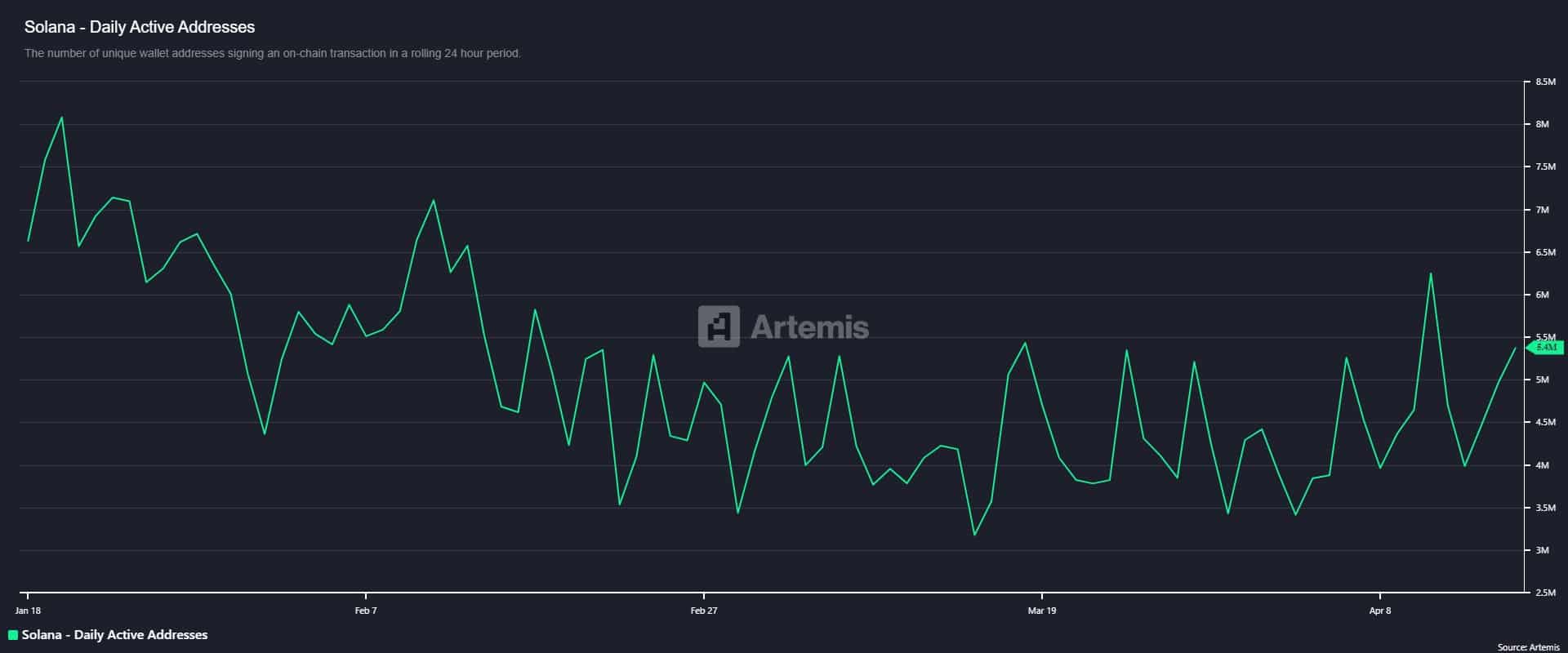

On-chain activity is certainly helping the bulls’ case. Unique Active Addresses have surged by a staggering 31% in just 24 hours, now sitting at a hefty 5.4 million. What does this mean, you ask? Fresh buying or a good old SOL hand-off—either way, bullish expectations are ramping up. 📈

The DEXes are buzzing too—trading volume has jumped by 15.35%, reaching a colossal $16.2 billion. Who knew Solana would become the belle of the decentralized ball?

But wait, there’s more! The Futures market is also putting on a bullish show. Open Interest, a measure of unsettled derivative contracts, continues to climb. And with a Long-to-Short Ratio sitting pretty at 1.0087, it seems like the bulls have got this one in the bag—for now, at least.

In the past 24 hours, investor confidence has grown. Liquidity flowing into Solana rose by a neat $72 million, bringing its Total Value Locked (TVL) to $7.144 billion. When TVL rises, it’s a sign that investors are locking in their SOL for the long haul. Classic move, isn’t it? People really do love a commitment.

So, if these bullish signals continue, we might just see SOL break through the clouds and soar higher. But let’s not get ahead of ourselves—it’s a market, darling, anything can happen. 💁♂️

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- Gaming’s Hilarious Roast of “Fake News” and Propaganda

2025-04-18 23:09