- Open Interest dropped 58% since January’s $6B peak.

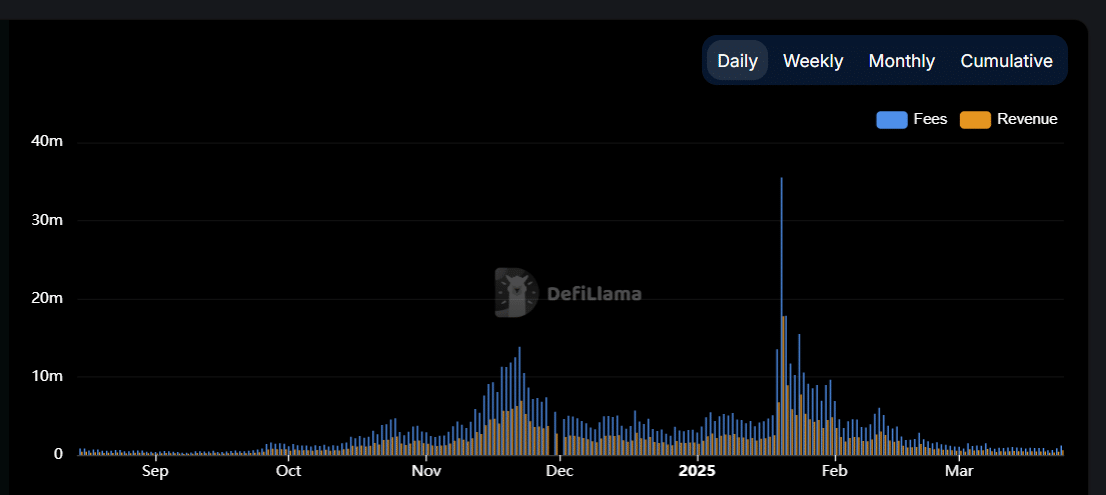

- Daily network fees dropped 96.5% from January to March.

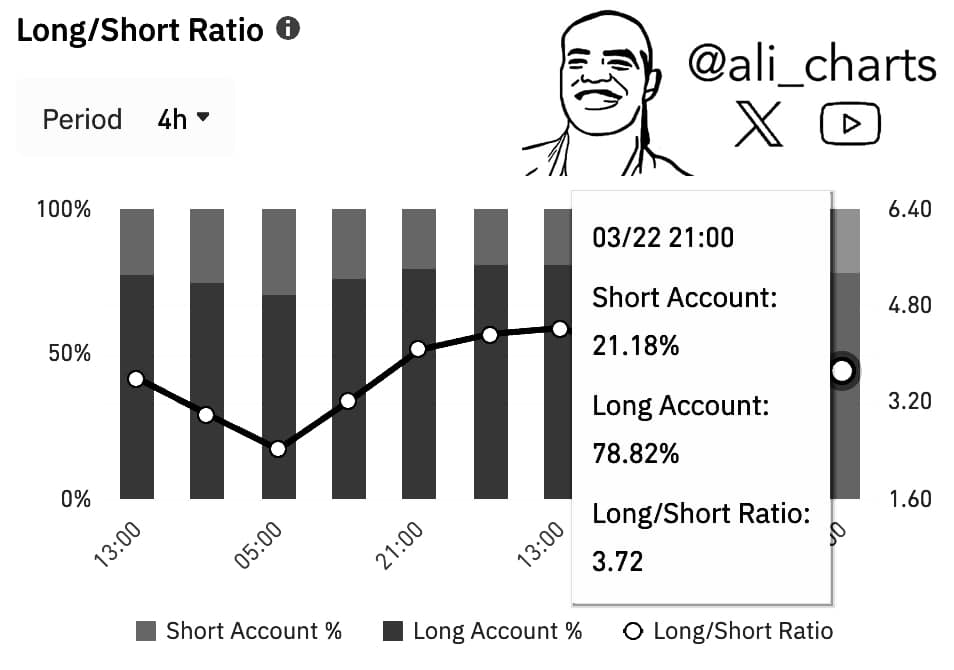

A surge in bullish sentiment is emerging among traders of Solana [SOL] futures.

Based on information provided by Ali Charts, it’s reported that as of the 22nd of March, about 78.82% of open Solana positions on Binance Futures are currently bullish (long).

The diagram signifies a 3.72 long/short ratio, implying that traders choose to wager on an upward trend approximately four times more frequently than on a downward one.

But how does this stack up against the rest of the market?

Questioning the herd

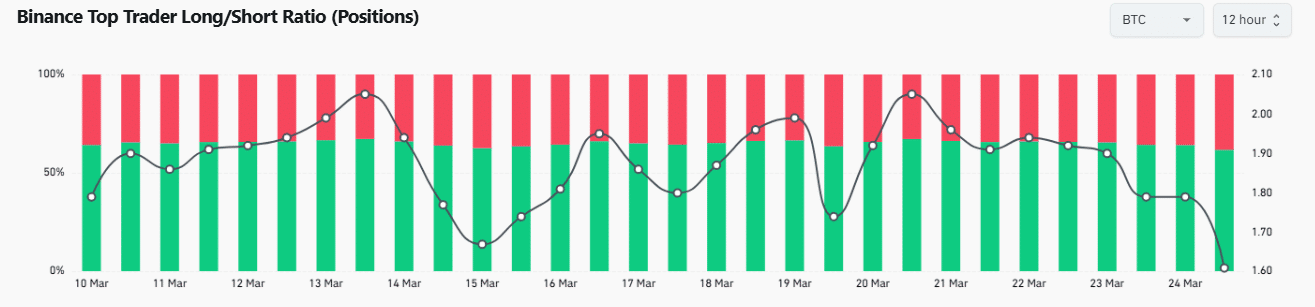

Other Long/Short Ratio datasets from Binance show a more conservative trend across top traders.

On the 21st of March, the Long/Short Ratio for Bitcoin Futures was 2.05. However, by the 24th of March, this ratio decreased to 1.71, representing a reduction of approximately 16.6%.

Eyes on Solana Open Interest

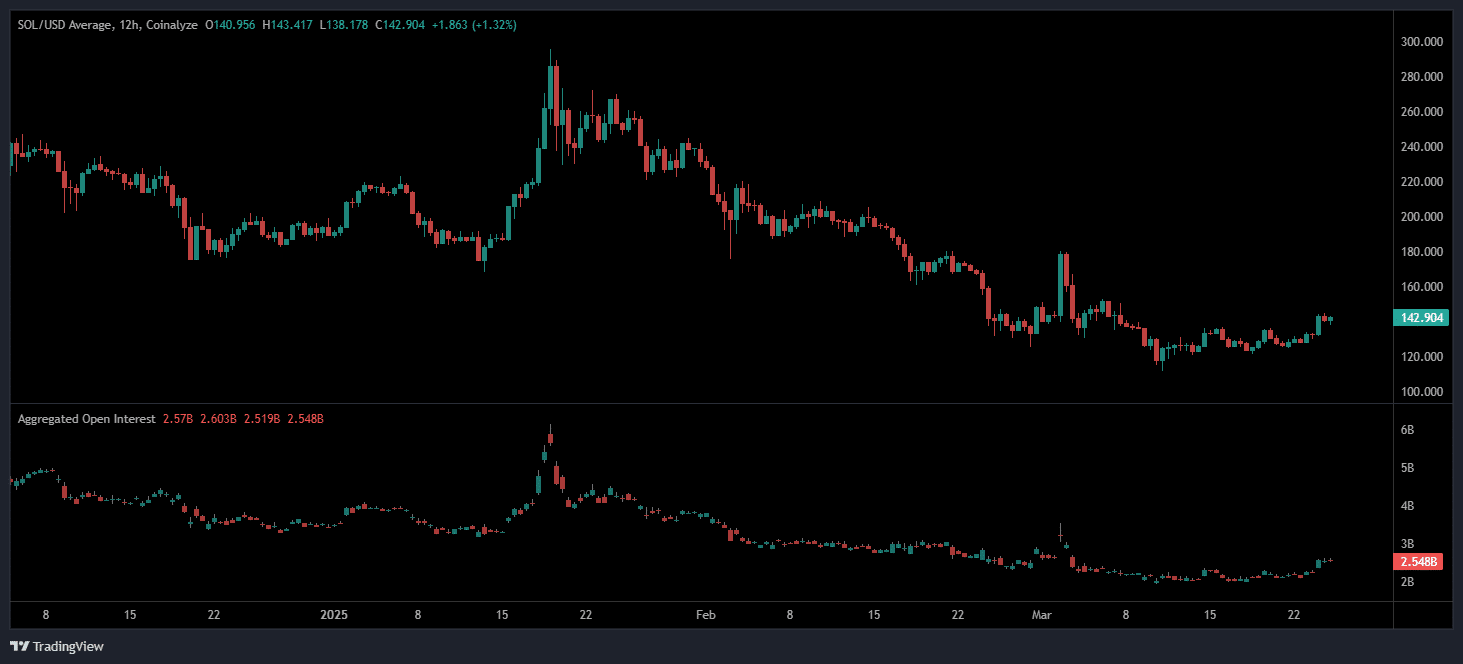

As Open Interest in Solana Futures seems to be stabilizing following a prolonged dip, there’s an increasing tendency towards optimistic trading stances.

The total amount of committed funds in Solana Futures reached approximately $6 billion in January 2025. However, since that time, it has dropped by about 58%, now standing at around $2.548 billion as of the 25th of March, according to Coinalyze’s latest data.

As an analyst, I’ve observed a notable decline that mirrors a 52% drop in the price of SOL, from approximately $290 in mid-January down to around $142 at present. This synchronous decrease in price and open interest suggests a widespread unwinding of leveraged positions on a large scale.

Now, traders are watching closely—because the chart may be turning.

On March 25th, it appears that the price trend for SOL might be leveling off, as there was a slight increase of approximately 1.32% in its daily value.

On-chain whispers

The on-chain actions are showing comparable indicators too; for example, the fee earnings data presents a very much alike image.

Between October 2024 and January 2025, the daily fees on Solana’s network experienced a massive increase of around 3,453%, culminating at approximately $35.53 million in late January. Simultaneously, income soared, peaking at an impressive $17.77 million.

Ever since then, network activities have significantly dropped off. By the 25th of March, daily charges had plummeted to approximately $1.28 million, representing a staggering 96.5% fall from the peak in January.

So, what’s holding up user confidence?

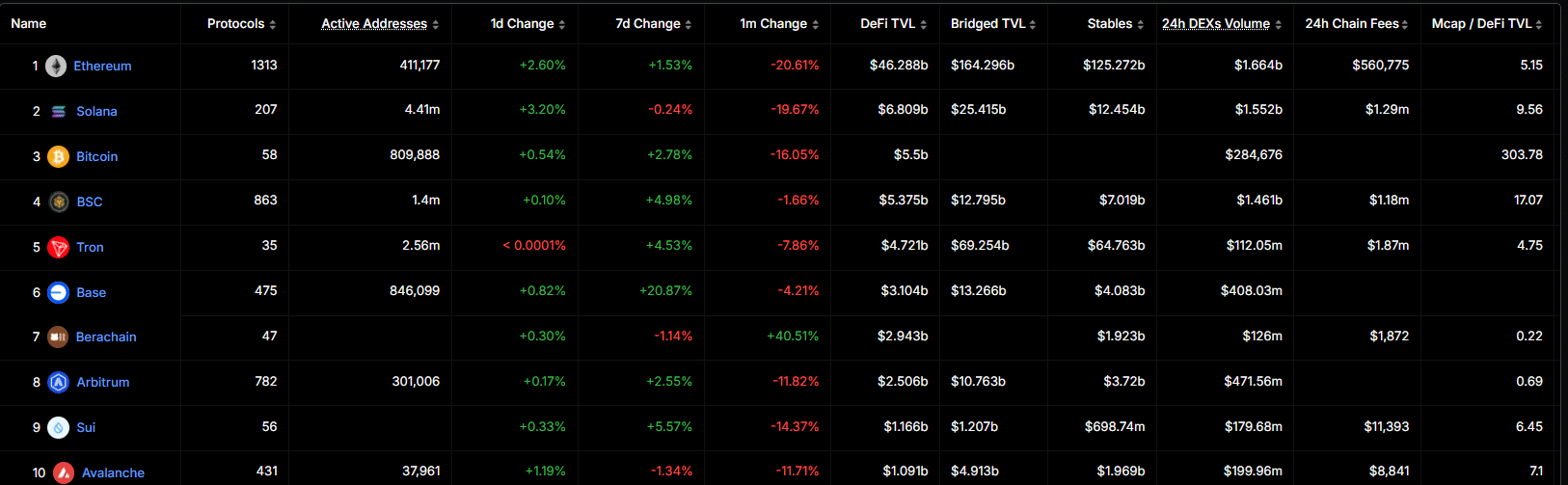

In a span of 24 hours, trading volume on DEX platforms built on Solana reached an impressive $1.552 billion, which is almost equivalent to Ethereum‘s $1.664 billion. This significant achievement comes even though Ethereum currently boasts more than six times the Total Value Locked (TVL) compared to Solana.

It seems like users on the Solana network are engaging in transactions at a quicker pace, leading to increased overall speed and possibly improved efficiency for each individual user.

It’s not an isolated metric, either.

On Solana network, the total value locked in Decentralized Finance (DeFi) stands at approximately $6.809 billion, making it the second-largest chain in this regard, trailing behind Ethereum with a TVL of about $46.288 billion. This trend indicates that despite decreasing fees and prices, Solana is still managing to draw genuine user activity.

Where does SOL go from here?

Solana’s price rose from under $60 in October 2024 to above $270 by mid-January.

Initially, it fell approximately 51%, landing around $132 by mid-March. Subsequently, by the 24th of March, its growth slowed down to a moderate 6.13%, with the price fluctuating around $142.

During that period, the market cap dominance dropped significantly from approximately 70.44% down to 34.93%. This suggests a decrease in the rate of growth or momentum.

It seems that traders on Binance are expecting a rebound as the long-short ratio for Solana Futures reaches 3.72, suggesting a higher number of long positions compared to short ones.

After experiencing a significant decrease in fees, open interest, and value, there remains an underlying positivity. However, the robust decentralized exchange (DEX) activity and user engagement on Solana suggest potential stability may be on the horizon.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

- MrBeast removes controversial AI thumbnail tool after wave of backlash

- KPop Demon Hunters: Real Ages Revealed?!

2025-03-25 21:20