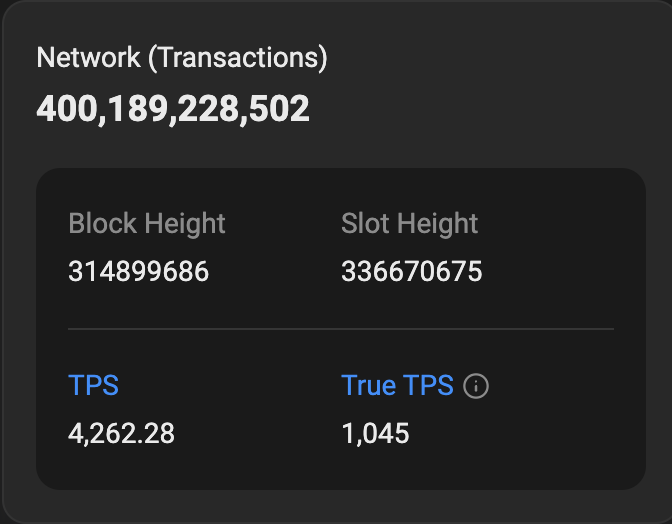

Solana (SOL) has decided it simply cannot be ignored and has leapt over the $150 mark, collecting a jaw-dropping 400 billion total transactions along the way. Take that, everyone who said they’d “never make it.” 🍾

While on-chain activity is doing an Olympic-level sprint, momentum indicators (looking at you, RSI and EMA) are throwing shade and whispering, “Let’s not get carried away, darling.” SOL now lounges precariously close to a support level of $145.59, unsure if it’s about to collapse in dramatic style™️ or bounce back like the plucky hero it fancies itself to be.

Solana Hits 400 Billion Transactions: Confetti Cannons in Blockchain Land

Solana has, rather nonchalantly, blasted past 400 billion transactions. Please pause for loud, awkward applause. 💃 This historic moment comes on the heels of SOL’s latest attempt to make $150 its home. Briefly, it soared—but then promptly tripped, fell, and had a modest price pullback. As is tradition.

On-chain action stays hotter than a British summer with DEX volume clocking in at $21 billion for the week. That’s a 44% jump, which is the financial equivalent of drinking five double espressos and running a marathon for bragging rights.

Let us not forget: SOL was scraping the crypto gutter at $9.98 on January 1, 2023. But fast forward through a Rocky-style montage, and we’re now gawping at a 1412% rally. Yes, you read that correctly—four digits, darling. 🥂

The ecosystem has ballooned so much that Pump (no relation to “Pump Up The Jam”) churned out $75 million in fees in a single month, while big guns like Raydium, Meteora, Jupiter, and Jito are all swimming in monthly millions. One imagines them meeting weekly to swim through their coins like Scrooge McDuck.

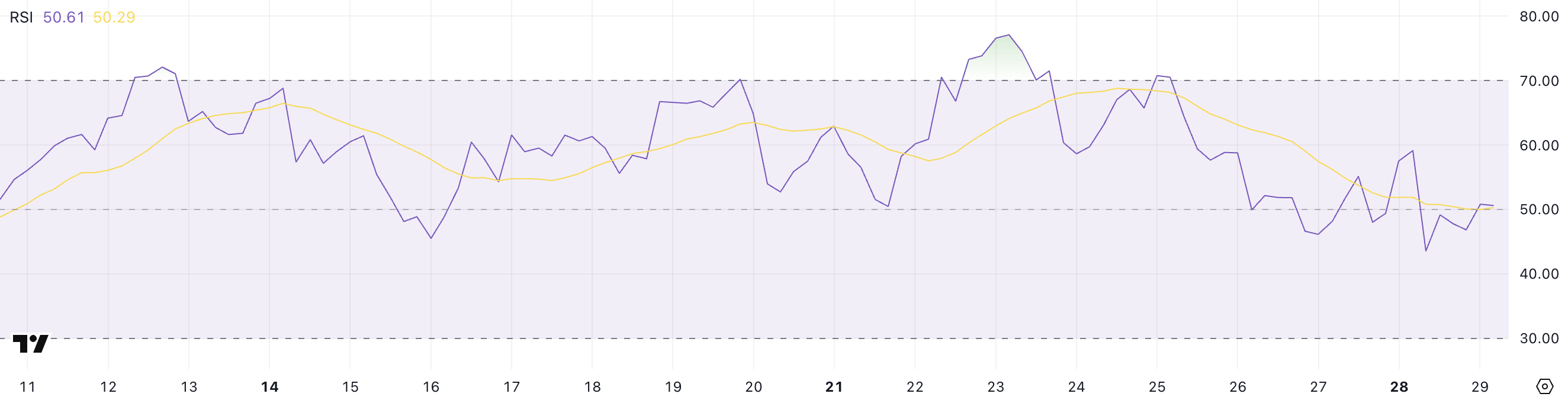

SOL’s Momentum: Not Exactly Leaping Out of Bed Anymore

Here comes the plot twist: Solana’s RSI, previously prancing about at 70.52, has dropped its coffee and crashed down to 50.61. Someone get it a motivational poster. 📉

This sharp drop loudly hints that our gallant bull rally is now limping a bit, like it had too much to drink last night.

(For those unfamiliar: RSI is the finance world’s way of asking, “Are we there yet?” Over 70 means everything’s overheated; under 30 and you need to call a medic. Around 50 is, well, a nervous “wait and see.”)

The whole market now side-eyes the RSI at this critical crossroads, half-expecting fireworks, half-preparing for a nap. Will we soar again, or is there another crypto-couch potato session ahead?

If buyers return, expect another wild dash upwards. If not, brace yourself—a price correction of “I told you so” proportions may be coming. Daring traders now bite their nails, waiting for SOL to pick a side (as if crypto wasn’t exciting enough). 🧐

Bullish Hopes or Yet Another Plot Twist?

EMA lines—the technical indicators everyone claims to understand—still lean bullish, with short-term averages on top. But, let’s be honest, the “OMG, bull market!!!” gap isn’t what it was a few days ago. Perhaps it’s hungover?

SOL is currently clinging to its support at $145.59 as if its social reputation depends on it. (Some might say it does.)

Should the support buckle, prepare yourselves for a trip down to $133.82. If things get really dramatic, we may plummet all the way to $123.46. Bring snacks for the ride.

Alternatively, in a plotline worthy of a comeback montage, we might just see a rebound—perhaps even a retest of $157. Break above that, and it’s party time on the way to $180.

Will SOL collapse in a pile of broken promises, or bounce back for an encore? Tune in next week for more blockchain drama. 🍿

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Lottery apologizes after thousands mistakenly told they won millions

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Umamusume: Pretty Derby Support Card Tier List [Release]

- J.K. Rowling isn’t as involved in the Harry Potter series from HBO Max as fans might have expected. The author has clarified what she is doing

- Mirren Star Legends Tier List [Global Release] (May 2025)

2025-04-29 23:08