As the Discworld turns, we find ourselves on the cusp of March24,2025, and lo and behold, the U.S. Securities and Exchange Commission (SEC) has been as silent as a mime in a library about dropping their appeal in the infamous case of Ripple (XRP). 🤫

This silence has caused more conspiracy theories to swirl around the cryptocurrency community than there are types of cheese in Ankh-Morpork. Why, oh why, has the SEC gone as quiet as a penguin in the Patrician’s palace?

The saga began in December2020, when the SEC, with the subtlety of a troll in a china shop, alleged that Ripple Labs and its merry band of executives had engaged in a most nefarious unregistered securities offering by selling XRP tokens.

Fast forward through years of litigation (and enough paperwork to make the Librarian go ‘ook’ in exasperation), and on March19,2025, Ripple CEO Brad Garlinghouse declared victory. The SEC had dropped its case, a move he described as a “long-overdue surrender,” boldly proclaiming that “XRP is not a security.” 🎉

“Progress is worth fighting for,” Garlinghouse quipped, with the sort of zeal one might expect from a man who’s just discovered a new type of potato. He added that this victory “paves the way for a pro-crypto future,” which sounds suspiciously like a plot from one of Moist von Lipwig’s schemes.

Reasons for the SEC’s Silence

There are several reasons why the SEC might be quieter than a mime trapped in a glass box:

Internal Approval Processes

Before making public announcements, the SEC goes through more internal reviews and approvals than there are hidden meanings in a Nanny Ogg wink. Even after waving the white flag, they must ensure that all legal and procedural boxes are ticked, crossed, and possibly stamped with a rubber octopus.

Scheduled Closed Meetings

The SEC, like a secret society of wizards, addresses legal and enforcement issues in closed meetings. The next such gathering is on Thursday, March27,2025, at2:00 PM ET. The Ripple case might just be the topic du jour, followed by an official announcement that could either be as enlightening as a flash of octarine or as confusing as a conversation with Hex.

Ongoing Negotiations

Ripple, not content with just one victory, is seeking a cross-appeal related to previous XRP sales to institutional investors. Judge Analisa Torres had previously slapped Ripple with a $125 million fine and a permanent injunction for breaching securities laws. Ripple’s management, ever the optimists, claim there are continued negotiations with the SEC to potentially lift these penalties. The commission could be holding off on making a public statement until all sides of the case, including Ripple’s cross-appeal, are as settled as a teacup on a saucer.

The news of the SEC throwing in the towel has sent XRP’s market value soaring like a broomstick on a windy day. Upon the announcement, the price of XRP rocketed up by around13% to almost $2.56, and it’s currently fluttering around $2.45, much like a dragon with indigestion.

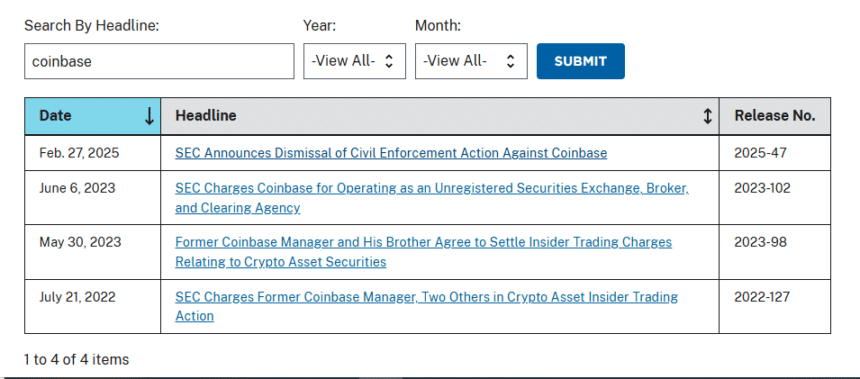

Curiously, when the SEC dropped its case against Coinbase, it issued a public statement faster than you can say “The Luggage.” However, in Ripple’s case, the agency has remained as tight-lipped as a clam in a shell, sparking speculation about internal delays or strategic reasons behind the lack of an official announcement. Perhaps they’re waiting for the right moment, or perhaps they’ve misplaced the memo under a pile of paperwork in Unseen University.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- LINK PREDICTION. LINK cryptocurrency

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

2025-03-24 20:38