In a tempest of words upon the digital X, Schiff, with the fervor of a prophet, denounced Saylor as the grand deceiver of Wall Street, his business model a “fraud” worthy of a Tolstoyan farce. One might think he’d pivot to discussing the weather, but no-his favorite subject, as ever, is Bitcoin: a “fake asset,” he declared, as if the very concept of value had been scribbled in crayon.

Naturally, this served as the perfect segue into his favorite topic: Bitcoin is a “fake” asset.

“Today is the beginning of the end of $MSTR. Saylor was forced to sell stock not to buy Bitcoin, but to buy U.S. dollars merely to fund MSTR’s interest and dividend obligations. The stock is broken. The business model is a fraud, and Saylor is the biggest con man on Wall Street.”

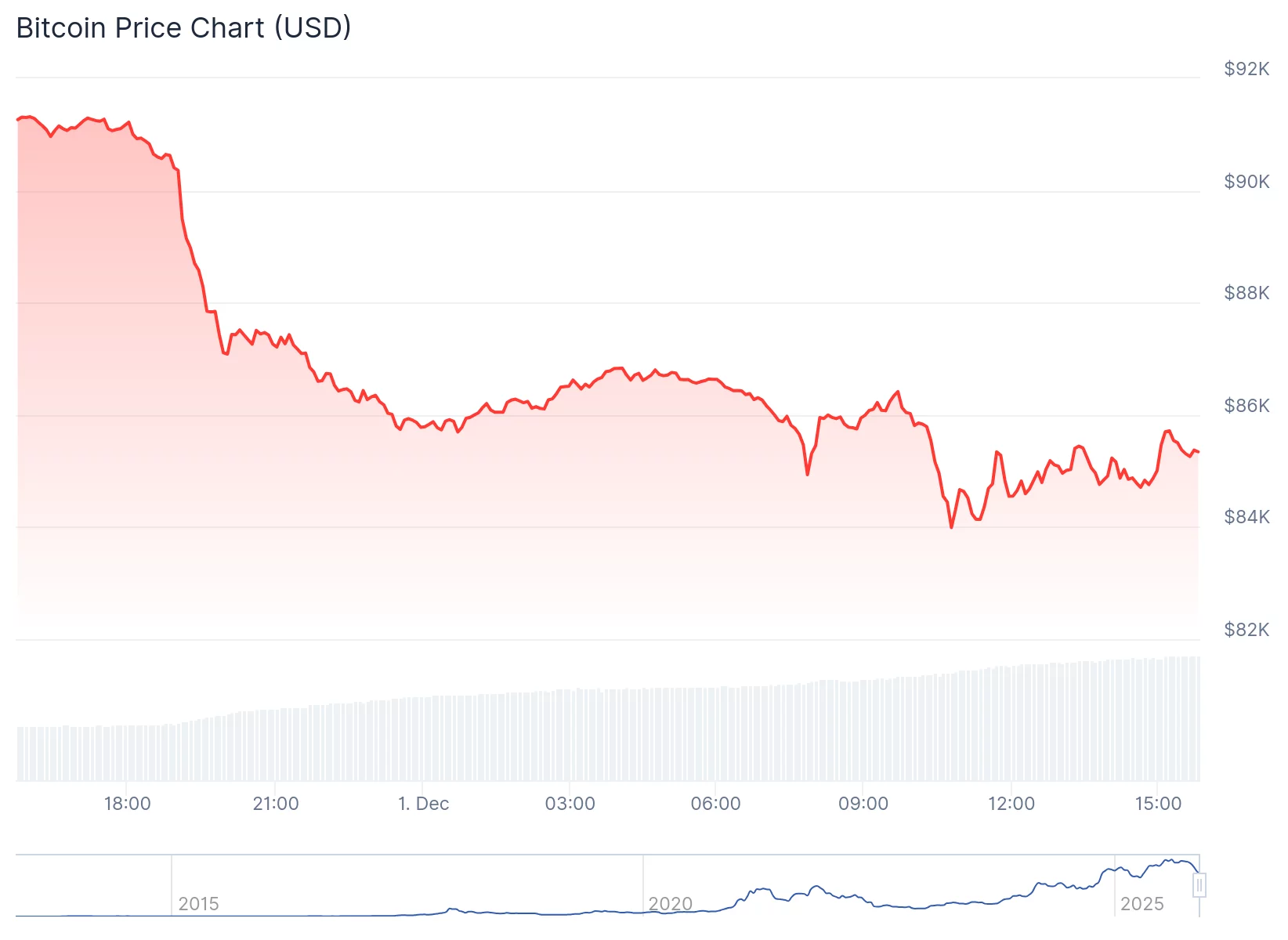

Schiff also noted how the cryptocurrency slid 28% from all-time highs, while the Nasdaq sits just 2% below its peak. November’s $500 billion wipeout, he argues, is proof that investors are fleeing what he sees as an imaginary asset and racing toward “real ones.” One might wonder: does he consider gold a “real” asset? Or perhaps a well-stocked larder?

Bitcoin isn’t selling off because it’s a risk asset, but because it’s a fake asset. The NASDAQ is less than 2% from its record high, yet Bitcoin is 28% below its record high. This shows that there’s more than just risk-off at play. This is a rotation from fake to real assets.

– Peter Schiff (@PeterSchiff) November 30, 2025

Bitcoin: ‘Stronger’ than ever?

Bitcoin is breaking down again, Schiff posted late Sunday. Over the past 24 hours, the world’s top digital asset has been in the red, down over 6% at last check. A tragedy, surely, for those who confuse volatility with vitality.

Last month, Saylor seemed unfazed but the sudden market downturn and remains confident despite Bitcoin’s recent pullback. A man who once bought Bitcoin at $100k like it was discount store candy, now grins through the storm. “Strategy, previously known as MicroStrategy, can handle extreme declines and is ‘engineered to take an 80-90% drawdown,’” he boasted on Fox Business. One might call it engineering-or perhaps sheer madness.

Bitcoin will stabilize at roughly 1.5 times the S&P 500’s volatility while outperforming it proportionally, he declared, as if forecasting the future from a Kremlin balcony. “Bitcoin is stronger than ever.” A sentiment as likely as a snowstorm in July, but then, who are we to question the wisdom of a man who treats a 6% drop as a personal victory lap? 🎉

Saylor vs. Schiff: Who’s right?

BlackRock’s Bitcoin ETFs – barely two years old – are now the firm’s most profitable product line, with IBIT climbing toward $100 billion in assets. Inflows continued even during November’s slump. Robinhood, Kazakhstan’s central bank, and corporations from Strategy to Metaplanet are treating Bitcoin as a strategic asset, not a meme. Volatility? Sure. Dead? Not so much. For the moment, Wall Street sees revenue and governments see opportunities. Indeed, Schiff is loud, but the capital flows are louder. And louder, one suspects, is where the future resides.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

2025-12-02 00:24