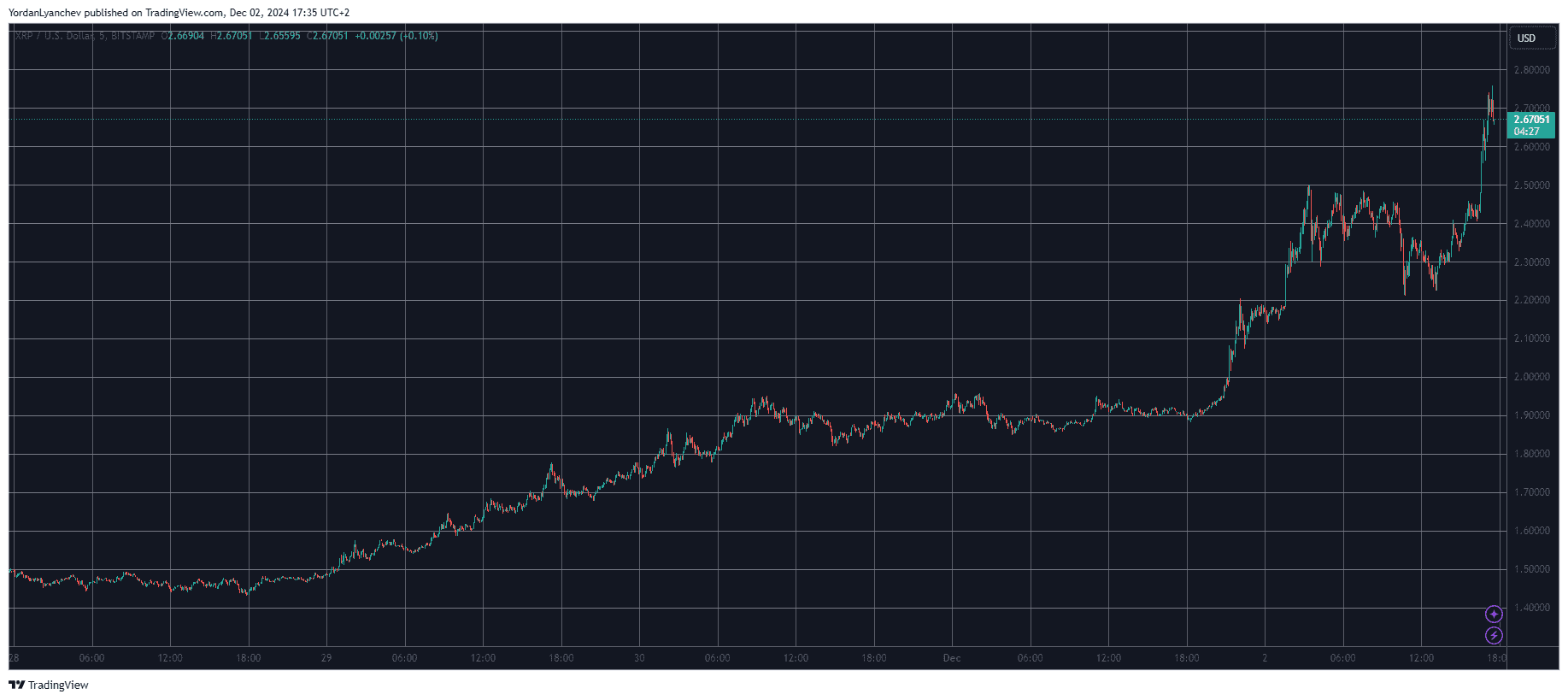

As an experienced crypto investor who has weathered numerous market cycles, I can confidently say that the recent surge of XRP is reminiscent of the wild west days of cryptocurrency trading. The rapid price increase beyond $2.7 for the first time in almost seven years is nothing short of astonishing, and it’s hard not to feel a sense of deja vu as I watch this asset defy expectations yet again.

TL:DR;

- XRP continues to make the headlines, with another notable surge that pushed its price beyond $2.7 for the first time in almost seven years.

- On-chain data has attributed this mindblowing monthly rally to whales accumulating the asset, mostly on Coinbase.

The pattern with XRP’s price movements over the past month, especially since Sunday, is becoming quite familiar, yet there’s a great deal of activity surrounding this digital asset.

Keep in mind that the value of Ripple‘s native token was approximately $1.9 yesterday. But, as stated earlier, it spiked beyond $2.2 and then reached an unprecedented high of $2.5 – a level not seen since January 2018.

Throughout the broad market pullback that occurred on Monday morning, it dipped to $2.2, however, the bulls accelerated once more, sparking yet another significant surge in price.

Speaking as a crypto investor, I’ve experienced an exhilarating surge in XRP’s value this time around, reaching a new local pinnacle at $2.75. Interestingly, it only missed its all-time high of $3.4 by a mere 23%. According to CoinGecko data, that’s quite close!

Despite retracing slightly to under $2.7 now, XRP is still up by over 420% in the past month. This surge has pushed its market cap to well beyond $150 billion, solidifying its place as the third-largest cryptocurrency by this metric.

According to multiple sources, it’s been reported that a significant amount of the asset was amassed by whales, who are large investors in this rally. However, CryptoQuant’s CEO, Ki Young Ju, not only agreed with this perspective but also added some additional insights. He pointed out that the majority of these purchases were made on the cryptocurrency exchange platform, Coinbase.

The reasoning behind this situation stems from the anticipated shift in U.S. politics after Donald Trump’s election as President, coupled with Gary Gensler’s decision to resign as SEC Chair in January.

Coinbase whales are driving this $XRP rally.

For the last month, the price difference between Coinbase and the market at a minute-by-minute level has fluctuated between a 3% undervaluation (when it was lower than the market) and a 13% overvaluation (when it was higher than the market) during the surge.

In other news, Upbit – a South Korean exchange that hosts more XRP investors than Binance – has yet to exhibit any substantial price premium.

— Ki Young Ju (@ki_young_ju) December 2, 2024

Read More

- SUI PREDICTION. SUI cryptocurrency

- Skull and Bones: Players Demand Nerf for the Overpowered Garuda Ship

- Navigating Last Epoch: Tips for New ARPG Players

- ‘The Batman 2’ Delayed to 2027, Alejandro G. Iñarritu’s Tom Cruise Movie Gets 2026 Date

- Why Sona is the Most Misunderstood Champion in League of Legends

- Gaming News: Rocksteady Faces Layoffs After Suicide Squad Game Backlash

- RIF PREDICTION. RIF cryptocurrency

- Honkai: Star Rail Matchmaking Shenanigans and Epic Hand-Holding Moments!

- League of Legends: The Mythmaker Jhin Skin – A Good Start or a Disappointing Trend?

- Brawl Stars Community Reacts to Quick Address of Recent Mishaps

2024-12-02 18:50