As a seasoned crypto investor with a decade of experience under my belt, I must admit that this latest Bitcoin rally has been quite unique. The speed and magnitude of its ascent following Trump’s election victory have left me both exhilarated and intrigued.

Following Donald Trump’s victory in the U.S. Presidential election in early November, Bitcoin experienced a significant surge. Within just a few weeks, its value increased by over $30,000, reaching a peak of more than $99,800.

The majority of reports suggest that the extended period of growth was primarily fueled by financial entities based in the U.S., a fact that can be substantiated by the staggering amounts of investment flowing into Bitcoin Exchange-Traded Funds (ETFs) located on the spot market.

When Retail?

In contrast to previous market rallies, such as the one in 2017 that took Bitcoin to $20,000 and the one in 2021 where it reached over $70,000, there doesn’t appear to be the same level of excitement or influx of retail investors during the current price increase. The usual fervor seen in past bull runs seems absent this time around.

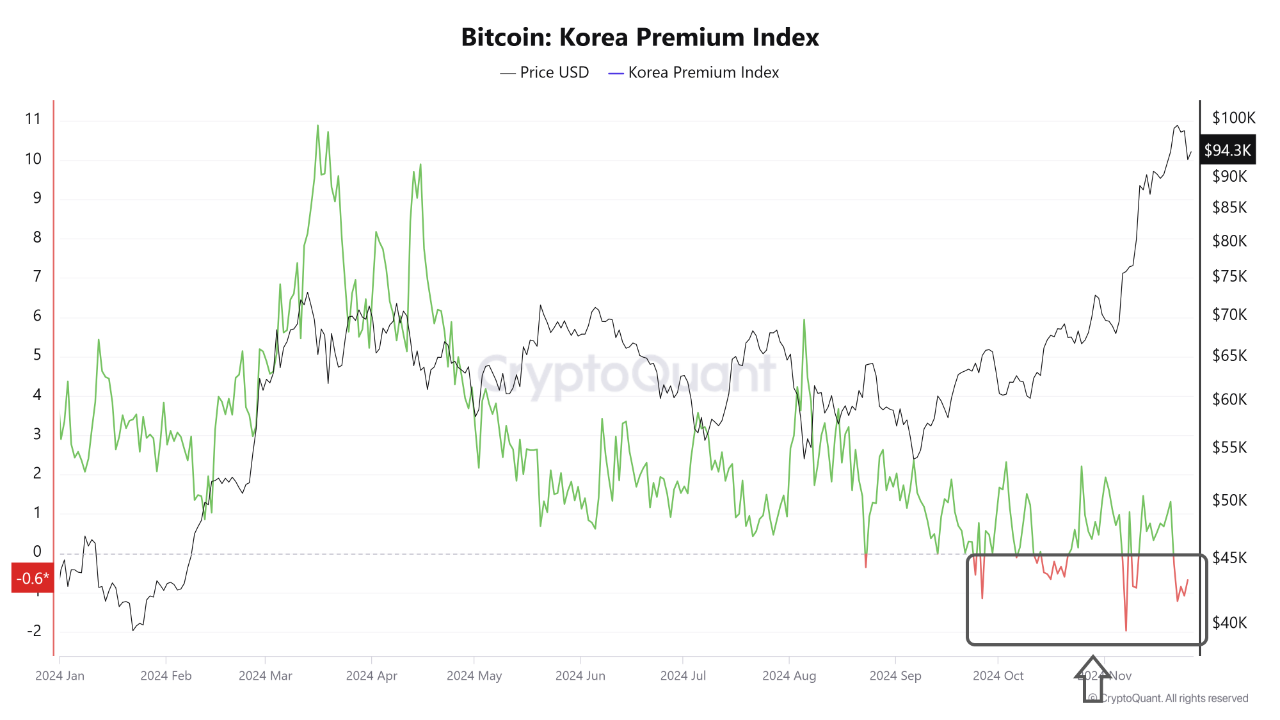

According to CryptoQuant’s data analysis, it appears that a significant number of retail investors are still absent from the market. The report primarily examined the Korea Premium Index, a crucial indicator representing retail involvement. This index measures the discrepancy between Bitcoin’s price on South Korean exchanges and those worldwide.

Over the last several weeks, the index has primarily been in a negative range, around -0.5. According to CryptoQuant’s assessment, this implies that retail participation has not significantly fueled the recent price surge.

As a crypto investor, I’ve found it beneficial to keep an eye on the Korea Premium Index. Historically, this index has surged to significant highs before Bitcoin’s price peaked (reached its maximum). Therefore, tracking the movements of the Korea Premium Index can be a useful strategy for identifying potential Bitcoin price tops.

What Does Google Say?

Google Trends data offers insights into the general interest of retail investors, as they tend to search for top cryptocurrencies like Bitcoin. This data indicates a significant increase in searches after Trump’s victory, pushing ‘bitcoin’ queries on the platform to a two-and-a-half-year high.

However, the levels are still significantly lower than those during the 2021 bull runs and the 2017 rally. This shows that there’s still a lot of room to grow in terms of retail participation. In fact, many analysts speculate on X that retail’s potential arrival could finally boost BTC to the coveted and unmatched target of $100,000.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Skull and Bones: Players Demand Nerf for the Overpowered Garuda Ship

- Gaming News: Rocksteady Faces Layoffs After Suicide Squad Game Backlash

- Mastering the Tram Station: Your Guide to Making Foolproof Jumps in Abiotic Factor

- League of Legends: The Mythmaker Jhin Skin – A Good Start or a Disappointing Trend?

- SUI PREDICTION. SUI cryptocurrency

- ‘The Batman 2’ Delayed to 2027, Alejandro G. Iñarritu’s Tom Cruise Movie Gets 2026 Date

- The Hilarious Realities of Sim Racing: A Cautionary Tale

- Honkai: Star Rail Matchmaking Shenanigans and Epic Hand-Holding Moments!

- Smite: Is the Current God TTK Too High? The Community Weighs In!

2024-11-26 18:38