What to know:

- Friday’s expiry represents 44% of the total expiry-wide open interest on Deribit, the largest ever in the exchange’s history.

- Options worth $4 billion are set the expire in-the-money.

- Vol-of-vol indicates directional uncertainty ahead of the expiry, while the outlook is more bearish for ETH.

As a seasoned researcher with years of experience in the volatile and ever-evolving world of cryptocurrencies, I find myself constantly on the edge of my seat, eagerly waiting for the next big event that could potentially shake up the market. And boy, does this upcoming options expiry on Deribit look set to deliver!

As if the end-of-year excitement wasn’t enough, a major options expiration is poised to stir things up even further in this already volatile market.

Derivative contracts, simply put, grant the buyer an option to either acquire or dispose of the underlying asset at a specified price in the future. In essence, a call option offers the privilege to purchase, while a put option provides the authority to sell.

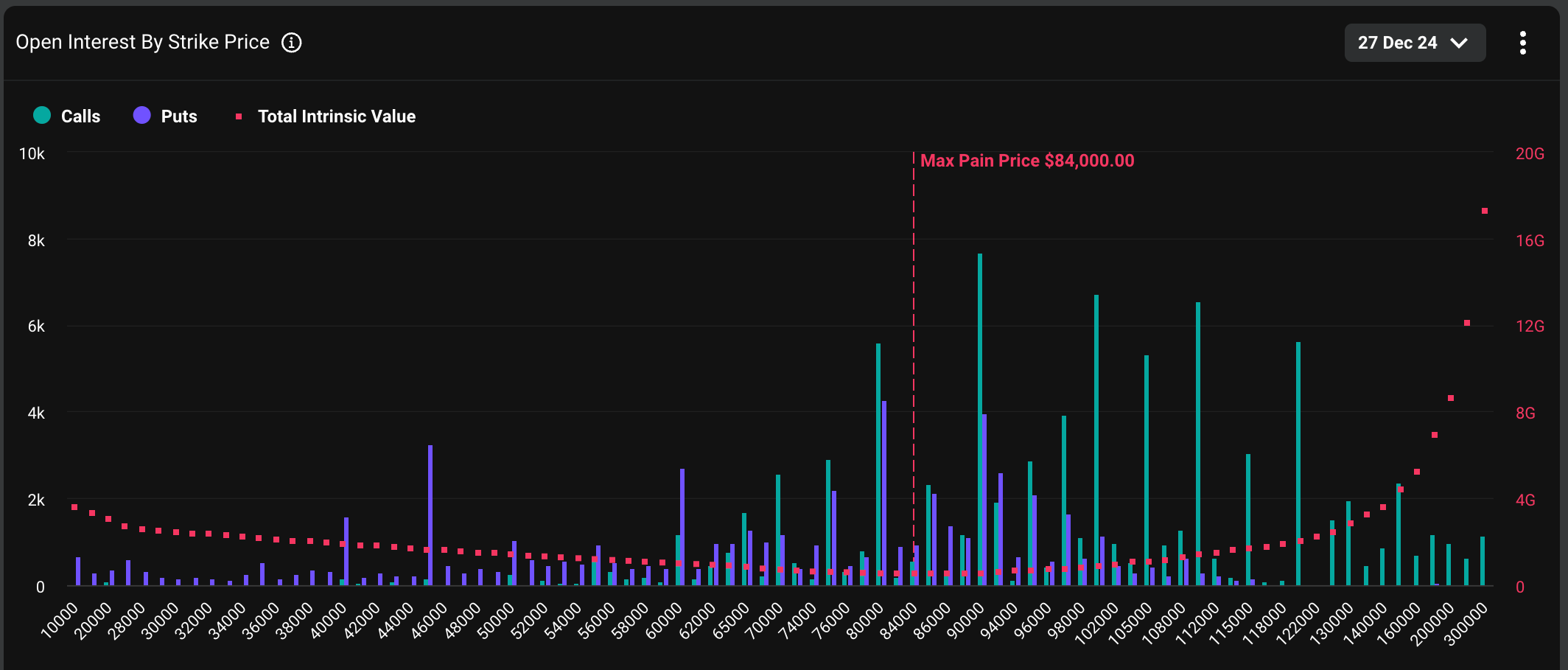

146,000 Bitcoin options contracts worth approximately $14 billion each, one Bitcoin per contract, are set to expire this Friday at 8:00 UTC on the crypto exchange Deribit. This notional amount equates to about 44% of the total open interest for all Bitcoin options across various maturities, making it the largest expiration event in Deribit’s history.

Approximately $3.84 billion in Ethereum (ETH) options are set to expire, following a nearly 12% drop in ETH’s value to around $3,400 since the Federal Reserve meeting. Deribit, which handles more than 80% of the worldwide crypto options market, is where these contracts will be settled.

Significant OI to expire ITM

Currently, it’s expected that approximately $4 billion worth of Bitcoin options, which accounts for around 28% of the total $14 billion open interest, will become profitable (in-the-money) on Friday. This could result in gains for buyers. These positions can either be closed out or moved to the next expiration date, possibly leading to market fluctuations.

According to Simranjeet Singh, a portfolio manager and trader at GSR, it’s likely that much of the active interest in Bitcoin (BTC) and Ethereum (ETH) will be transferred to options expiring on January 31st and March 28th, as these dates offer the greatest liquidity to start the new year.

It’s worth mentioning that on Friday’s expiration, the ratio of open put options to call options was approximately 0.69, implying that for every 10 call options still active, there are seven put options in play. This higher number of open call options suggests a biased upside potential for buyers, as it indicates a lean towards leverage on the positive side.

Despite a strong push earlier, Bitcoin’s upward trend seems to have lost its force following the Federal Reserve’s decision on Wednesday. In this decision, Chairman Jerome Powell stated that the Fed would not be buying Bitcoin and hinted at fewer interest rate reductions in 2025.

BTC has since dropped over 10% to $95,000, according to CoinDesk indices data.

In simpler terms, if traders have made leveraged bets predicting a rise (bullish), they face increased potential for significant losses. If these traders choose to withdraw from these bets, it might result in higher market volatility.

According to Deribit’s CEO, Luuk Strijers, speaking to CoinDesk, the strong upward trend (bullish momentum) that had been prevalent earlier has slowed down, creating a vulnerable situation in the market with a large potential for growth if positive events continue. However, this setup also means there’s a higher chance of a swift and substantial downturn if negative developments occur.

Everyone is eagerly anticipating this deadline, as it could significantly influence the storyline as we approach the upcoming year, noted Strijers.

Directional uncertainty lingers

The use of key performance indicators clearly demonstrates that the market is experiencing confusion about future price fluctuations, with the upcoming deadline approaching.

According to Strijers, the eagerly awaited end of the year is approaching, marking an exceptional 12 months for the bulls. Yet, there remains a question about where the market will head next, a query that has become more prominent due to increased volatility in the volatility itself.

The variability in the variability, often referred to as ‘volatility of volatility (vol-of-vol)’, is a gauge that quantifies the changes in the volatility, or price turbulence, of an asset. Essentially, it tells us how much the volatility, or the level of price instability, within the asset can change. If an asset’s volatility experiences substantial shifts over time, it is considered to have a high vol-of-vol.

In simple terms, a high volume of volatility implies that market movements become more reactive to news or economic data, resulting in quick fluctuations in asset values. This heightened reactivity may demand frequent adjustments to positions and hedging strategies.

Market more bearish on ETH

As an analyst, I observe that the current pricing of options approaching maturity suggests a relatively pessimistic view on Ethereum (ETH) compared to Bitcoin (BTC). This implies that traders and investors anticipate a potential downturn in the value of ETH compared to BTC over the short term.

In comparing the volatility smiles for options expiring on Friday between today and yesterday, Andrew Melville, a research analyst at Block Scholes, noted that Bitcoin’s smile remains relatively unchanged, whereas the implied volatility of Ethereum calls has noticeably decreased.

A volatility smile is a chart showing the estimated volatility of options with the same end date but varying price points. The decline in implied volatility for Ethereum call options suggests reduced interest in optimistic wagers, implying a muted forecast for the future value of Ethereum’s native token.

It’s clear that this is indicated as well by the options skew, a measurement showing how eager investors are to purchase call options with disproportionately high rewards compared to put options.

Following over a week of less favorable performance in the spot market, the difference between ETH’s options for puts versus calls is leaning heavily bearish (2.06% for puts compared to a more balanced 1.64% for calls in the case of BTC), as Melville pointed out.

In simpler terms, the overall outlook at the end of the year shows a somewhat less optimistic stance compared to what was expected in December, and this is particularly evident when comparing Ethereum (ETH) to Bitcoin (BTC), as Melville pointed out.

Read More

- “I’m a little irritated by him.” George Clooney criticized Quentin Tarantino after allegedly being insulted by him

- South Korea Delays Corporate Crypto Account Decision Amid Regulatory Overhaul

- George Folsey Jr., Editor and Producer on John Landis Movies, Dies at 84

- Why Sona is the Most Misunderstood Champion in League of Legends

- ‘Wicked’ Gets Digital Release Date, With Three Hours of Bonus Content Including Singalong Version

- Destiny 2: When Subclass Boredom Strikes – A Colorful Cry for Help

- An American Guide to Robbie Williams

- Not only Fantastic Four is coming to Marvel Rivals. Devs nerf Jeff’s ultimate

- Leaks Suggest Blade is Coming to Marvel Rivals Soon

- Why Warwick in League of Legends is the Ultimate Laugh Factory

2024-12-24 10:17