Scene: The mighty financiers of BlackRock, bedecked in doublet and hose, dust off their quills to pen a most peculiar amendment to the weighty S-1 for Monsieur iShares Bitcoin Trust (alias IBIT).

Oh, la la! In this grand missive dated the 9th day of May, our somber clerks whisper tales of a sorcery new: computing so puissant, it sets even the cleverest cryptographic locks atremble, like a poodle before a rolling cabriolet.

A Most Theatrical Fear: Enter, the Quantum Phantasm 🤡

With great ceremony, our heroes caution: should this “quantum” marvel, that ghost in the mathematician’s machine, blossom beyond its tender youth, it may make a mockery of Bitcoin’s vaunted security.

Imagine, if you will, a band of ruffians—armed not with daggers, but with algorithms—making merry with your digital treasure while the constabulary (read: your password) snore in blissful ignorance.

Though quantum computing remains a mere stripling—barely sprouting its first beard!—BlackRock, in a flush of dramatic honesty, confesses: ‘Who knows what the future holds, but pray you, take our warning!’

If there lurk dragons beneath the bridge, even if none have been seen, it is the merchant’s duty to wave his arms and shout, “Beware!”

The sorcerer Seyffart of Bloomberg, sounding almost drowsy with experience, remarks that such risk-mongering is but a theatrical tradition of the ETF guild. “Every peril, from meteor strikes to poorly cooked quiche, must be listed, else the comedy may end in tragedy,” he nods.

“To be clear. These are just basic risk disclosures. Any calamity—from quantum goblins to ill-timed rain showers—is obliged to make an appearance on stage. Standard routine, and really, who could argue otherwise?” muses Seyffart, adjusting his powdered wig.

Yet not content with quantum doom, BlackRock’s scribe solemnly recites: the perils of shadowy regulators, the gluttonous energy needs of Bitcoin miners, dragons hoarding coins in their Chinese lairs, forking roads, and—egad!—the collapse of FTX. This reality is enough to fill even Tartuffe with envy.

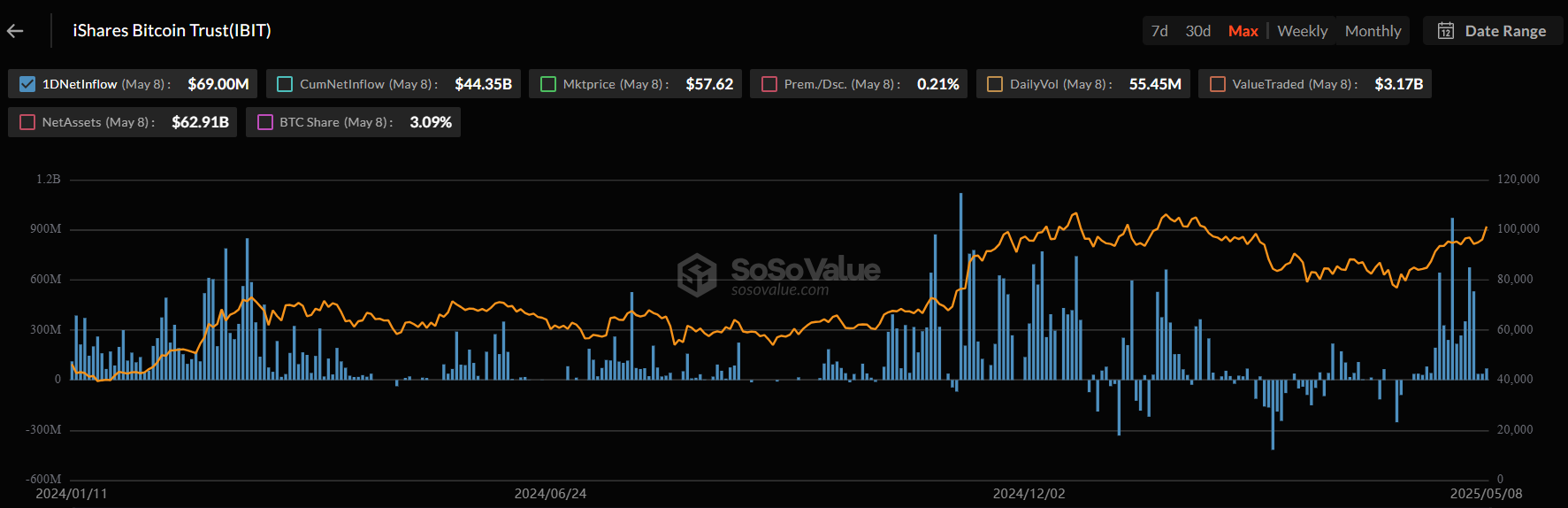

Despite the cacophony of groans, IBIT prances forward as the unrivaled hero of spot Bitcoin ETFs, basking in 19 successive days of citizenry tossing florins into its purse—over 5.1 billion, and not a single sou lost to quantum prestidigitation!

Meanwhile, In Ethereum: The Comedy of In-Kind Redemption 🎭

Elsewhere on this bustling stage, M. Seyffart fans the script for BlackRock’s Ethereum ETF—le gasp! A new act is revealed: in-kind creation and redemption.

Investors may now trade shares for Ethereum itself, instead of that dreary old cash, which evokes less excitement than a cup of week-old bouillon.

This, they say, may soften the fee-happy jaws of brokers and sidestep the grim specter of “slippage.” All hail the redemption model that keeps crypto, well… crypto!

Alas, the mighty SEC has not yet removed its ruffled periwig to approve such innovations, though rumors in the gallery reckon 2025 may see the plot thicken.

“Eric Balchunas & I wager our powdered wigs that approval will come anon…The last act is set for mid-October 2025,” intones Seyffart, juggling scrolls as a practiced valet.

Thus ends this merry tale, with BlackRock’s emissaries scurrying to parley with regulators on matters of staking, tokenization, and all manner of digital wizardry—a veritable ballet of bureaucrats and bitcoiners. 🍷

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Basketball Zero Boombox & Music ID Codes – Roblox

- How to use a Modifier in Wuthering Waves

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-05-10 12:55