What to know:

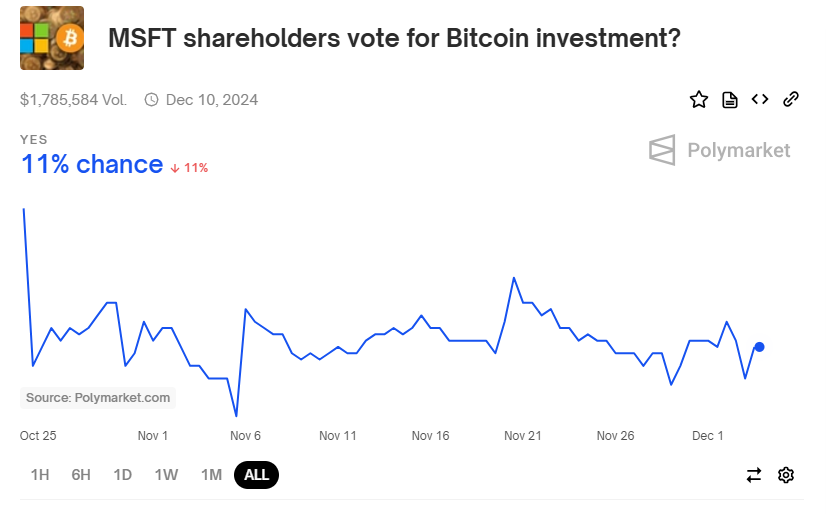

As a seasoned crypto investor with over two decades of experience navigating the volatile world of financial markets, I find myself intrigued by Michael Saylor’s pitch to Microsoft’s board about adding Bitcoin to their balance sheet. While Polymarket bettors have only given an 11% chance of this happening, I can’t help but recall my own early days in crypto when even suggesting such a move would have been met with laughter.

It seems that Michael Saylor’s argument to Microsoft’s board about incorporating bitcoin into their financial holdings has a slim likelihood of gaining approval from shareholders, as per wagers on Polymarket, the probability is estimated at just 11%.

Each wager consists of both an affirmative and negative outcome. If the forecast proves correct, each share will reward you with $1 in USDC, a digital currency equivalent to the U.S. dollar, otherwise, it will pay nothing.

Back in October, a suggestion from the National Center for Public Policy Research proposed that Microsoft should incorporate bitcoin into its financial reserves as a diversification strategy. However, their board advised shareholders against it, stating that cryptocurrencies lacked the stability necessary to be integrated into the financial portfolio of a corporation as substantial as MSFT. From my perspective as a crypto investor, this highlights the ongoing debate about the maturity and reliability of digital currencies in traditional finance.

Saylor, the executive chairman of Microstrategy (MSTR), which has seen its stock rocket up 455% year-to-date, recently pitched Microsoft’s board on this issue, arguing bitcoin could act as a hedge against inflation and economic uncertainty, potentially boosting Microsoft’s $3.2 trillion market cap to over $8 trillion.

According to Saylor, Microsoft’s current financial strategy, which involves distributing dividends and buying back shares, has been detrimental to the company. He contends that instead of giving away $200 billion in capital over the past five years, this money could have been used to invest in Bitcoin, which has seen a staggering rise of over 1,200% during this period.

One Polymarket bettor argued that there wasn’t really a point for institutional investors to want Microsoft to add bitcoin to its balance sheet, because there are already so many options out there to get bitcoin exposure – which wasn’t the case when Microstrategy originally bought.

In simpler terms, trader Oxymirin stated that they are complicating the evaluation of secure investments by mixing them with unpredictable ones. Oxymirin has a $2000 stake in a position advocating against this mix.

A different investor, with a perspective contrary to yours, suggested that due to Microsoft’s substantial cash reserves, it could potentially purchase a modest quantity of Bitcoin.

A trader named titanlin suggests that a modest portion of funds will likely be set aside for testing purposes, as it’s essential to keep shareholders’ interests in mind. With Microsoft having ample cash reserves, they offer various options for investing in Bitcoin.

Microsoft has set a date for its upcoming shareholders’ gathering on December 10th, during which the proposed resolution will be put to a vote.

Read More

- “I’m a little irritated by him.” George Clooney criticized Quentin Tarantino after allegedly being insulted by him

- South Korea Delays Corporate Crypto Account Decision Amid Regulatory Overhaul

- George Folsey Jr., Editor and Producer on John Landis Movies, Dies at 84

- Why Sona is the Most Misunderstood Champion in League of Legends

- ‘Wicked’ Gets Digital Release Date, With Three Hours of Bonus Content Including Singalong Version

- Destiny 2: When Subclass Boredom Strikes – A Colorful Cry for Help

- An American Guide to Robbie Williams

- Not only Fantastic Four is coming to Marvel Rivals. Devs nerf Jeff’s ultimate

- Leaks Suggest Blade is Coming to Marvel Rivals Soon

- Why Warwick in League of Legends is the Ultimate Laugh Factory

2024-12-03 15:35