Key Highlights:

- OM decided to throw a party, surging 23% in just 24 hours on May 21, leaping from $0.38 to $0.47 after its big debut on Upbit. 🎉

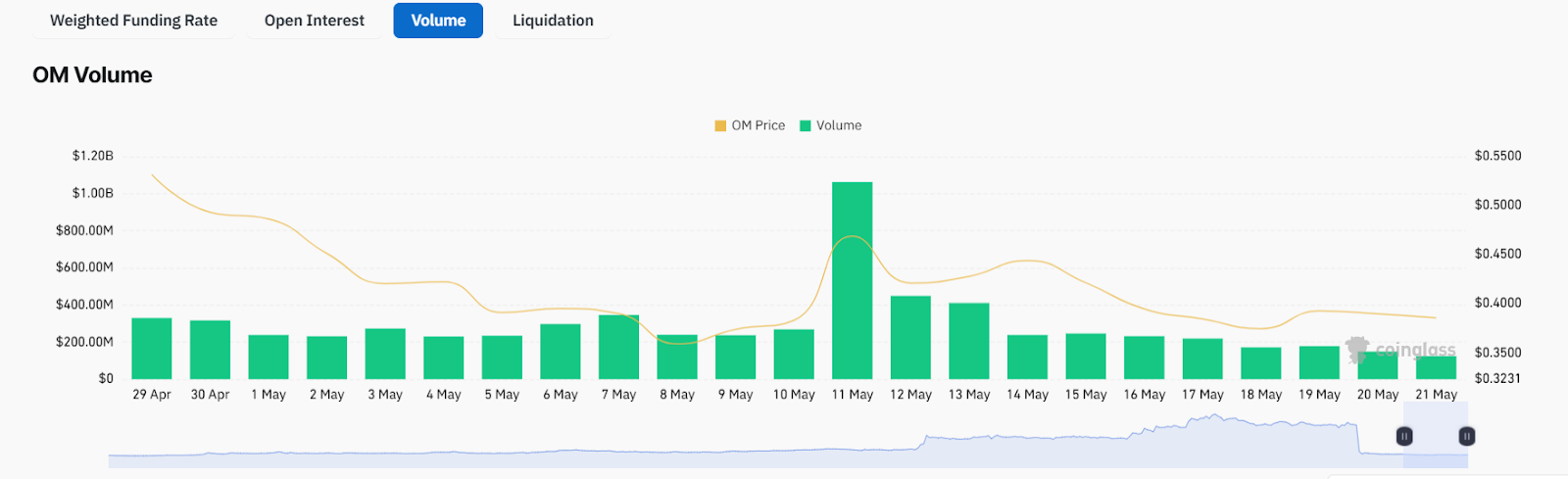

- Daily trading volume went absolutely bonkers, spiking over 460% in 24 hours, briefly hitting $385 million. Talk about a shopping spree! 🛒

- OM peaked at $0.47 before doing a little cha-cha back to $0.4381. Classic! 💃

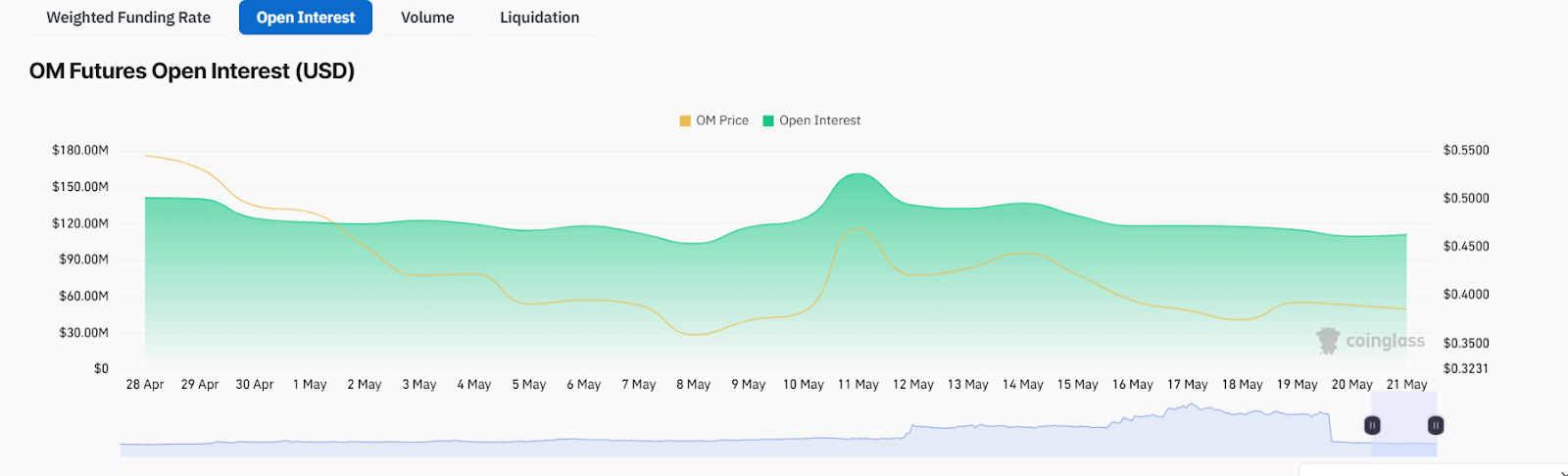

- Futures volume and open interest are showing signs of a speculative party, but is anyone really invited? 🤔

- Despite the jump, OM is still down 95% from its February high of $9.04. Ouch! 😬

Mantra (OM) saw a sharp 23% price spike following its listing on South Korea’s top exchange, Upbit. But is the rally here to stay, or is it just another hype-driven surge? Spoiler alert: probably the latter! 🙃

OM Gets Listed on Upbit – Price Responds Instantly

On May 21, OM Coin was officially listed on Upbit, joining the cool kids like ACS, GO, OBSR, QTCON, and RLY. OM was offered with trading pairs against KRW, BTC, and USDT. The announcement triggered a 23% price jump, as OM shot from $0.38 to $0.47 within 24 hours, before cooling to $0.4381 by press time. Can we say “overreaction”? 😅

South Korean interest fueled this move, but can OM hold these gains or will history repeat itself like a bad rom-com? 🍿

OM/USDT Technical Analysis: Bounce or Trap?

After weeks of doing the sideways shuffle near $0.38, OM finally decided to climb 23% on May 21, forming a strong bullish candle after the Upbit listing. This marked the second notable surge in recent weeks. Can we get a round of applause? 👏

On May 10–11, OM also jumped 22% from $0.385 to $0.47 amid rising on-chain volume ($1.06B) and open interest ($175M). That rally faded faster than my willpower at a buffet, showing the rally was likely fueled by leveraged traders rather than long-term buyers. 🍰

RSI, which dropped to 17 on May 9, has gradually recovered — rising to 23 on May 10 and further climbing to 27.74 by May 21. This indicates improving momentum from oversold conditions, though it remains below the neutral 50 level. So, basically, it’s still a bit of a mess. 🤷♀️

MACD continues to reflect early bullishness, with the MACD line curving upward and the histogram turning green. This crossover suggests upward pressure is building but still lacks strong confirmation. It’s like waiting for a text back that never comes. 📱

Unless $OM pushes above the $0.47–$0.50 resistance, this move may stay short-lived. Just like my last relationship! 💔

On-Chain and Derivatives: Traders React, But Conviction Lags

CoinGlass data reveals OM’s futures open interest spiked to $175M on May 11, with funding rates hitting 0.0261% — showing an overly bullish crowd. Someone’s feeling optimistic! 😏

Volume surged to $1.06B that day, the highest since April. But the excitement faded quicker than a TikTok trend, suggesting most of the inflow was speculative. 📉

Market cap rose from $372M (May 20) to $417M after the listing — a 12% increase — but failed to hold above $420M for long. Classic case of “too good to be true.” 🙄

Conclusion: Can Hype Trigger a Sustainable Rally?

The Mantra Coin, OM’s 23% rally shows how strong catalysts like exchange listings can spark quick moves. Yet, technicals and on-chain metrics suggest this is more of a short-term reaction. Like a one-night stand, it’s fun but probably not lasting. 😏

A confirmed breakout above $0.47–$0.50 with volume could flip the trend bullish. Without that, OM may revisit the $0.40–$0.42 range. Short-term sentiment remains neutral to slightly bullish, but traders should watch closely for follow-through this week. 👀

Unless OM sustains its gains with rising volume and new ecosystem developments at this stage, not yet. Otherwise, the move remains speculative in nature. Just like my dating life! 😂

Analyst Perspective: What Should Traders Do Next?

- Short-term traders should watch for a breakout above $0.50 with volume before considering momentum-based longs. Until then, risk remains for a retest of $0.40. So, keep your eyes peeled! 👀

Long-term investors might view dips near $0.38–$0.40 as early accumulation zones — but only if OM builds stronger fundamentals beyond exchange catalysts. Because let’s be real, we all want something with substance! 💖

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Basketball Zero Boombox & Music ID Codes – Roblox

- Lottery apologizes after thousands mistakenly told they won millions

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Umamusume: Pretty Derby Support Card Tier List [Release]

- J.K. Rowling isn’t as involved in the Harry Potter series from HBO Max as fans might have expected. The author has clarified what she is doing

2025-05-21 14:29