Dear me, what to know:

- My dears, Robinhood’s crypto trading volume had a rather dramatic fall in February, down 29% – quite the performance, outdoing even the declines in equities and options trading.

- However, let us not forget that despite the monthly drop, the crypto volumes were still a staggering 122% higher than in February 2023. Quite the rollercoaster, wouldn’t you say?

- The decline, oh the decline, coincides with a broader crypto market downturn, with bitcoin and the CoinDesk 20 Index experiencing losses that would make even the most seasoned gambler flinch.

Robinhood (HOOD), my dear friends, saw its crypto trading volumes take quite the tumble in February, down a shocking 29% from the previous month. A decline led by retail traders, mind you, that might just carry a message for other platforms like Coinbase (COIN). Oh, the drama!

The month-over-month drop to $14.4 billion, outpaced declines in equities and options trading, each falling a mere 1%. Yet, the figure was more than double the year-earlier level, the company said in a press release. Quite the show of resilience, wouldn’t you agree?

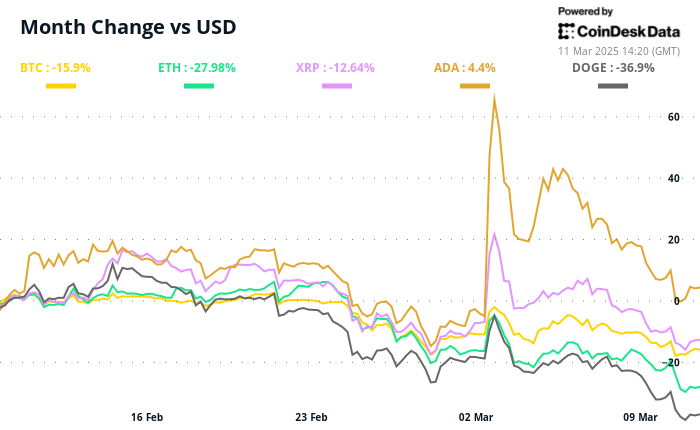

The figure reveals how trading dropped off as the cryptocurrency market slid. Bitcoin (BTC) lost about 15% of its value last month and the broader CoinDesk 20 Index (CD20) fell by around 23%. Across centralized cryptocurrency exchanges, spot trading dropped 19% to $2.3 trillion in February compared with January, CoinDesk data shows. Oh, the numbers, the numbers!

Memecoin activity also eased, with leading token launchpad Pump.fun seeing daily token launches plunge to 24,000 from 62,000, according to 10x Research. Quite the comedown, wouldn’t you say?

The slowdown in cryptocurrency trading volumes suggests lower retail interest in the space and could have implications for other exchanges including Coinbase (COIN), which caters to a similar audience. Quite the predicament, wouldn’t you say?

Shares of Robinhood, a retail-focused trading platform that also offers equities, have dropped 4% this year. Coinbase, in contrast, has fallen 15%, in line with the broader crypto market retreat. Quite the disparity, wouldn’t you say?

Coinbase has, however, been expanding its institutional services and blockchain infrastructure business, which could help offset some of the impact from weaker retail trading. The company recently announced the introduction of 24/7 bitcoin and ether futures trading. Quite the silver lining, wouldn’t you say?

Read More

- How to use a Modifier in Wuthering Waves

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mistfall Hunter Class Tier List

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Basketball Zero Boombox & Music ID Codes – Roblox

- Ultimate Half Sword Beginners Guide

- Unlock All Avinoleum Treasure Spots in Wuthering Waves!

- WIF PREDICTION. WIF cryptocurrency

2025-03-11 19:33