Oh, the grand theatre of the digital realm, where Non-Fungible Tokens (NFTs) once pirouetted on the grand stage of economic promise, now seem to be stumbling about like a debutante at her first ball. As the crypto market braces itself for a tempest of tariff wars, the NFT market appears to be in a rather unenviable state – think of it as a grand ballroom where the music has suddenly stopped, and everyone is awkwardly standing around, wondering what to do next.

The voluminous volumes of trading are waning, and marketplaces are closing their opulent doors as if they were the last chapters of a tragic novel. The once-celebrated world of NFTs, which was prophesied by some overly enthusiastic analysts to burgeon to a staggering $264 billion by2032, now seems to be hobbling along, not unlike a character from a Dickensian tale. Weekly trading volumes have been dropping faster than Wildean wit at a Victorian dinner party, scaring off capital and dragging our dear NFTs back to the austere levels from whence they came in their explosive2020 debut.

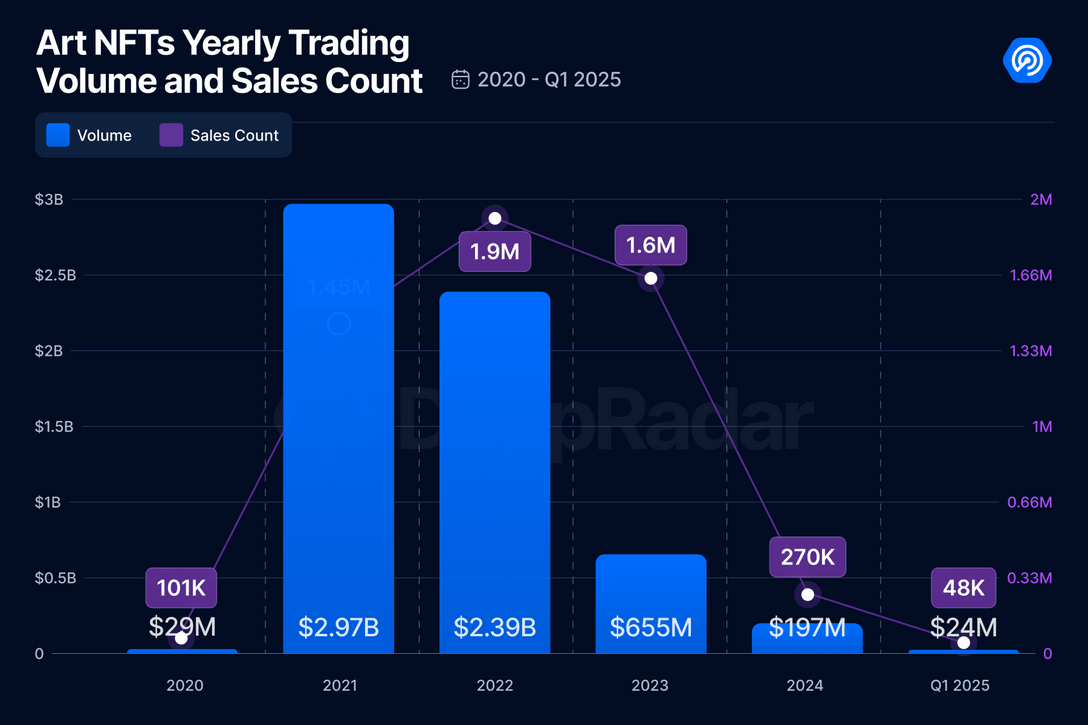

Blockchain analytics, those modern-day crystal ball gazers, notably DappRadar, showed us a time not long ago when trading volumes in2021 were soaring, nearly touching the $3 billion mark. Fast forward to the rather bleak first quarter of2025, and that figure has plummeted a staggering93% to a mere $23.8 million. “Active traders have vanished,” laments blockchain analyst Sara Gherghelas, as if she were mourning the departure of guests from a particularly dreary house party.

“This rapid growth coincided with global shifts driven by the COVID-19 pandemic, accelerating the adoption of digital platforms and pushing artists to explore innovative methods of engaging with their audiences. However, three years later, the hype around Art NFTs has significantly decreased.”

Sara Gherghelas

Alas, the data corroborates her lament. In2024, trading volume took a nearly20% dive from the previous year, while total sales slumped by18%. As Gherghelas so eloquently put it in her2025 research, it was “one of the worst-performing years since2020.”

The Speculative Spectacle

In an interview that could rival any salon discussion, OutsetPR’s legal officer, Alice Frei, coyly suggested that the regulatory landscape for NFTs resembles a jigsaw puzzle with half the pieces missing. Governments, it seems, are as undecided about how to classify NFTs as a Victorian gentleman is about choosing the right cravat.

In the U.S., these digital darlings are often treated like securities, forcing platforms to tiptoe around legalities as delicately as one would around a sleeping tiger. In the U.K., they are regarded more like collectibles under intellectual property law, a classification as quaint and confusing as an English garden maze.

“These are examples of leading countries with clear cryptocurrency regulations; in many other countries, the situation is even more uncertain. This lack of regulatory clarity creates an environment that is ripe for fraud and erodes investor confidence. Until there is more consistency, NFT adoption will remain stagnant.”

Alice Frei

Frei, with the insight of a seasoned philosopher, highlighted a deeper existential crisis: beyond the glittering realms of cryptocurrency and gaming, NFTs are still “trying to prove that they offer real value,” much like an artist trying to convince the world of his genius while his paintings gather dust.

“In theory, they could revolutionize several industries — think concert tickets that prevent scalping, digital IDs for online verification, or property deeds stored on the blockchain. But in practice, most NFTs are still largely speculative assets.”

Alice Frei

Speaking of gaming, where NFTs have the potential to dazzle like a shooting star, their adoption is as hesitant as a first-time ballroom dancer. Ubisoft’s Project Quartz, an ambitious attempt to weave NFTs into the fabric of AAA games, was met with resistance so fierce, it forced the company to retreat faster than a scandalized aristocrat. Frei notes that gamers are “hesitant about digital assets that feel more like currency than a genuine addition to their experience,” a sentiment as understandable as it is damning.

The Carousel of Closures

As if the data wasn’t painting a picture bleak enough for a Brontë novel, March delivered yet another blow: a series of marketplace shutdowns that added insult to injury. Among the casualties, South Korean tech giant LG shuttered its LG Art Lab, a venture launched amidst the zenith of NFT mania just three years prior. The company’s reasoning was as vague as a politician’s promise, merely stating that “it is the right time to shift our focus and explore new opportunities.”

A mere week later, X2Y2, once a formidable rival to OpenSea boasting $5.6 billion in lifetime volume, also folded its cards, citing a “90% shrinkage of NFT trading volume from its peak in2021” and struggles to stay afloat in the increasingly stormy seas of the NFT space.

Then came Bybit, still reeling from a $1.46 billion theft linked to North Korea-affiliated hackers, quietly closed its platform. Emily Bao, head of web3 at Bybit, spun the decision as a move to “enhance the overall user experience while concentrating on the next generation of blockchain-powered solutions,” a statement as optimistic as it is ambiguous.

Amidst this whirlwind of closures, Frei aptly describes the NFT market as feeling like “a revolving door,” where projects like the Bored Ape Yacht Club, once the epitome of NFT prestige, have seen their prices plummet faster than a lead balloon. The crux of the matter, she suggests, is that many NFT projects have relied more on hype than on tangible utility, a strategy as sustainable as building a house of cards in a hurricane.

Hope on the Horizon?

Coinbase, too, appears to be subtly stepping back from the NFT fray. While it hasn’t officially pulled the plug on its NFT platform, indications suggest a shift in focus, particularly towards Base, its layer-2 blockchain network. Coinbase’s silence on the matter, despite multiple inquiries from crypto.news, speaks volumes, much like a character’s unspoken thoughts in a Wilde play.

Frei, ever the pragmatist, posits that with the current trajectory, smaller platforms are likely to be winnowed out, leaving only a few dominant players like OpenSea and Blur standing. The shift, she explains, is driven by two major forces: the looming specter of tighter regulations, which promises to put an end to the “Wild West days of NFTs,” and the gaming sector, which may offer NFTs a lifeline, albeit a narrow one. Gaming, she suggests, could be NFTs’ “last hope,” provided developers can navigate the treacherous waters of avoiding “pay-to-win mechanics that could turn players away.”

“The hype is over,” Frei concludes, with the finality of a curtain falling at the end of a play. “If NFTs are to survive, they will need to prove that they offer more than just expensive pictures on the blockchain.” A fitting epilogue to a saga that has been as dramatic as it has been unpredictable.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- KPop Demon Hunters: Real Ages Revealed?!

- Basketball Zero Boombox & Music ID Codes – Roblox

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Lottery apologizes after thousands mistakenly told they won millions

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

2025-04-06 20:16