What to know:

- MicroStrategy would rank sixth in trade volume if it were in the basket of the seven magnificent tech stocks.

- MicroStrategy has the highest 30-day implied volatility of any magnificent seven tech stock.

The technology firm MicroStrategy (MSTR), which specializes in Bitcoin (BTC), is among the most unpredictable and actively-traded stocks available.

The fluctuation in stock prices (volatility) of equities can prove advantageous because it encourages heavy trading activity. Interestingly, despite MicroStrategy’s relatively small market capitalization of under $100 billion, its trading volume is on par with the trading volumes of the seven major technology companies.

Among the impressively valued technology companies, each has a market worth of at least one thousand billion dollars, which is more than ten times the market value of MicroStrategy. Notably, Apple (APPL), NVIDIA (NVDA), and Microsoft (MSFT) individually boast market values surpassing $3 trillion.

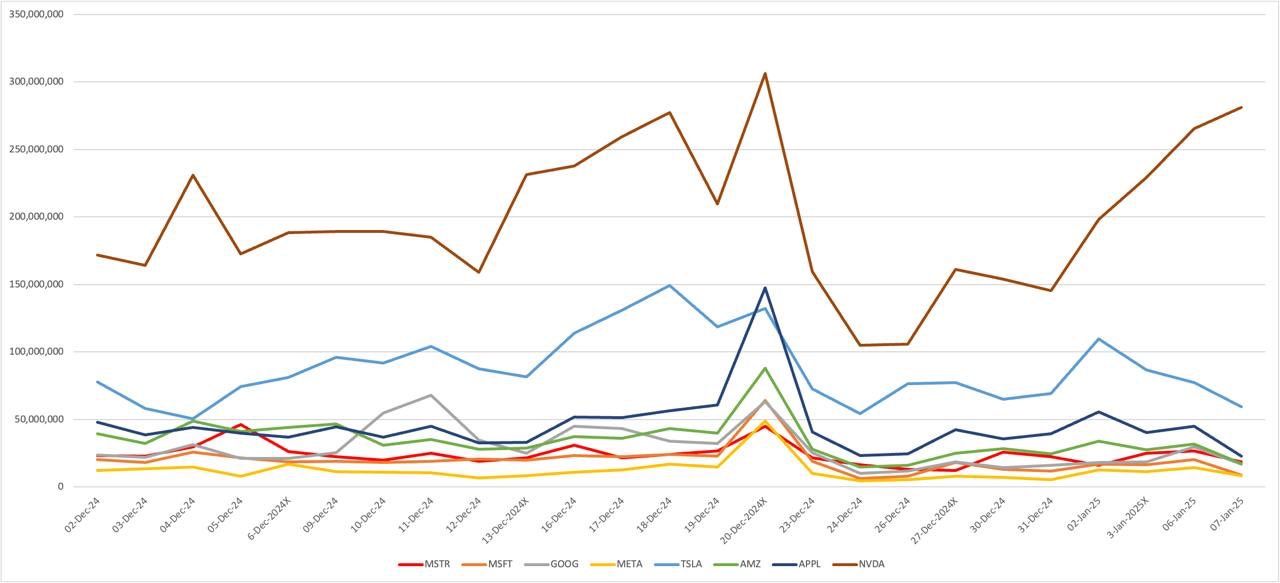

According to Market Chameleon’s data, an average of approximately 24 million MicroStrategy (MSTR) shares were traded each day from December 2, 2024, to January 7, 2025. This puts MSTR as the sixth most actively traded tech stock when compared to others like Microsoft (MSFT), trading around 20 million shares daily, and META (META) with approximately 12.2 million shares exchanged daily. However, it’s NVIDIA that takes the lead in this group, while Tesla (TSLA) follows closely in second place.

In simple terms, MicroStrategy has increased by approximately 14% so far this year. The 30-day Implied Volatility (IV) is currently at 104. This figure represents the market’s forecast for potential price fluctuations in MicroStrategy over the next month.

As a crypto investor, I find it fascinating that the Implied Volatility (IV) from options pricing plays a significant role in my investment decisions. For instance, iShares Bitcoin Trust (IBIT) currently has an IV of approximately 60, which means MicroStrategy (MSTR) is about 1.7 times more volatile than IBIT.

Now, here’s where things get interesting. As per the data from Jan. 7, MicroStrategy boasts the highest Implied Volatility Skew (IV30) of an astounding 105, outperforming all seven other tech stocks in volatility. Tesla comes close but still trails behind with an IV30 of 71.0. This intriguing finding is based on the insights from market chameleon data. So, while IBIT might be relatively stable, my investment in MSTR could potentially yield more dynamic returns due to its high volatility.

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- DAG PREDICTION. DAG cryptocurrency

- Record Breaking Bitcoin Surge: Options Frenzy Fuels 6-Month Volatility High

- New Mass Effect Jack And Legion Collectibles Are On The Way From Dark Horse

- „I want to give the developer €30 because it damn slaps.” Baldur’s Gate 3 creator hopes Steam adds tipping feature for beloved devs

2025-01-08 14:45