In a world where fortunes are built on the whims of digital coins, an epic saga unfolds—a tale as remarkable as it is bizarre. Under the watchful eye of the indomitable Executive Chairman Michael Saylor, MicroStrategy has orchestrated a dollar-cost averaging strategy that echoes through the annals of financial history, with returns soaring above $102.5 billion like a rocket adorned with gilded dreams! 🎇

With around 500,000 BTC acquired at an average cost of $66,384, just imagine the glee when the price of BTC dances above $87,000. It’s as if Saylor’s investments have emerged from the shadows, shaking hands with the Gods of Fortune. The recent surge has jolted prices from the depths below $30,000 early last year to heights no one dared to dream in Q1 of 2025—one could almost hear the jubilant laughter of traders echoing in the halls of riches! 😂

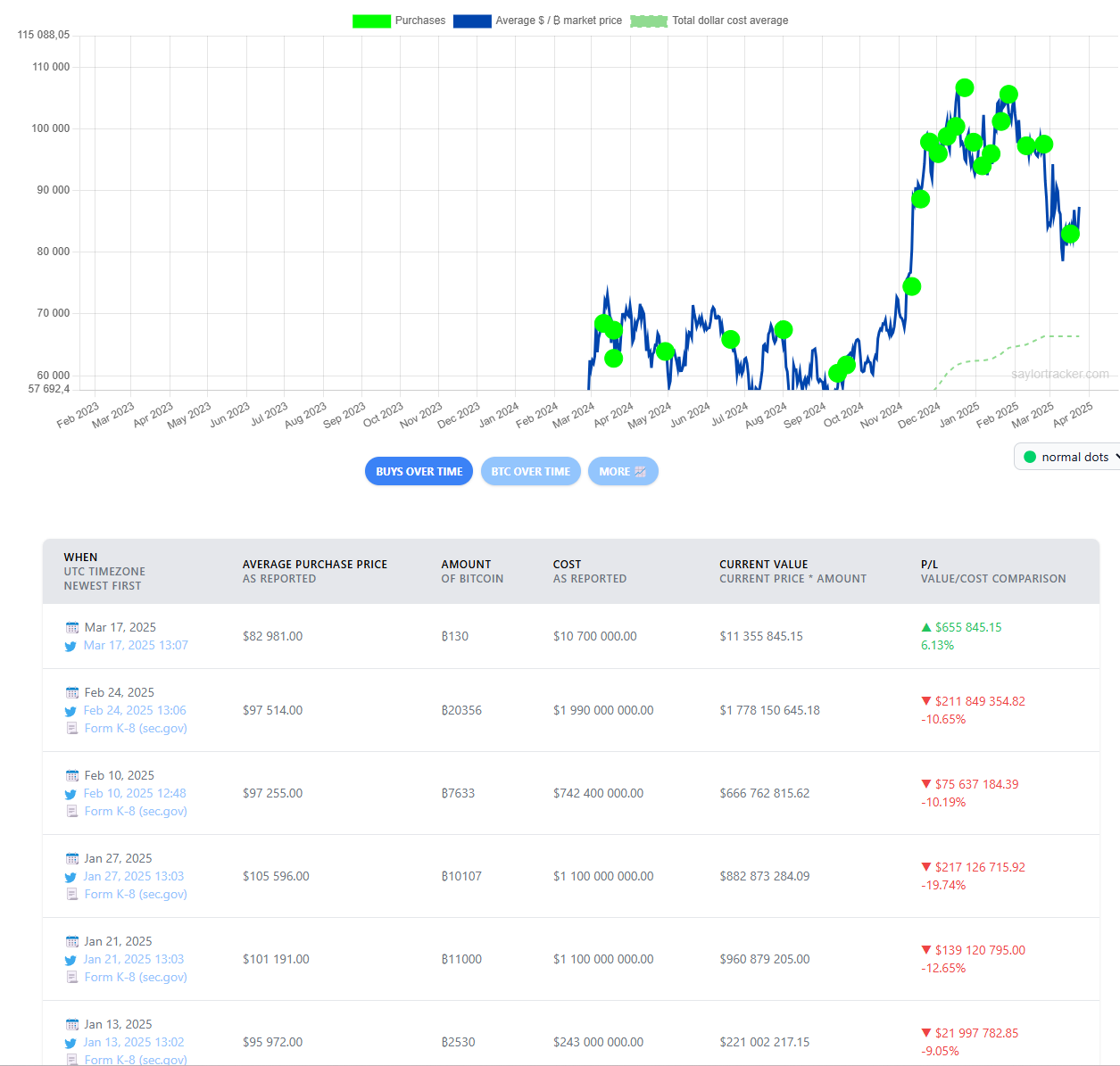

But before we don our rose-tinted glasses, a footnote of caution creeps into this glittering narrative. A keen eye reveals that many of MicroStrategy’s latest acquisitions remain besieged in the limbo of pending status. Those high-volume purchases from late 2024 and early 2025, made as though shooting for stars, are dancing perilously close to the abyss, with average prices gravitating between $97,000 and $105,000—an exquisite display of how the mighty can stumble. 😅

Take, for instance, the brave acquisition of 10,107 BTC on January 27, purchased at $105,596, now with the graceful elegance of a 19.74% loss. Or the audacious attempt of over 20,000 BTC on February 24 at $97,514, currently down at a charming 10.65%. Yet, like a seasoned warrior of yore, the company remains steadfast, clutching to its long-term strategy that rallies through the storms of volatility. 🌪️

Ironically, it’s those large purchases made back in the halcyon days of 2020 and 2022 when BTC prices were dramatically under $30,000 that now cloak these sorrows with a more favorable sheen. Saylor’s arguments that Bitcoin serves as a treasury reserve asset, ripe for growth, ring truer than a bell tinkling in a serene monastery. As supply constraints loom with the ever-anticipated halving, and inflows into Bitcoin’s spot ETFs strengthen day by day, one can’t help but chuckle at the prospect of newfound wealth waiting to spring forth. 😏

As the tides of financial fate ebb and flow, MicroStrategy’s relentless accumulation strategy continues to play the tune of success—outshining many institutional counterparts who remain lost in the labyrinth of their indecision. With more than $10 billion in unrealized gains, the company stands proud, a monumental presence in the digital realm! So, beware, dear investors; in the bizarre circus of cryptocurrency, fortunes await the bold and the patient alike! 🎪

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- KPop Demon Hunters: Real Ages Revealed?!

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

2025-03-24 17:01