What to know:

As an analyst with over two decades of experience in the financial markets, I must say that MicroStrategy’s latest move to acquire 15,350 more Bitcoins is nothing short of bold and strategic. With their total holdings now worth approximately $45.6 billion, they are not just playing a game here; they are making a statement about the future potential of Bitcoin as a store of value.

According to their own description, the Bitcoin (BTC) development firm MicroStrategy (MSTR) has expanded its Bitcoin holdings to a grand total of 439,000 BTC after completing the purchase of an additional 15,350 BTC on December 15.

MicroStrategy revealed that they spent a grand sum of $1.5 billion to acquire 15,350 Bitcoins, which amounts to approximately $100,386 per Bitcoin on average. With this latest purchase, their total Bitcoin holdings now stand at an impressive 439,000 coins, valued at about $45.6 billion given the current market prices. The company’s average cost for each Bitcoin they own is around $61,725.

The most recent purchase was financed by selling shares under our at-the-market (ATM) program. Prior to the announcement, MicroStrategy had approximately $9.19 billion remaining from its ATM offering. After the announcement, the company’s remaining funds from this offering stand at around $7.65 billion, as per the latest report.

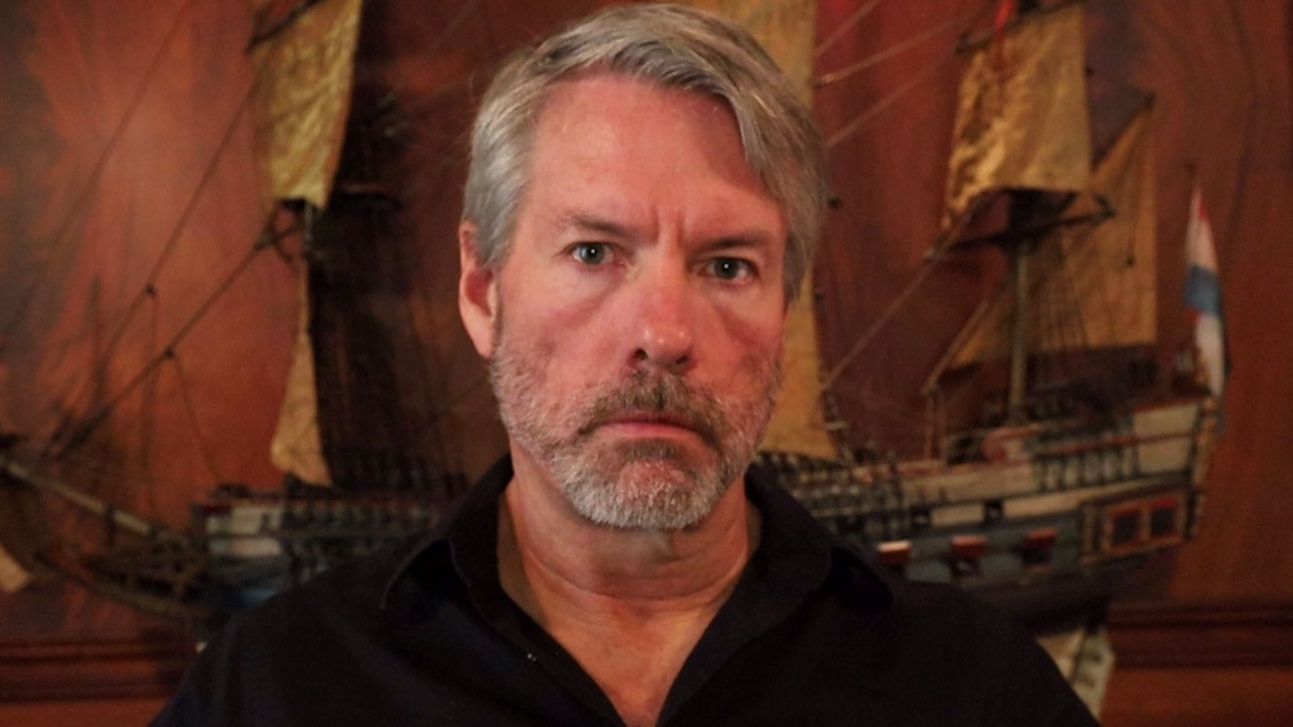

Once again, Executive Chairman, Michael Saylor teased the Monday announcement with a Sunday post.

For the past five weeks, MicroStrategy has consistently made a bitcoin purchase on Mondays, just before the U.S. market begins. In total, they have bought 171,430 BTC worth approximately $15.61 billion. This is according to a post by @LuckyXBT__. This latest acquisition aligns with their ongoing “21/21 plan”. As of now, MicroStrategy still holds $18 billion in convertible note offerings, but only $3 billion has been utilized so far, as per the information given by @LuckyXBT.

Today’s announcement is a continuation of the news that emerged last Friday about MicroStrategy joining the Nasdaq 100. The changes from this reshuffle will take place and become effective on December 23rd.

Beginning with fiscal years commencing after December 15th, 2024, the Financial Accounting Standards Board (FASB) has endorsed fair value accounting for bitcoin and other digital assets. This decision was made in the year 2023.

In simpler terms, this change allows companies to report increases or decreases (gains or impairments) in their Bitcoin holdings on their financial statements based on their current market value (fair value). Previously, companies were only allowed to record losses (impairments) if the Bitcoin’s market value fell below its original purchase price, but they couldn’t record any profits if the Bitcoin increased above the purchase price.

In the wake of announcements about its Nasdaq 100 inclusion and recent Bitcoin acquisition, MicroStrategy’s share price has increased by 4% in pre-market trades, with each share priced at approximately $425. Notably, Bitcoin is currently trading above $104,000, having reached an all-time high of over $106,000 just recently.

Semler Scientific recently purchased additional bitcoin, specifically 211 units, at a total cost of approximately $421.5 million, with each unit valued around $101,890. As of December 12th, the company now holds a total of 2,084 bitcoins in its possession.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

- Gaming News: Gabe Newell Reflects on Steam’s Rocky Start in the Industry

2024-12-16 16:25