- BNB has flipped SOL on the rankings charts, thanks to a tweak in emerging memecoin trends

- However, SOL/BNB remains at a pivotal point and SOL can still regain lost ground on the charts

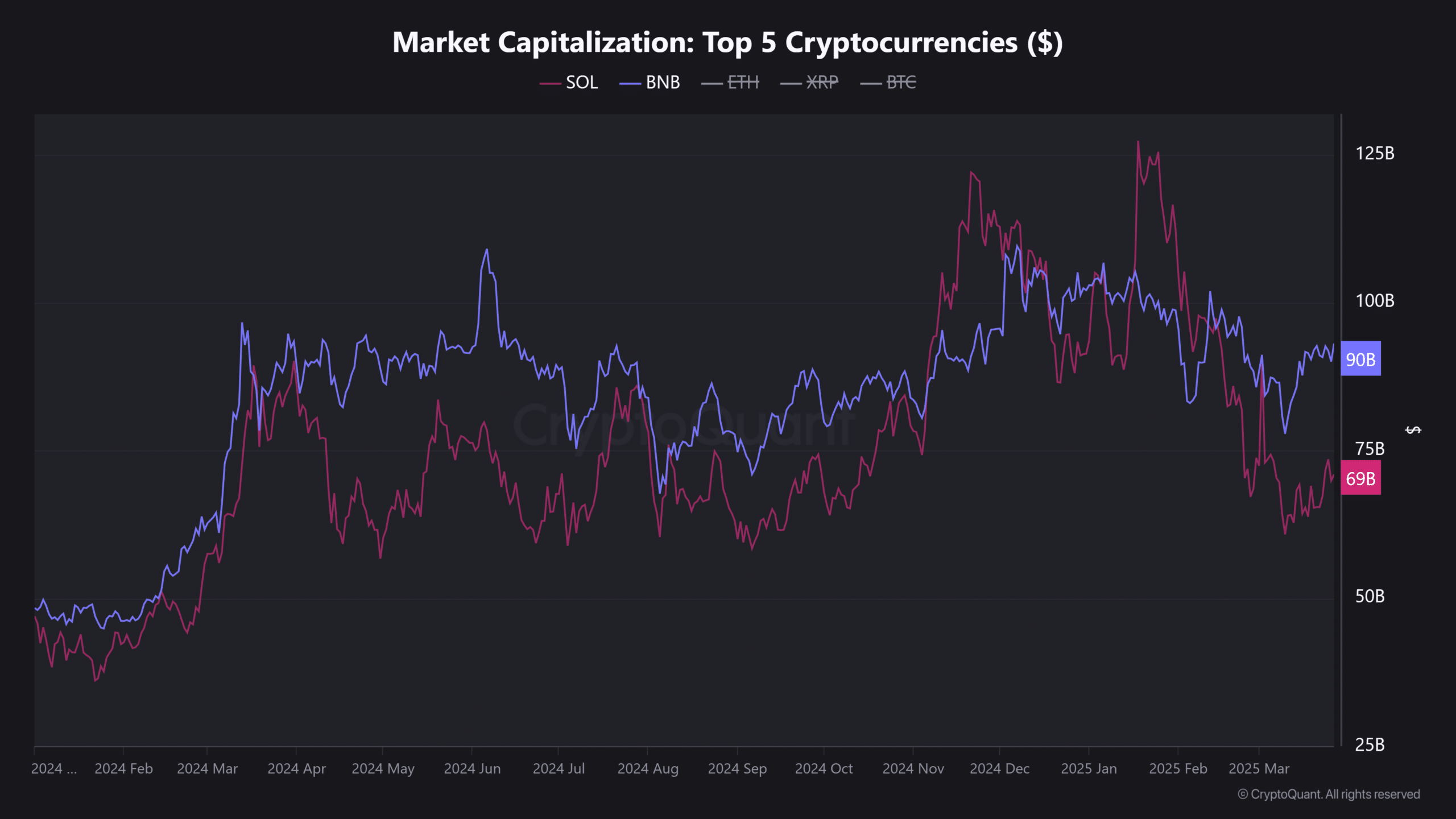

It seems that the tides of memecoin mania have shifted, and Binance Coin (BNB) has reclaimed the fifth-largest cryptocurrency position on the rankings charts, flipping Solana in the process. According to CryptoQuant, the shift was driven by the whims of memecoin enthusiasts, who have moved their attention from Solana to BNB Chain. As a result, BNB’s market capitalization has surged to $91 billion, while Solana trails behind at $73 billion.

“BNB flipped SOL. Memecoin momentum has shifted to BNB Chain, pushing its market cap back into the top five at $91B. SOL now trails at $73B.”

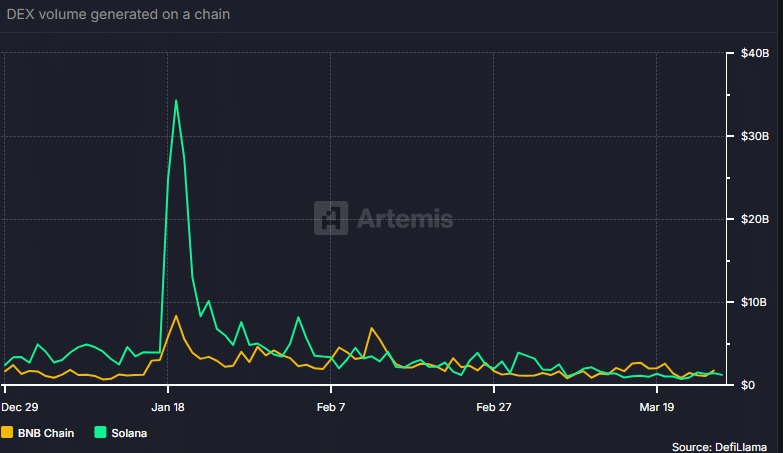

It appears that the shift in memecoin momentum occurred in mid-February, following the LIBRA memecoin saga and market manipulation revelations. As a result, memecoin traction on Solana dropped significantly, with DEX (decentralized exchange) volumes tanking by 60% on notable platforms like Pump.fun and Raydium.

SOL vs BNB Traction

The changes in DEX trading volumes also reflect the shift in memecoin momentum. Over the past three months, Solana’s DEX volumes have plummeted from a record high of $30 billion to $1.4 billion – a 95% decline. In contrast, BNB Chain’s DEX volumes have seen a slight increase of 4% over the same period.

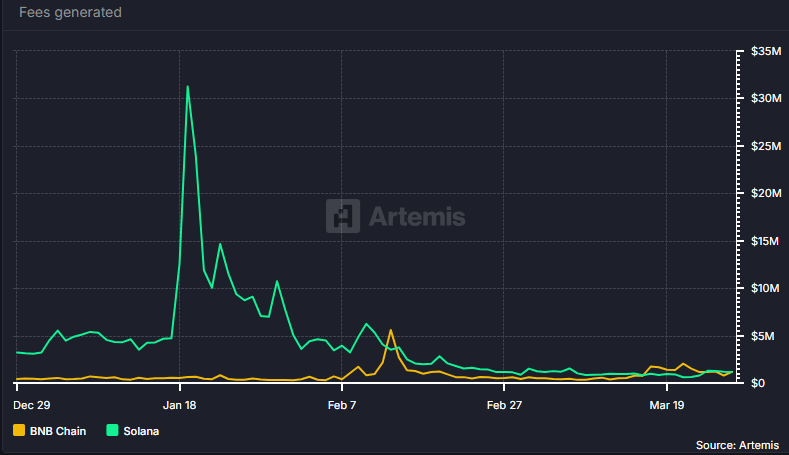

It’s worth noting that the BNB Chain has collected more fees than Solana over the same period, with fees averaging $1.17 million over the past three months – a 171% surge. In contrast, Solana’s fees have declined by 63% and averaged $1.16 million.

However, Solana still has a higher daily active address count (around 4 million) compared to BNB Chain’s 1.6 million. This suggests that Solana could reclaim its spot as the ‘home of memecoins’ if the broader market sentiment improves.

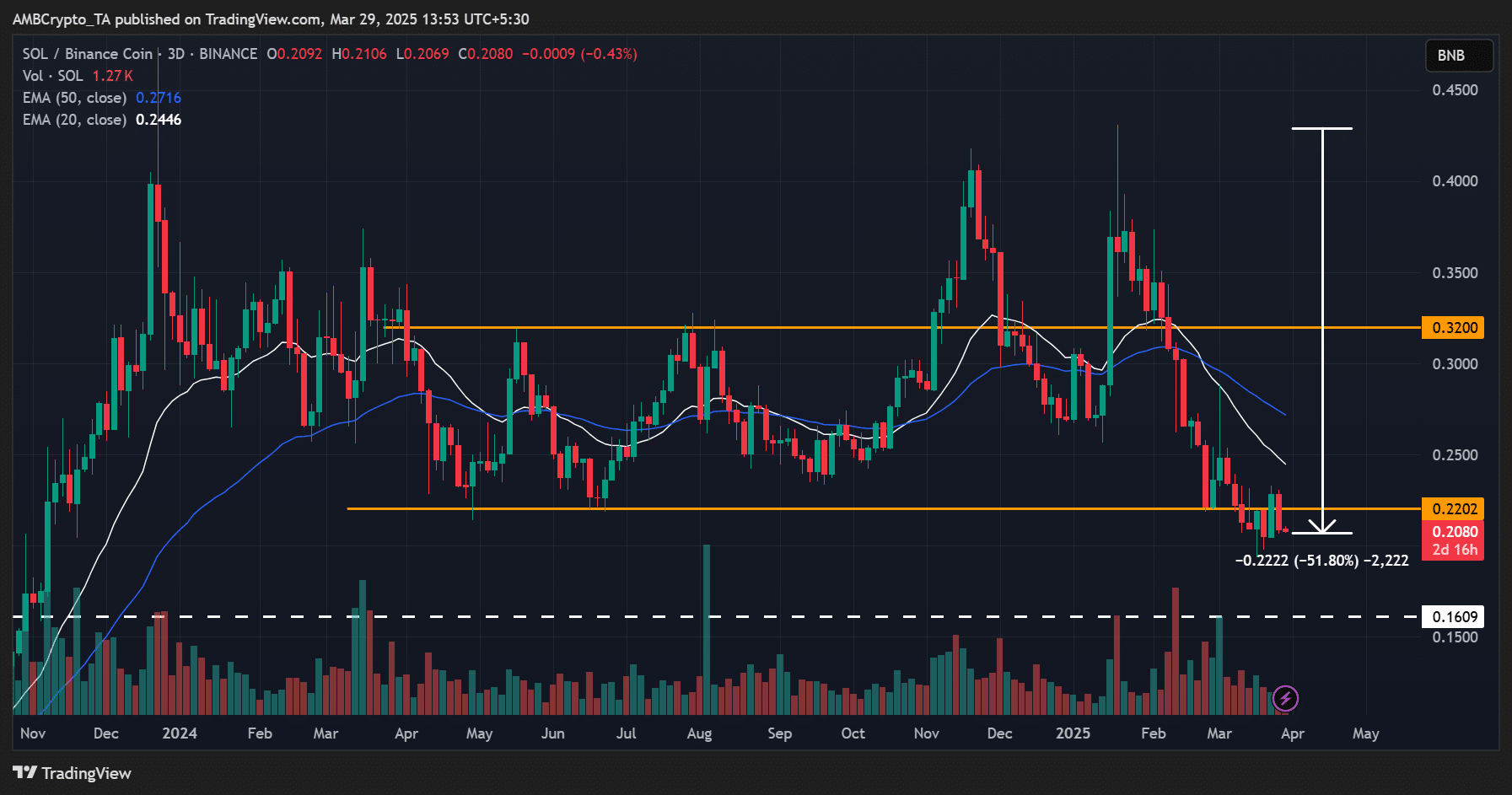

From an investor’s perspective, BNB holders are now better off than their SOL counterparts, with the SOL/BNB ratio dropping by over 50% in 2025. This ratio tracks SOL’s relative price performance to BNB, with a decline indicating that SOL underperformed BNB and a rally suggesting the opposite.

The 50% decline meant that SOL holders lost almost half their capital value compared to BNB holders. However, worth noting that the SOL/BNB ratio is at the range-low of a multi-month channel right now, suggesting that a rebound and SOL potentially regaining ground against BNB cannot be ruled out just yet.

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- KPop Demon Hunters: Real Ages Revealed?!

- Here’s Why Your Nintendo Switch 2 Display Looks So Blurry

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

2025-03-29 23:06