Morning, crypto crusaders! Grab your coffee, because this isn’t your grandma’s finance report. Welcome to the US Crypto News Brief—your daily dose of chaos, irony, and impending Bitcoin domination.

Today, we witness corporate giants tossing the old rulebook out the window faster than you can say “HODL.” Big players are rewriting what it means to go all-in, risking it all, and maybe even getting a bit reckless. Who needs stability when you can have a rocket fuel dash toward 1 million Bitcoin? 🚀

Crypto News of the Day: Strategy Rips Up the Rulebook on Path to 1 Million Bitcoin, Says Max Keiser

Strategy — no, not that one with the chess pieces — just dropped something called STRC, aka “Stretch,” which sounds like the latest yoga pose but is really a perpetual preferred stock with a spicy 9% dividend. Basically, it’s a fancy way to say, “We’re stacking Bitcoin, deal with it.”

Michael Saylor (who else?) tweeted about this IPO like a proud parent showing off their kid’s crayon drawing. His message? It’s another lever for Bitcoin, as if they needed another one. Because why just buy Bitcoin when you can buy *more* Bitcoin?

Strategy is offering $STRC (“Stretch”), a new Perpetual Preferred Stock via IPO, to select investors. $MSTR

— Michael Saylor (@saylor) July 21, 2025

But hold on, in a plot twist that’s more predictable than your favorite TV soap, Max Keiser steps in with a mic drop: “Strategy is committed to 1 million Bitcoin by any means necessary. They’re tearing up the corporate finance rule book and charging hell-bent for leather to the 1 million Bitcoin promised land.” Honestly, Max, what’s next? Bitcoin as a legal tender for brunch?

Big banks like Morgan Stanley and Barclays are playing along, probably figuring it’s safer than betting on the horse race called traditional finance. But Keiser isn’t mincing words — he’s saying Strategy doesn’t even want *more* Bitcoin. Oh no, they want ALL the Bitcoin. All of it. Like crypto Thanos with a really bad case of FOMO.

This is a decade-long shift. Starting as an enterprise software company, now it’s basically Bitcoin’s biggest hype man—or possible overlord? The stakes are sky-high, and some analysts warn it could turn into a cascade worse than Mt. Gox or Three Arrows Capital — fun times!

MARA Raises $850 Million to Double Down on Bitcoin

Meanwhile, MARA, the giant among Bitcoin miners, just punched a hefty $850 million ticket to keep mining and accumulating. Because why not throw more money into the digital fire? They’re playing the long game: buy more BTC, and pray the price keeps shoving higher.

MARA Holdings, the world’s largest public bitcoin miner, raises $850 million to continue buying bitcoin. MARA currently holds more than 50k BTC — enough to make a few heads spin.

— Wu Blockchain (@WuBlockchain) July 23, 2025

They’re using the cash to buy more Bitcoin, fund general corporate shenanigans, and basically make sure everyone knows they’ve got skin in the game. As Bitcoin’s riding high, MARA’s already sitting on over half a million bucks—literally.

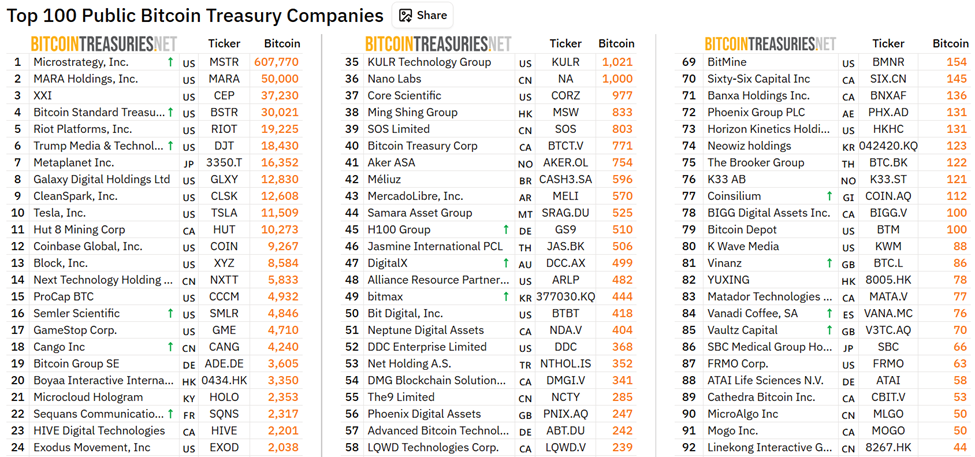

Meanwhile, MicroStrategy remains the big boss, holding a staggering 607,770 BTC worth about $71.8 billion. It’s like the CEO is saying, “You want money? Here’s trillions worth of digital gold, suckers.”

Chart of the Day

Byte-Sized Alpha

Let’s keep the humor coming, but there was no specific content to rewrite here, so skipping.

Crypto Equities Pre-Market Overview

| Company | At the Close of July 22 | Pre-Market Overview |

| Strategy (MSTR) | $426.40 | $425.74 (-0.15%) |

| Coinbase Global (COIN) | $404.44 | $405.50 (+0.26%) |

| Galaxy Digital Holdings (GLXY) | $29.11 | $29.90 (+2.71%) |

| $MARA Holdings (MARA) | $19.88 | $18.86 (-5.33%) |

| Riot Platforms (RIOT) | $14.27 | $14.13 (-0.98%) |

| $Core Scientific (CORZ) | $13.48 | $13.60 (+0.89%) |

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- LINK PREDICTION. LINK cryptocurrency

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- All Songs in Superman’s Soundtrack Listed

2025-07-23 17:47