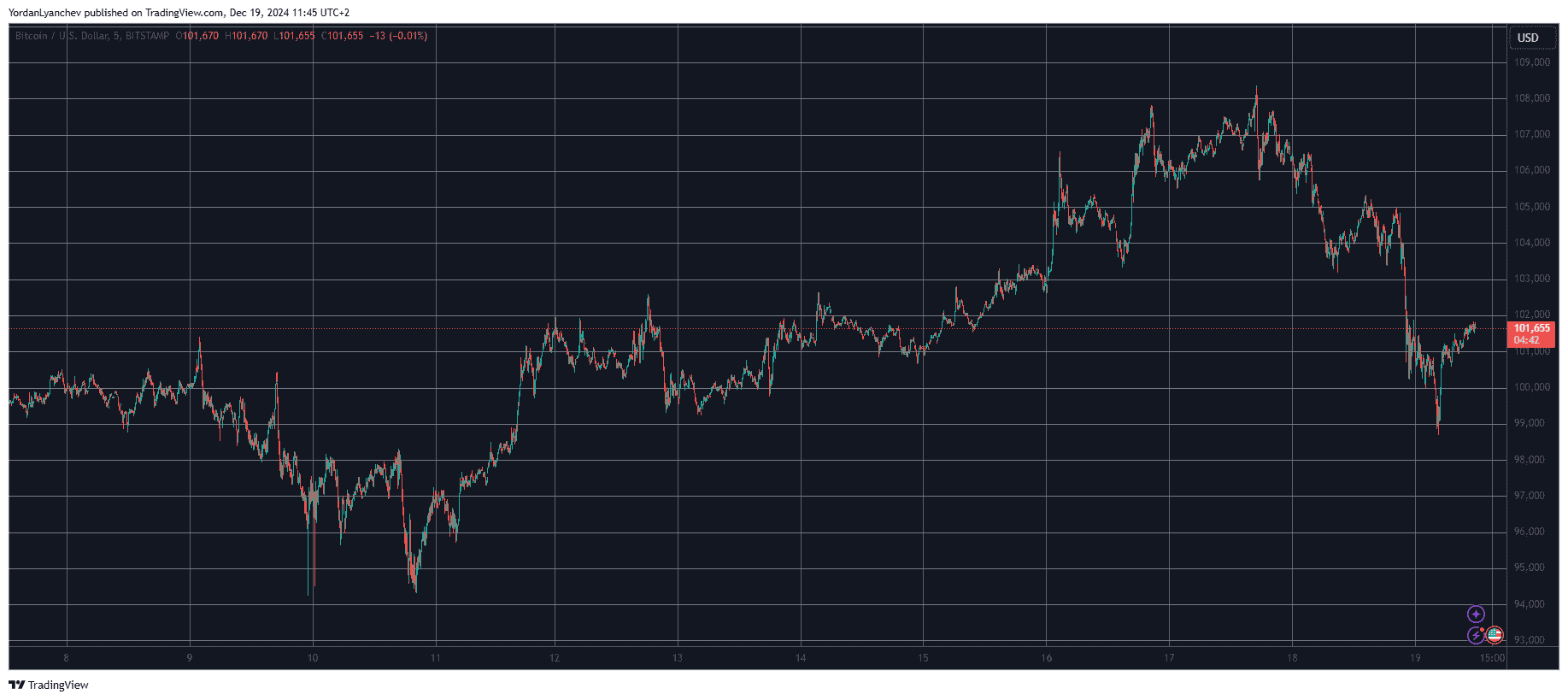

As a seasoned crypto investor with years of experience navigating the volatile digital asset market, I have learned to embrace the rollercoaster ride that comes with investing in this space. The recent Fed’s stance on rate cuts has undeniably put immense pressure on cryptocurrencies, and Bitcoin‘s tumble from over $108,000 to under $99,000 within a day is a stark reminder of the market’s unpredictable nature.

In simpler terms, the Federal Reserve’s contentious viewpoint about potential interest rate reductions caused concern for riskier investments such as cryptocurrencies. For instance, Bitcoin dropped dramatically by more than $8,000 in just a day or so, falling below $99,000.

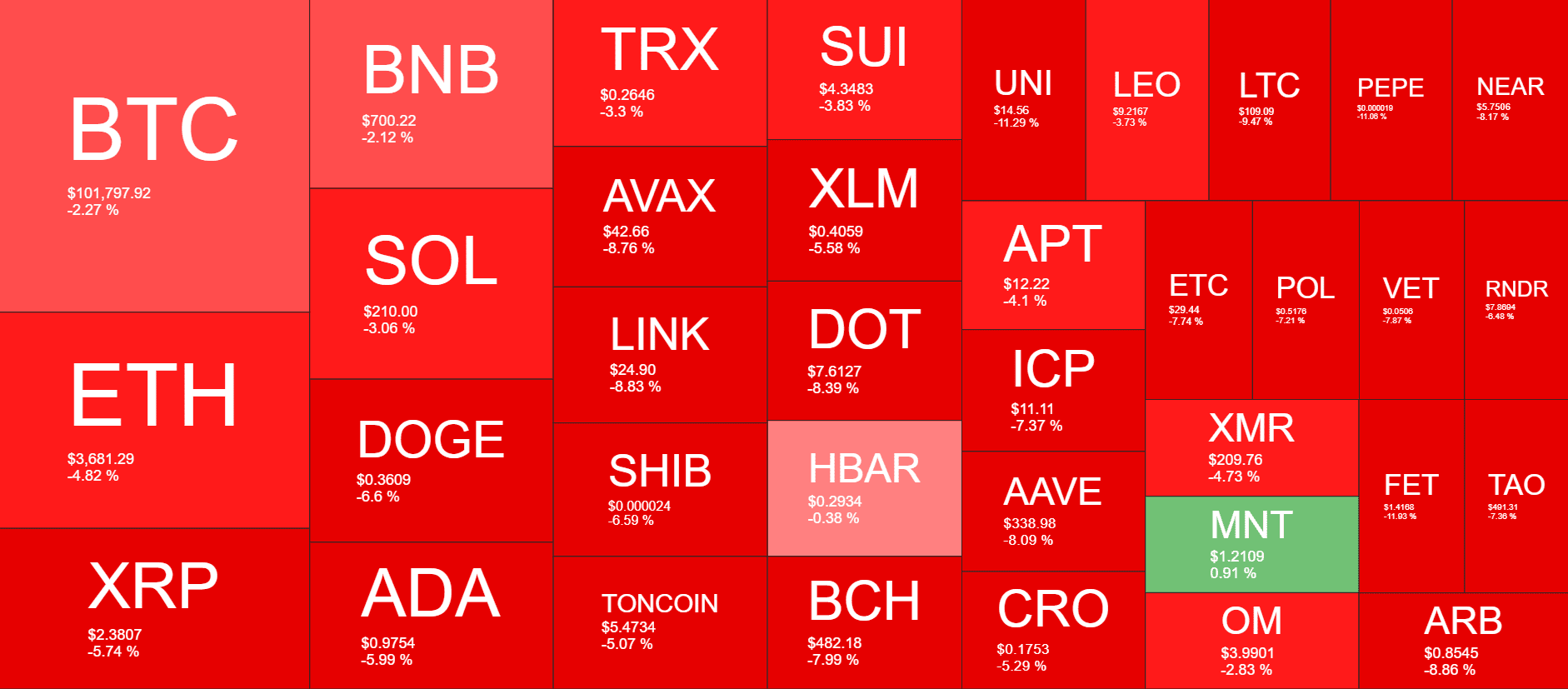

Additionally, various altcoins experienced significant declines in value, as seen by steep price decreases for cryptocurrencies such as Ripple (XRP), Avalanche (AVAX), Dogecoin (DOGE), Chainlink (LINK), and numerous others.

BTC’s Crash

In the days leading up to yesterday’s decline, Bitcoin experienced a significant surge in value. From December 10 to December 17, it rose by more than $14,000. This upward trend propelled the cryptocurrency above the $100,000 mark and peaked at over $108,000, setting a new all-time high record.

Subsequently, everyone’s gaze shifted towards the US Federal Reserve’s FOMC meeting held the day prior. As anticipated, the central bank reduced interest rates by 0.25%. However, remarks made by Jerome Powell caused a downward trend in the entire cryptocurrency market.

Initially, he pointed out that it’s possible the central bank could halt its rate cuts by the next year. However, he expressed skepticism about Trump’s claim that the U.S. could begin purchasing Bitcoin, suggesting such an action might not materialize.

Due to recent developments, the value of bitcoin significantly dropped. It had previously retreated to approximately $105,000 following its peak, but continued to fall further, reaching nearly $99,000 as the day went on. Despite regaining some ground and currently being above $101,000, it still represents a decrease of over 2% compared to the start of the day.

On CryptoGems (CG), the company’s market cap dropped to a value of $2.010 trillion, yet its control or supremacy among alternatives has dramatically increased to approximately 54.6%.

Alts in Deep Red State

During the market-wide adjustment, these alternate cryptocurrencies experienced a further decline. Numerous coins saw drops of ten percent or more from their peak to their lowest point. Although some have regained ground, many are still significantly in the red. Coins like XRP, DOGE, ETH, ADA, AVAX, LINK, SHIB, DOT, XLM, BCH, CRO, and others fall into this category.

As per Santiment’s analysis, it appears that four of these could potentially rebound, bringing about noteworthy returns.

Despite a drop in value, the overall cryptocurrency market capitalization has decreased significantly from approximately $3.950 trillion two days ago, reaching below $3.6 trillion during the evening lows yesterday.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-19 12:52