Ah, the delightful world of cryptocurrency, where chaos reigns supreme and the only certainty is uncertainty. Today, we find ourselves in a peculiar situation as approximately 29,000 Bitcoin options contracts casually stroll toward their impending expiration, with a staggering notional value of about $2.5 billion. Yes, that’s billion with a ‘b’—not to be confused with the number of socks missing from your laundry. 👀

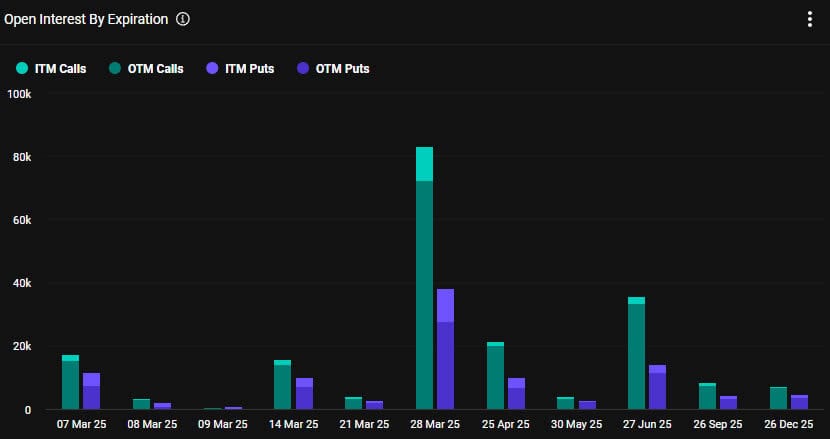

Now, if you were hoping for a raucous market tumult similar to last week’s thrice-evanescent end-of-month expiry, prepare yourself for a mild yawn as this week’s antics appear considerably more humble. But don’t fret, a titanic end-of-quarter contract expiry is just around the corner on March 28, waiting to stir the pot like a particularly confused chef. 🍲

Bitcoin Options Expiry: The Musical Chairs Edition

This week’s selection of Bitcoin options contracts is gracing us with a put/call ratio of 0.67—meaning there are slightly more call contracts up for expiration than the puts. You could say that more traders are feeling optimistic, if that’s how you’d like to define optimism. 🤔

Open interest (yes, it sounds important, doesn’t it?) remains sky-high at the $120,000 strike price—a staggering $1.4 billion worth of contracts yet to meet their maker according to our astute friends at Deribit. Meanwhile, there’s more than a billion bucks lounging about at the $100,000 and $110,000 price points. And wouldn’t you know it, bearish sentiment is creeping in as a shy cat at a party, especially because there’s $750,000 in open interest pathetically parked at $80,000 and $70,000.

Now, in a stunning reveal, the crypto derivatives provider Greeks Live has proclaimed that the traders remain “predominantly bearish.” Well, golly gee! They seem to anticipate further downside while gnashing their teeth over extreme volatility that feels like being on a roller coaster designed by an angry octopus. 🎢

“Market experiencing extreme price swings with Bitcoin moving $6k in a day, creating what traders describe as ‘scam both ways’ price action.”

Now let’s sprinkle in some Ethereum for good measure! Today, around 223,000 Ethereum contracts are also on their way out, with a notional value of $482 million and a put/call ratio of 0.71. This brings our gloriously chaotic crypto buffet to a combined value of roughly $3 billion. Bon appétit! 💸

“Trump tariff announcements (and subsequent reversals) are contributing to market confusion, with many traders sitting out due to unpredictable price action,” Greeks concluded, presumably while sighing deeply.

Spot Market Tanks: The Titanic Edition

Over the last 24 hours, the market’s been as stable as a three-legged giraffe, with total capitalization plummeting about $200 billion following one of the most charismatic executive orders of our time—the strategic Bitcoin Reserve by none other than Donald Trump.

Imagine this: Bitcoin plummets nearly 6%, dropping from above $90,000 to a tragic $85,000 in a flash of confusion before somewhat heroically bouncing back to $88,000. Bravo! This frantic chaos ensued after our dear White House crypto czar, David Sacks, casually noted that the reserve would be funded by BTC already pilfered by the U.S. government. You know, just your average Saturday. 🏦

Naturally, retail traders interpreted this as the U.S. deciding to take a little break from buying any more BTC, leading to a dramatic sell-off. However, if you squint at the fine print, you’ll see that the Treasury and Commerce secretaries have been graciously instructed to scour their couches for “budget neutral” ways to acquire BTC. Hide your wallets, folks! 💰

And so, as Friday’s sun rises over the crypto landscape, we find that our beloved markets remain immersed in a rather deep shade of crimson, like a poorly designed underwater theme park. Cheers! 🎈

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Mirren Star Legends Tier List [Global Release] (May 2025)

- KPop Demon Hunters: Real Ages Revealed?!

- Elden Ring Nightreign Enhanced Boss Arrives in Surprise Update

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

- Pacers vs. Thunder Game 7 Results According to NBA 2K25

- League of Legends MSI 2025: Full schedule, qualified teams & more

2025-03-07 11:33