Amidst the symphony of U.S. government debt, the markets are dancing a melancholic waltz, with the Dow Jones shedding 600 points, while Bitcoin, the rebellious teenager of the financial world, hits an all-time high. 🎵📉💰

The U.S. public debt, a specter haunting the halls of Wall Street, has sent investors into a frenzy. On May 21, the S&P 500, like a wounded bird, fluttered down to 5,882.35 points, losing 0.98%, while the tech-heavy Nasdaq, with a heavy heart, fell to 21,232.05, down 0.63%. The Dow Jones, the grand old man of the market, was deep in the red, plummeting to 42,059.08, a loss of 620.63 points, or 1.46%. 📉💔

Investors, with their eyes fixed on the rising bond yields, are like sailors in a storm, fearing that the government deficit will swell to unprecedented heights. The latest $16 billion auction of 20-year Treasury bonds, a dud if there ever was one, sent bond yields soaring. This followed the U.S. credit rating downgrade by Moody’s, a blow to the nation’s financial pride. 🌪️💔

Meanwhile, the U.S. Congress, in a move that could either be genius or folly, is pushing a new bill to extend Trump-era tax cuts. These cuts, a boon for high-income earners, promise to increase disposable income but also raise the specter of a wider federal deficit. 🤔💰

Yet, in this uncertain macroeconomic landscape, Bitcoin, the phoenix of the crypto world, has risen to new heights, while gold, the old reliable, has shown its mettle, rising 0.94% to $3,313.5 per ounce. 🌟💰

Tech stocks, healthcare down, Google stock up 4%

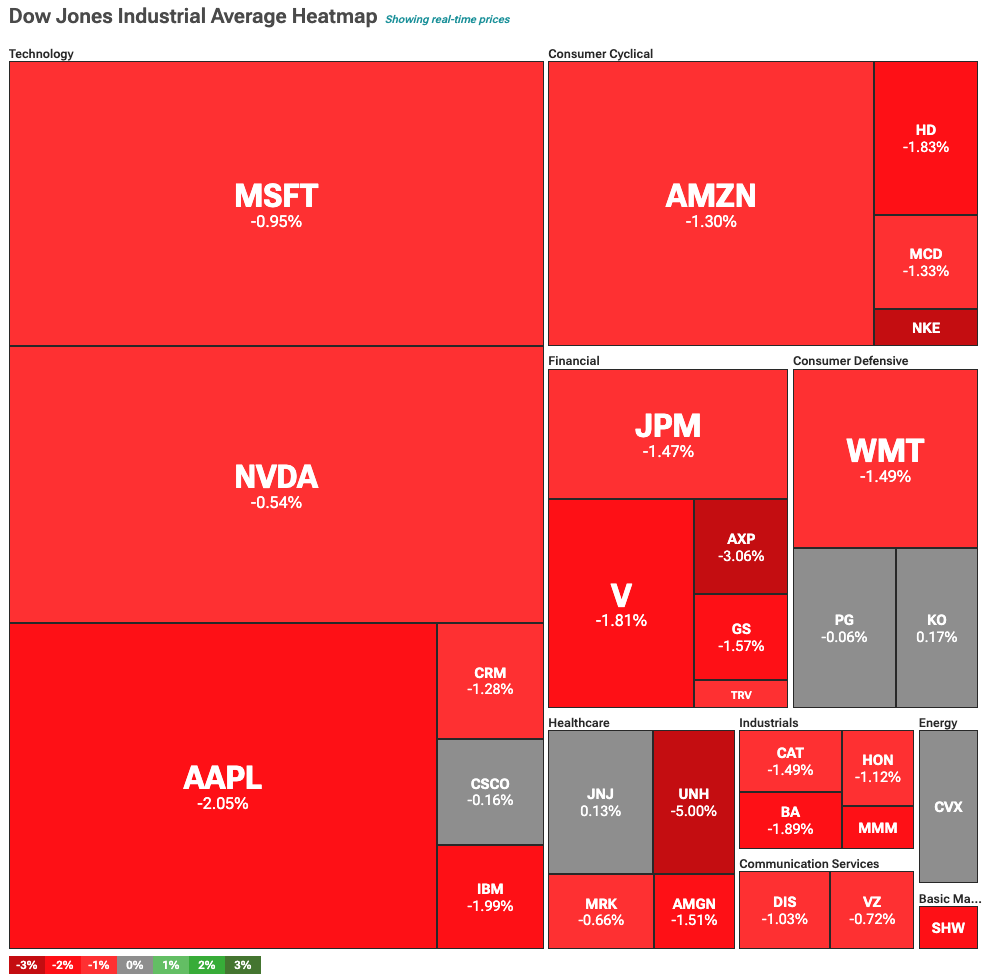

Almost all the top 30 companies listed on the DOW Jones are in decline, a parade of falling stars in the tech, retail, and healthcare sectors. However, the Nasdaq-listed Alphabet, like a ray of sunshine, rose 4% on the news of Google’s new AI announcement. The tech giant, ever the innovator, is redefining search to mirror the big AI models. 🌟💡

UnitedHealth, the insurance giant, continues its downward spiral, a tale of scandal upon scandal. The latest revelation, that the company attempted to cut insurance payouts by paying nursing homes to reduce patient transfers to hospitals, has exposed it to potential litigation. Its stock, like a leaf in the wind, dropped 6% on the news. 🍂💔

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-05-22 05:35