What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

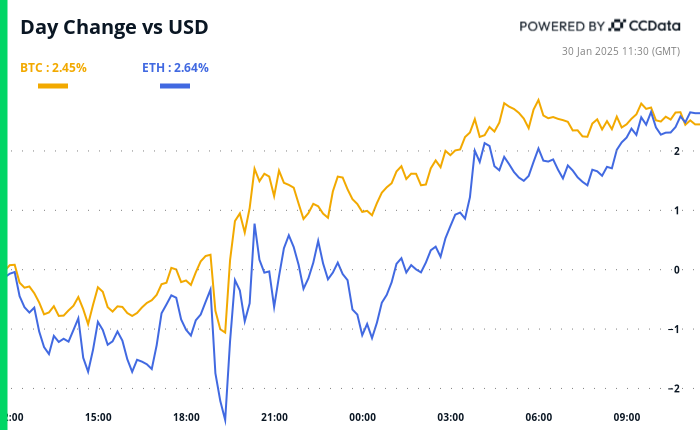

Ah, the crypto market! A place where fortunes are made and lost faster than you can say “blockchain.” With the Fed’s risk event now a mere memory, the market has decided to don its party hat, focusing on the bright side of life. You know, like the crypto-friendly president in the White House, Tether’s market doing a little jig, and the ever-optimistic Chinese New Year effect. 🎉

And speaking of parties, the star of the show is none other than Litecoin (LTC), the silver to Bitcoin‘s gold, which has decided to jump more than 11% since the early hours of the Asian market. Meanwhile, the rest of the cryptocurrencies are doing their best impression of a tortoise, with gains of a measly 1% to 3%. It seems LTC is the only one who remembered to bring the snacks! 🍿

In a twist that would make even the most seasoned soap opera writer raise an eyebrow, the SEC has acknowledged Canary Capital’s Litecoin ETF proposal. This is the first altcoin ETF filing to get a nod, which is like getting a gold star in a class full of misfits. Bloomberg’s Senior ETF analyst, Eric Balchunas, took to X to announce this monumental occasion, noting that this proposal is the one to make the most progress in regulatory requirements. Who knew regulations could be so exciting? 📈

Now, if LTC manages to get listed, it could be as positive for it as it has been for BTC and ETH. But let’s not get too carried away; despite the price surge to $130, LTC is still a far cry from its record high of $410 back in 2021. It’s like finding a shiny new penny but realizing you still need to pay for that overpriced coffee. ☕

In other news, on-chain activity tracked by Glassnode shows that retail participation in BTC is lower than a limbo stick at a particularly unenthusiastic party. This is encouraging for bulls who are desperately looking for signs that the latest move above $100,000 is not just a mirage in the desert of despair. Meanwhile, Lombard Finance is becoming the big cheese in the bitcoin staking space, capturing a giant share of the total BTC staked this week. 🧀

Ethereum‘s active addresses have recently topped a March 2024 high, signaling a renewed uptick in on-chain activity, according to IntoTheBlock data. Ether’s price has crossed above $3,200 but is still playing hard to get with that pesky bearish trendline connecting the Dec. 16 and Jan. 6 highs. Talk about commitment issues! 💔

In the traditional markets, the yield on the benchmark U.S. 10-year Treasury note has dropped to 4.50%, which is like a warm hug for risk assets. Those bullish on BTC may be hoping for U.S. core PCE inflation to come in softer-than-expected later today, driving the bond yield even lower. Fingers crossed! 🤞

But wait, there’s more! We will also get the fourth-quarter GDP alongside the weekly jobless claims report. Meanwhile, European gas prices have surged to a 15-month high, which could inject some volatility into risk assets. So, keep your helmets on, folks! 🪖

What to Watch

- Crypto:

- Jan. 31: Crypto.com is suspending purchases of cryptocurrencies USDT, WBTC, DAI, PAX, PAXG, PYUSD, CDCETH, CDCSOL, LCRO, and XSGD in the EU to comply with MiCA regulations. Withdrawals will be supported through Q1.

- Feb. 2, 8:00 p.m.: Core blockchain Athena hard fork network upgrade (v1.0.14)

- Feb. 4: Pepecoin (PEPE) halving. At block 400,000, the reward will drop to 31,250 PEPE.

- Feb. 5, 3:00 p.m.: Boba Network’s Holocene hard fork network upgrade for its Ethereum-based layer-2 main

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-30 15:18