As a seasoned crypto investor with battle scars from the 2017 and 2018 bear markets, I’ve learned to weather the storm and not panic during these turbulent times. The recent price drops, triggered by Fed Chair Powell’s statements, are no exception. It’s a reminder of the volatile nature of this asset class, but also an opportunity for those with a long-term perspective.

The negative pricing trends that began following the contentious remarks made by the Chair of the U.S. Federal Reserve have persisted and are still ongoing. Currently, Bitcoin‘s value has dropped below $98,000.

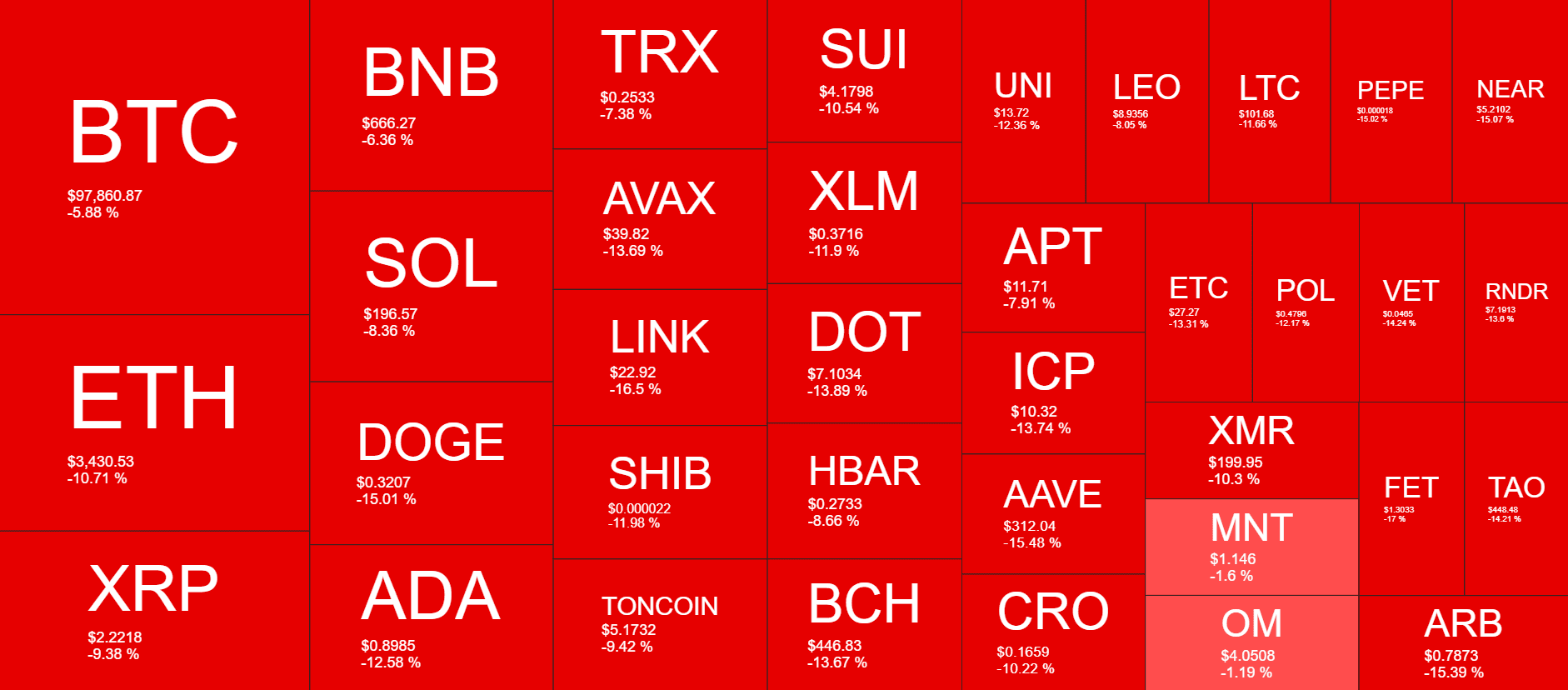

As a researcher, I find myself grappling with the harsh impact on the altcoin market. These digital assets, including Ethereum (ETH), Dogecoin (DOGE), Cardano (ADA), Avalanche (AVAX), Chainlink (LINK), and numerous others, have suffered significant double-digit setbacks.

Yesterday’s price fluctuations in cryptocurrencies were reported by CryptoPotato, following the Federal Open Market Committee (FOMC) meeting. During this meeting, Powell indicated that the Fed would not buy bitcoin, and he hinted that potential rate cuts scheduled for 2025 could be reconsidered.

Bitcoin plunged from approximately $105,000 down to around $98,000, prompting altcoins to mirror this trend. However, the leading cryptocurrency made a partial comeback today and peaked close to $103,000 not long ago.

Currently, the value of the asset has dropped dramatically yet again, causing it to fall to a new low of $97,500 on Bitstamp this week.

According to the graph we see, the overall cryptocurrency market is currently in a downturn, showing red figures across the board. Specifically, XRP has dropped below $2.2 and is now down by over 10%. Other coins like DOGE, SHIB, AVAX, LINK, ADA, BCH, DOT, XLM, SUI, and even ETH are also experiencing significant price drops of a similar or even greater magnitude.

As a crypto investor, I’ve noticed that the second-largest digital currency I hold has slipped beneath the crucial $3,500 threshold following a steep 11% drop in value today.

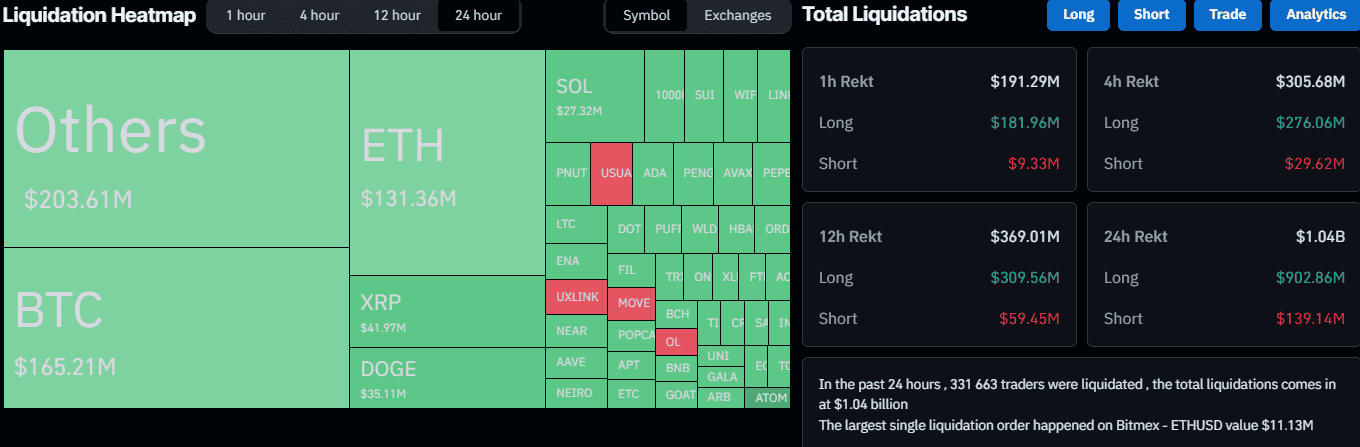

Excessively leveraged traders have suffered significant losses due to the extreme price swings in the market. Over 330,000 traders were adversely affected in just the last day. The combined worth of all liquidated positions is estimated to be over $1 billion, as reported by CoinGlass.

As a researcher, I recently discovered an incident of significant magnitude on the Bitmex platform. This event revolved around Ethereum (ETH), with a value exceeding $11 million at stake.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-19 21:16