In the shadowy glow of the lamp-lit desk, Kraken, that stoic and occasionally perplexed institution in American cryptocurrency, has produced its account books for the first quarter of 2025.

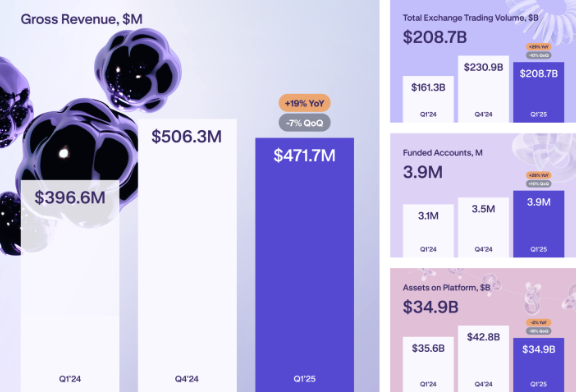

The ledgers, groaning under the ink, reveal revenues of $472 million—a 19% leap, as if bitten by a radioactive coin, compared to last year’s dreariness. Yet, as is the case with all large numbers, behind these figures lurks the same old human comedy: ambition, trepidation, and men silently gnawing on pencils, lost in reverie or existential dread.

Kraken’s Financial Revelry: Figures That Might Make a Banker Blush

So it turns out, the 19% jump was not a fever dream. EBITDA, a creature beloved by accountants but shunned at the theater, reached $187.4 million—a 17% increase. Even the most austere bean-counters must suppress a smile. Or perhaps a burp.

All of this unfolded beneath the swirling clouds of market volatility—a chaos not unlike the first act of a poorly rehearsed play—sparked mainly by President Trump’s return, whose pro-crypto rhetoric sent traders into a mild fever. (Picture, if you will, Wall Street barbers learning to shave bitcoins rather than chins.)

Why did numbers leap? Bitcoin’s price, like a well-fed goose, swelled from $69,000 to $94,000 over just three months. No word yet on whether the goose laid any golden eggs, but trading volumes soared. Some attribute this charm to Trump’s musings about a national Bitcoin reserve—because nothing says stability like chain-link wallets in the national treasury.

Amidst the jubilation, Kraken wasted no time. They unleashed something called a FIX API for “institutional” futures trading (because ordinary APIs are too déclassé), and soon monthly trading volumes multiplied by 250%!

Not satisfied with their lot, Kraken acquired NinjaTrader for a cool $1.5 billion. Two million new traders stumbled in, bewildered, wondering if they should have brought nunchucks or just their wallets. And so, Kraken began dabbling in asset classes formerly reserved for more “respectable” folks (the kind who wear pinstripes and never smile).

The Obligatory Gloom: Challenges, Foes, and Regulatory Headaches

But every banquet has its draughts. Kraken must tussle with competitors—Coinbase and Binance, in particular, eager to nibble more of the crypto pie. Innovation is demanded, as is a charm offensive to persuade traders not to relocate elsewhere at the first sign of free snacks.

Relying on volatility to pay the bills is, as Chekhov might say, like trusting the Moscow weather not to spoil your picnic. Sooner or later, all good things become regulated, consolidated, or buried in paperwork.

New plans are afoot: Kraken eyes Asia—where, rumor has it, some even believe in crypto after breakfast. They’re launching Kraken Pay and rolling out more on-chain staking, probably with the same enthusiasm as a Russian leshy preparing for winter.

Ultimately, if Kraken expects its story to end in laughter rather than weeping, it must plot a future that doesn’t depend entirely on chaos, presidential tweets, or the next windfall acquisition of a financial ninja. After all, in finance as in literature, one mustn’t always rely on deus ex machina—sometimes the audience just wants a quiet, hopeful ending. 🚀😉

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-05-02 11:26