What to know:

- JUP, the native token of Solana’s DEX aggregator Jupiter, is strutting its stuff, outpacing bitcoin like a cat on a hot tin roof, all thanks to a shiny new buyback plan.

- With a 50% protocol fee buyback program, Jupiter is locking tokens away in a long-term reserve, making investors feel as warm and fuzzy as a kitten in a sunbeam.

- But beware! This success might lead to a cozy over-reliance on one project, which is about as decentralized as a one-horse town. 🐴

As the crypto markets bled like a scene from a horror film, with liquidations hitting monthly highs and major tokens plummeting faster than a lead balloon, Jupiter’s native token decided to throw a party. 🎉

According to TradingView, JUP is up more than 34% against bitcoin over the past week, despite a recent 11% dip. Talk about a rollercoaster ride! 🎢

At its inaugural event, Catstanbul 2025, the enigmatic founder known only as ‘Meow’ unveiled plans to use 50% of all protocol fees to buy tokens from the open market, stashing them away in a “long-term litterbox.” Who knew crypto could be so… cat-like? 🐱

Ryan Lee, Bitget Research’s Chief Analyst, noted that this move has sparked a surge in investor confidence, potentially attracting new users and liquidity to the Solana ecosystem. It’s like a catnip for investors! 😸

In a chat with CoinDesk, Lee mused that this buyback program could be the magic potion for long-term growth, estimating it could add hundreds of millions to the buyback volume annually. Cha-ching! 💰

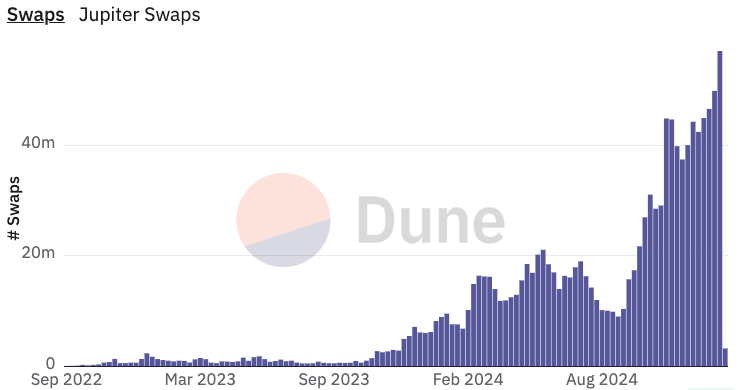

Jupiter is the reigning champion of Solana’s DEX aggregators, boasting nearly $2.2 trillion in total volume over 1.25 billion token swaps. In the last 24 hours alone, it racked up a trading volume of $6.5 billion over 6.9 million swaps. Talk about a busy little bee! 🐝

‘Monopolistic behavior’

While the announcement may have sent JUP’s price soaring, it also raised eyebrows in the community. Chris Chung, the founder of Solana swap platform Titan, expressed his disappointment over Jupiter’s new 5bps fee for basic swap trades in its default ‘Ultra’ mode. It’s like finding a hair in your soup! 🍲

Jupiter’s Ultra mode promises features like real-time slippage estimation and a shiny new “Jupiter Shield” security tool. But as Lee pointed out, this success could come with a side of centralization. Yikes! 😱

“If Jupiter keeps flexing its muscles and becomes the top dog in the Solana ecosystem, we might end up with a one-project wonder,” Lee warned, shaking his head at the irony of it all. 🥴

Chung lamented that Solana’s whole appeal is lower costs and higher throughput, and a 5-10bps increase in trading costs is like a slap in the face when there’s no noticeable performance gain. Ouch! 😬

In a twist of fate, Jupiter also announced it snagged a majority stake in Moonshot, the memecoin trading platform that reportedly brought 200k+ new users on-chain. It’s like a cat adopting a whole litter! 🐾

Jupiter’s acquisition of on-chain portfolio tracker SonarWatch has Chung worried that it’s on a mission to dominate the Solana ecosystem, which he believes is “unhealthy and detrimental for innovation.”

To Chung, Jupiter’s moves are nothing short of “monopolistic behavior,” allowing the big fish to raise prices unchecked. Isn’t that what decentralized finance

Read More

- “I’m a little irritated by him.” George Clooney criticized Quentin Tarantino after allegedly being insulted by him

- George Folsey Jr., Editor and Producer on John Landis Movies, Dies at 84

- Why Sona is the Most Misunderstood Champion in League of Legends

- ‘Wicked’ Gets Digital Release Date, With Three Hours of Bonus Content Including Singalong Version

- An American Guide to Robbie Williams

- Not only Fantastic Four is coming to Marvel Rivals. Devs nerf Jeff’s ultimate

- Why Warwick in League of Legends is the Ultimate Laugh Factory

- South Korea Delays Corporate Crypto Account Decision Amid Regulatory Overhaul

- Why Fortnite’s Most Underrated Skin Deserves More Love

- Sonic 3 Just Did An Extremely Rare Thing At The Box Office

2025-01-28 02:11