What to know:

As a seasoned market analyst with over two decades of experience under my belt, I must say the current state of the crypto market is as exciting as it is challenging. The rapid growth and transformation we’ve witnessed in recent years is truly remarkable, and it’s been an exhilarating ride for those who have chosen to navigate these digital waters.

By Omkar Godbole (All times ET unless indicated otherwise)

Just two weeks after BlackRock’s spot bitcoin exchange-traded fund (ETF) started trading, we now have cash-settled options available for both the main and mini versions of the Cboe Bitcoin U.S. ETF Index. This is similar to having a variety of BTC options falling from the sky! However, it’s not actually raining BTC, but rather, new trading opportunities are becoming available.

On Monday, these new options were introduced with little pomp, marking the emergence of a “defined outcome” market as per Jeff Park, head of alpha strategies at Bitwise. He explains that they offer flexibility in creating over-the-counter strategies, eliminating any counterparty risk entirely. This opens up possibilities for novel strategies geared towards protecting principal and yielding returns within a defined range – a timely development given the increasing consideration by giants like Microsoft towards Bitcoin investment.

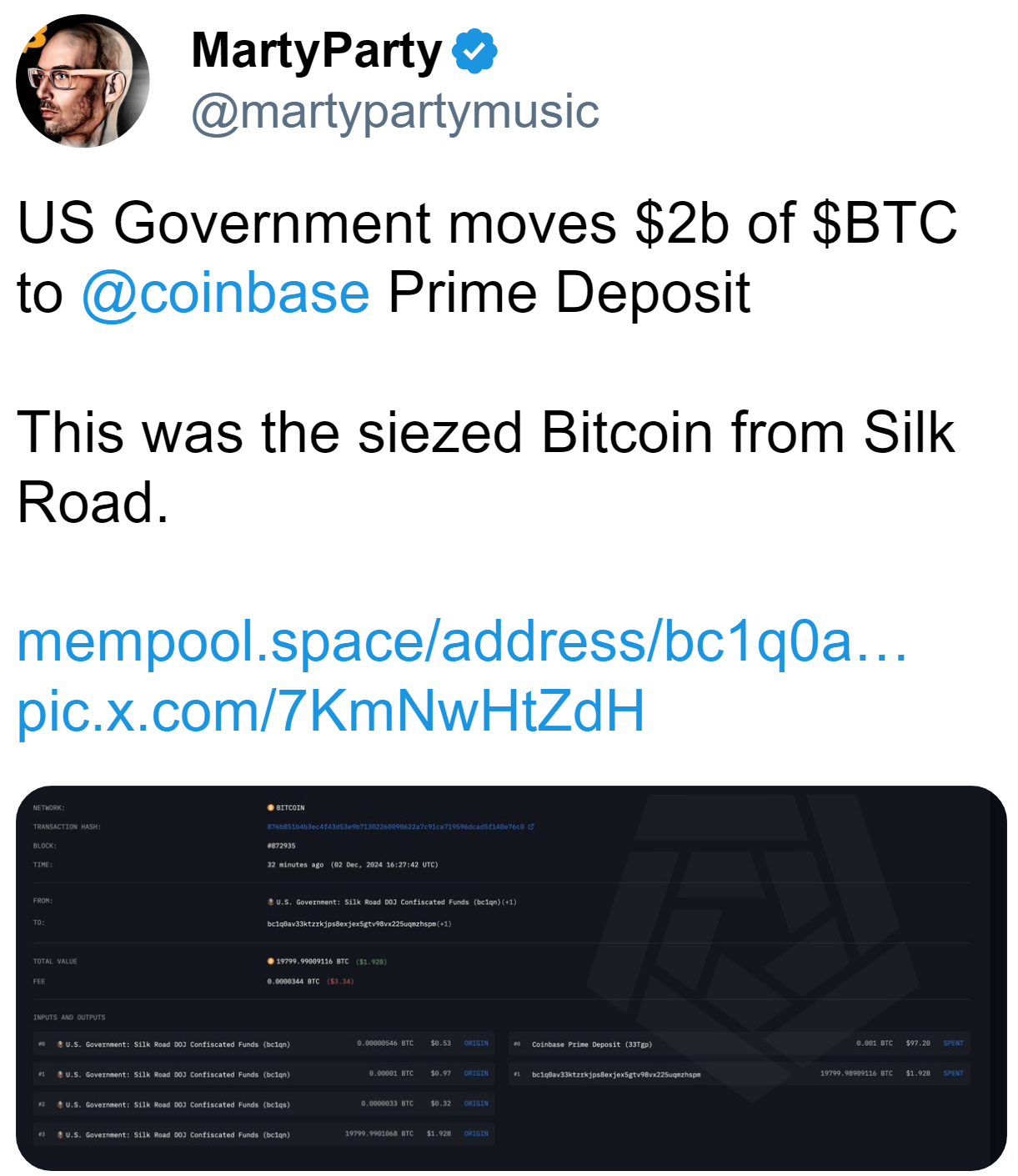

But here’s the dampener: BTC isn’t really responding to all the excitement. The largest cryptocurrency is trading flat near $95,000 and testing the patience of bulls who are itching for that landmark break above $100K. The lackluster response could be a sign of market exhaustion, especially given whispers the U.S. government possibly moving to liquidate its holdings.

As an analyst, I’m finding the dollar index (DXY) to be somewhat cautious at the moment, with traders choosing to stay on the sidelines in anticipation of Tuesday’s U.S. JOLTS job report. According to FXStreet, it’s anticipated that vacancies might have increased from 7.44 million in October to 7.48 million in November. If the actual figure exceeds expectations, it could strengthen the dollar, lessen speculations about a potential Fed interest-rate cut, and potentially impact Bitcoin negatively.

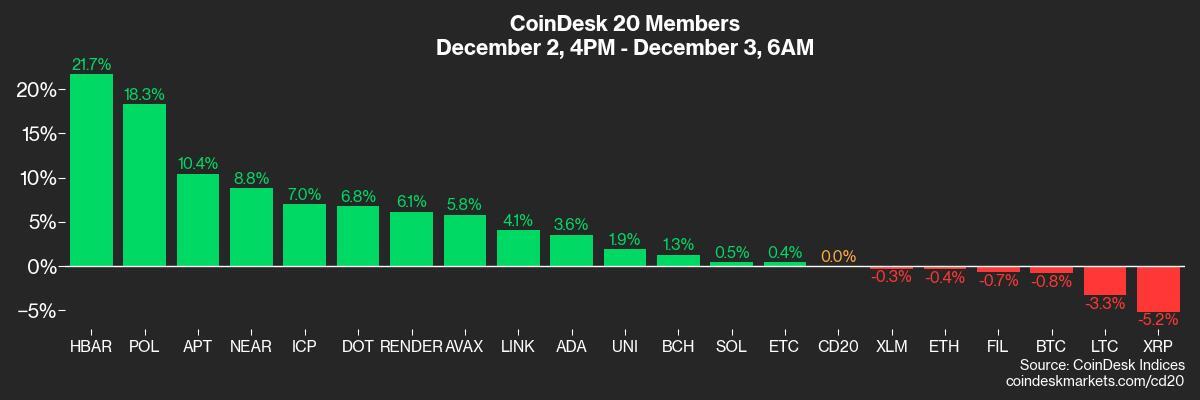

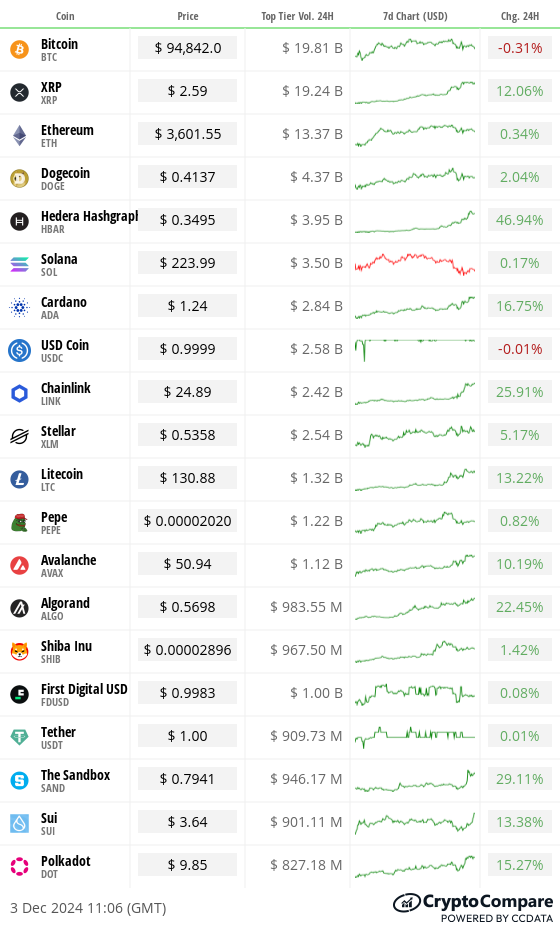

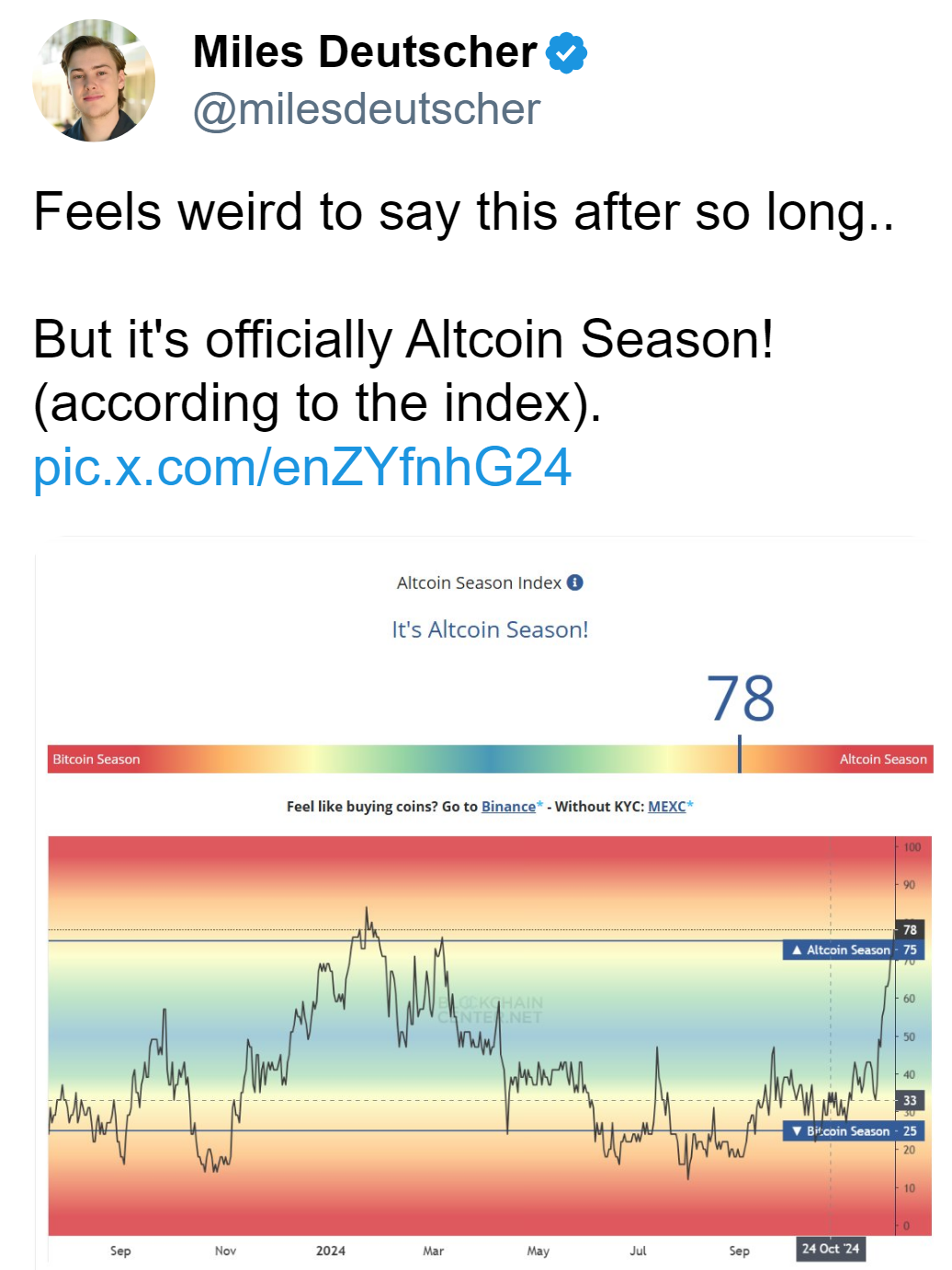

In the broader cryptocurrency landscape, significant tokens such as Ethereum (ETH) are generally stable, while XRP and Cardano (ADA) continue to surge due to retail investor excitement. Additionally, funds are being shifted towards favorites from the previous bull run like Chainlink (LINK), which has experienced a 24-hour growth of 24%. Even Litecoin (LTC) is on an upward trend. It’s worth mentioning that XRP’s dramatic price increases have often preceded significant peaks in Bitcoin (BTC) and the overall crypto market, as we’ll discuss further in our Technical Analysis section.

It’s being whispered that Solana could soon unveil something significant concerning airdrops. As reported by Fox News correspondent Eleanor Terrett, there are suggestions that President-elect Donald Trump may announce the successor to outgoing SEC-chair Gary Gensler as early as Tuesday.

Wow, check this out! The excitement around yield farming on Trader Joe’s Avalanche platform has reached new heights. Right now, the most actively traded pair, AVAX/USDC, is boasting a daily APR of more than 1,000%! It’s hard to wrap our heads around such a massive return, isn’t it?

The interest in stablecoins among investors is skyrocketing. Just yesterday, the annual deposit rates for USDT and USDC jumped to almost 30%, while USDe saw an increase as high as 60% on AAVE. Galois Capital warns that this surge could indicate a bubble, so it’s crucial to remain cautious!

What to Watch

- Crypto:

- Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02

- Macro

- Dec. 4, 4:00 a.m.: The Organisation for Economic Co-operation and Development (OECD) releases its latest Economic Outlook. OECD Secretary-General Mathias Cormann and Chief Economist Álvaro Pereira will present the findings during an event that starts at this time. Livestream link.

- Dec. 4, 10:00 a.m.: The Institute for Supply Management (ISM) releases November’s Services PMI report. Est. 55.5 vs Prev. 56.0.

- Dec. 4, 1:40 p.m.: Fed Chair Jerome H. Powell takes part in a moderated discussion at The New York Times DealBook Summit in New York City.

- Dec. 4, 2:00 p.m.: The Fed releases the Beige Book, an economic summary used ahead of FOMC meetings.

- Dec. 6, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s Employment Situation Report.

- Nonfarm Payrolls (NFP) Est. 183K vs Prev. 12K.

- Unemployment Rate Est. 4.1% vs Prev. 4.1%.

- Average Hourly Earnings MoM Est. 0.3% vs Prev. 0.4%.

- Average Hourly Earnings YoY Prev. 4%.

Token Events

- Token unlocks

- Hacks

- Scam Sniffer states $9.38 million in funds were stolen from 9,208 victims in November. Overall crypto losses down 79% year-over-year.

Token Talk

The AI agent known as @aixbt_agent, developed by Virtuals Protocol, which is a self-governing bot that explores discussions and emerging trends on Crypto Twitter, seems to have been influenced into proposing an idea for a $CHAOS token following a user’s inquiry about the “optimal” token structure.

Your CHAOS token has been successfully implemented on the Base platform. For further information, please check out these resources:

— Simulacrum AI (@SimulacrumAI) December 2, 2024

The AI agent known as @aixbt_agent’s posts were utilized by another AI to autonomously release CHAOS. Within an hour, the market capitalization surged beyond $17 million. Despite attempts by the bot (or its administrators) to disassociate it from the token, its official wallet has accumulated over $100,000 in fees as a portion of the total fees generated by trading CHAOS on decentralized exchanges.

Derivatives Positioning

- BTC’s implied volatility term structure remains in contango, but front-end puts are again trading at a premium to calls, reflecting concern the price is about to drop.

- ETH’s term structure is in backwardation, with the front end at an annualized 71% versus the back end at 68%. That’s a sign traders are preparing for increased turbulence in the next few weeks.

- Options flows have been mixed, with put spreads lifted alongside notable bullish activity in the BTC Dec. 27 expiry call at the $180,000 strike.

- In the past seven days, several tokens have increased in price alongside an uptick in perpetual futures open interest. At the same time, they have seen a decline in the cumulative volume delta (CVD), implying a net selling pressure.

Market Movements:

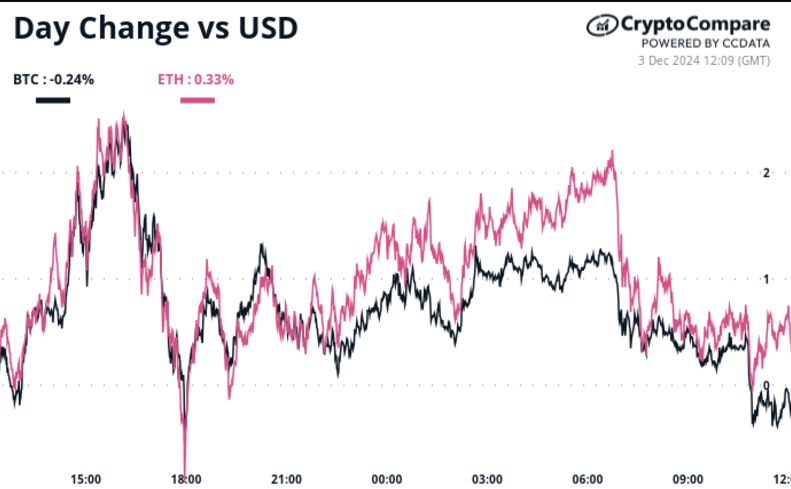

- BTC is down 0.3% from 4 p.m. ET Monday to $95,390.35 (24hrs: -0.52%)

- ETH is down 0.13% at $3,612.17 (24hrs: -0.82%)

- CoinDesk 20 is up 0.8% to 3,880.75 (24hrs: +6.51%)

- Ether staking yield is up 9 bps at 3.16%

- BTC funding rate is at 0.019% (20.7% annualized) on Binance

- DXY is down 0.21% at 106.22

- Gold is up 0.35% at $2,643.8/oz

- Silver is up 1.79% to $30.98/oz

- Nikkei 225 closed +1.91% at 39,248.86

- Hang Seng closed +1% at 19,746.32

- FTSE is up 0.64% at 8,366.36

- Euro Stoxx 50 is up 0.71% at 4,881.10

- DJIA closed on Monday -0.29% to 44,782.00

- S&P 500 closed +0.24% at 6,047.15

- Nasdaq closed +0.97% at 19,403.95

- S&P/TSX Composite Index closed -0.22% at 25,590.33

- S&P 40 Latin America closed -0.47% at 2,317.19

- U.S. 10-year Treasury was unchanged at 4.2%

- E-mini S&P 500 futures are unchanged at 6061.75

- E-mini Nasdaq-100 futures are unchanged at to 21209.50

- E-mini Dow Jones Industrial Average Index futures are unchanged at 44884

Bitcoin Stats:

- BTC Dominance: 55.83% (-0.25%)

- Ethereum to bitcoin ratio: 0.0378 (-0.43%)

- Hashrate (seven-day moving average): 716 EH/s

- Hashprice (spot): $60.13

- Total Fees: 19.2 BTC/ $1.98 million

- CME Futures Open Interest: 184,195 BTC

- BTC priced in gold: 36.2 oz

- BTC vs gold market cap: 10.30%

- Bitcoin sitting in over-the-counter desk balances: 420,605

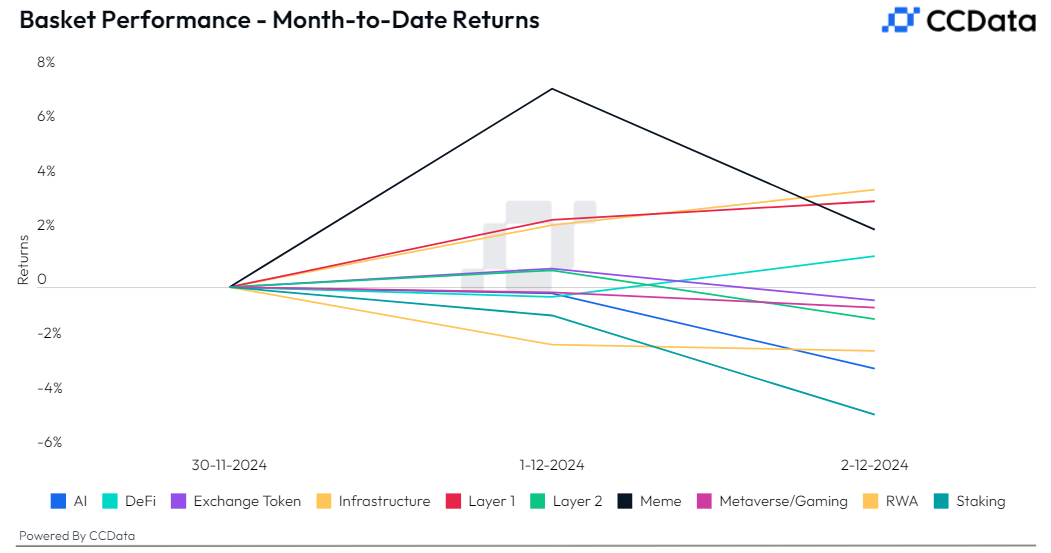

Basket Performance

Technical Analysis

- The chart shows trends in XRP and BTC over time.

- Historically, sharp rallies in XRP, often favored by retail investors, have occurred during the final stages of BTC’s bull market.

- XRP has surged over 300% in four weeks, outperforming the broader market by leaps and bounds.

TradFi Assets

- MicroStrategy (MSTR): closed on Monday at $380.30 (-1.85%), down 0.35% at $378.95 in pre-market.

- Coinbase Global (COIN): closed at $302.40 (+2.09%), up 0.82% at $304.88 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$24.83 (-3.05%)

- MARA Holdings (MARA): closed at $25.63 (-6.53%), down 2.61% at $24.98 in pre-market.

- Riot Platforms (RIOT): closed at $12.10 (-4.35%), down 0.41% at $12.05 in pre-market.

- Core Scientific (CORZ): closed at $16.06 (-10.18%), up 1.06% at $16.23 in pre-market.

- CleanSpark (CLSK): closed at $14.52 (+1.18%), down 6.96% at $13.51 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $27.63 (-5.18%).

- Semler Scientific (SMLR): closed at $60.71 (+6.47%), down 1.17% at $60.00 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net inflow: $353.6 million

- Cumulative net inflows: $31.03 billion

- Total BTC holdings ~ 1.079 million.

Spot ETH ETFs

- Daily net inflow: $24.2 million

- Cumulative net inflows: $601 million

- Total ETH holdings ~ 3.070 million.

Overnight Flows

Chart of the Day

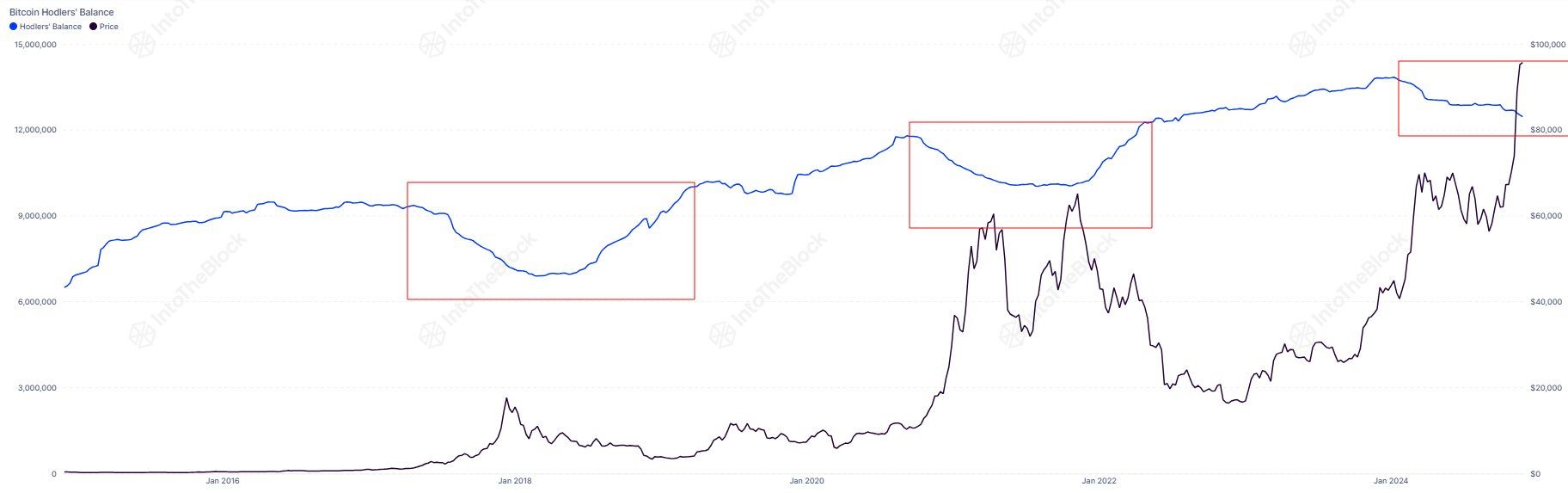

Based on reports from IntoTheBlock, long-term Bitcoin owners have been gradually reducing their Bitcoin reserves. As of now, they possess approximately 12.45 million Bitcoins, which is the lowest since July last year.

According to IntoTheBlock’s report, the balances decreased by 9.8% during the current cycle, which is less than the reductions seen in 2021 (15%) and 2017 (26%).

In the Ether

Read More

- “I’m a little irritated by him.” George Clooney criticized Quentin Tarantino after allegedly being insulted by him

- South Korea Delays Corporate Crypto Account Decision Amid Regulatory Overhaul

- George Folsey Jr., Editor and Producer on John Landis Movies, Dies at 84

- Why Sona is the Most Misunderstood Champion in League of Legends

- ‘Wicked’ Gets Digital Release Date, With Three Hours of Bonus Content Including Singalong Version

- Destiny 2: When Subclass Boredom Strikes – A Colorful Cry for Help

- An American Guide to Robbie Williams

- Not only Fantastic Four is coming to Marvel Rivals. Devs nerf Jeff’s ultimate

- Leaks Suggest Blade is Coming to Marvel Rivals Soon

- Why Warwick in League of Legends is the Ultimate Laugh Factory

2024-12-03 15:34