- Traders, do resist the siren call of FOMO as XRP pirouettes past the six-week trendline resistance.

- Ah, the tantalizing prospect of a short squeeze! A minor bounce may just be the perfect opportunity to don your bearish cap.

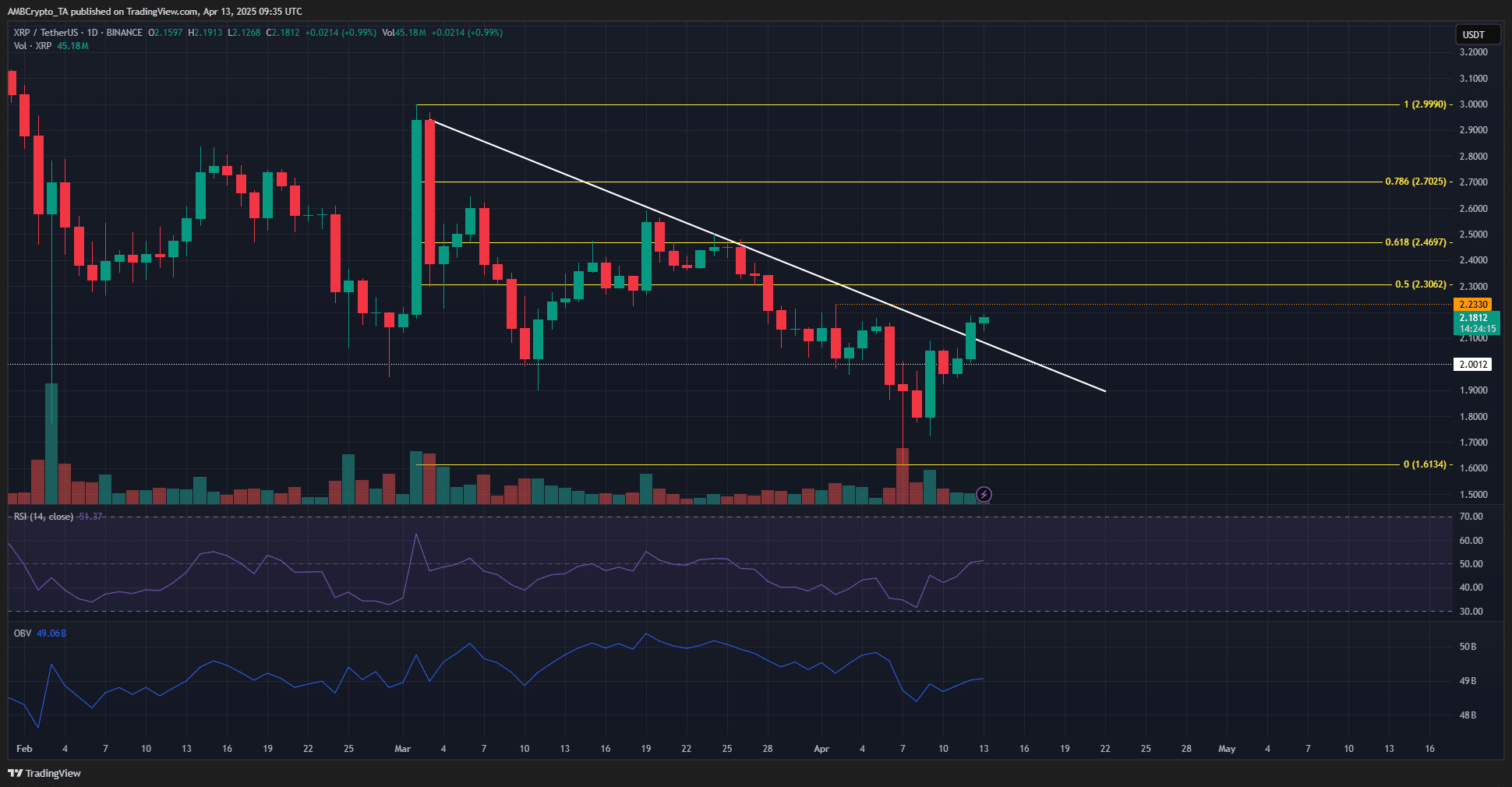

In a rather theatrical display, Ripple [XRP] has managed to break free from the shackles of its descending trendline resistance, a feat that has been in the works since the early days of March.

While this breakout, coupled with the psychological triumph of flipping the $2 level to support, might seem like a cause for celebration, let us not be too hasty; the downtrend is far from extinguished.

Earlier analyses hinted at a liquidity build-up around $1.95, with whispers of a deeper plunge towards $1.2. Yet, the liquidity overhead has conspired to lift prices higher, a trend that appears poised to continue—at least for now.

Investors and traders, brace yourselves for the sell-off at these levels!

The daily price chart reveals a bearish structure, with the lower high at $2.23 still standing tall, despite the trendline resistance being breached. Traders, keep your bearish hats firmly in place!

The RSI, perched at 54, suggests a bullish momentum shift, a glimmer of hope overshadowed by the OBV’s rather gloomy findings. The volume indicator is on a downward trajectory, much like my enthusiasm for Mondays.

Until XRP can muster the strength to set a new higher high, signaling a steady demand, investors and traders should tread carefully when considering bullish positions. The Fibonacci retracement levels indicate that $2.46 and $2.7 are formidable fortresses beyond the local resistance at $2.23.

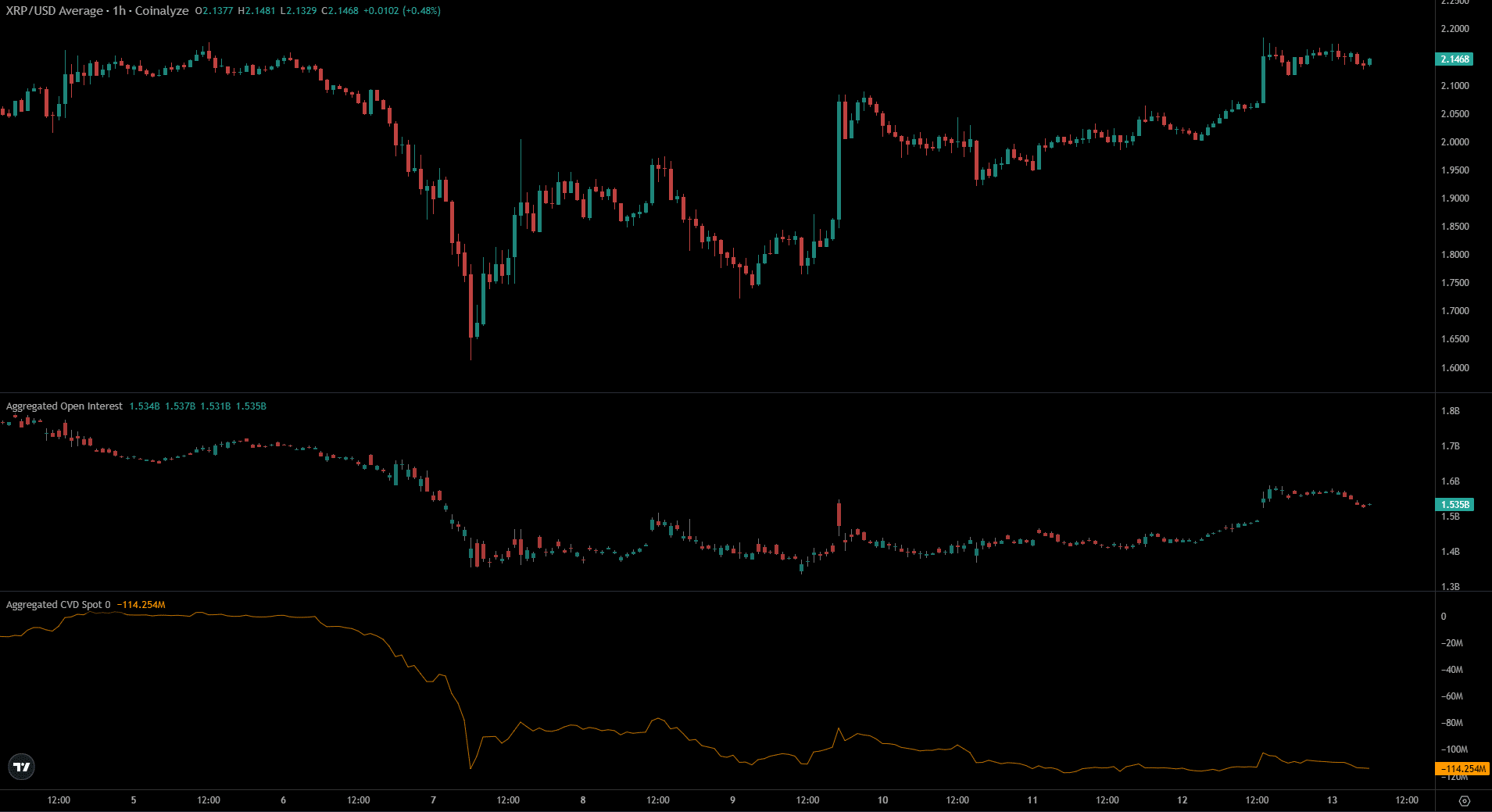

In a rather curious turn of events, the Open Interest (OI) behind XRP has surged over the past 24 hours, coinciding with a 6% price rally. However, this increase in OI has not been accompanied by a rise in spot CVD, raising eyebrows and suspicions alike.

This curious phenomenon suggests a distinct lack of buying pressure in the spot markets. It appears that the recent rally may have been orchestrated by derivatives, and could very well stumble soon—much like a tipsy debutante at a ball.

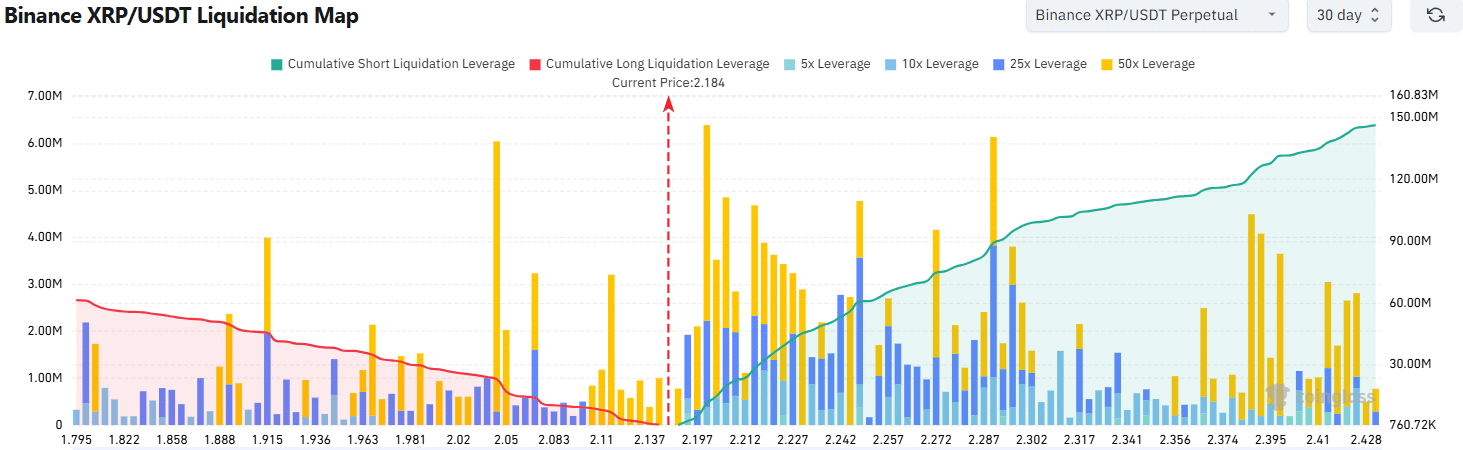

The liquidation heatmap further corroborates this theory, revealing a cluster of high-leverage liquidations just above the XRP market price, extending to $2.25.

The increased cumulative leverage overhead implies that short sellers may soon find themselves in a precarious position before the inevitable bear reversal strikes.

This short squeeze could yield a fleeting bounce, providing traders with a golden opportunity to don their shorting attire once more.

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- How to use a Modifier in Wuthering Waves

- Basketball Zero Boombox & Music ID Codes – Roblox

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

2025-04-14 00:10