What to Know:

- This month, XRP’s performance was about as decisive as a young lady hesitating to accept her suitor — showing signs of great internal conflict, with a doji candle indicating that perhaps the bull market has lost its early zest.

- Yet, in a most peculiar fashion, the spirited bulls persist on Deribit! Their open interest in lofty call options suggests they are quite determined to keep the game lively.

- The cryptocurrency’s role in international payments, combined with hopes of a U.S. ETF debut, seems to foster an air of optimism and perhaps folly — a delightful mix indeed.

In the grand dance of finance, XRP, the darling of Ripple and a facilitator of cross-border transactions, closed the month of May with an inclination towards indecision — a sentiment more fitting for a young lady wavering over her affections. Nevertheless, activity on the esteemed platform of Deribit indicates that the bullish faction is not yet ready to dip their handkerchief and retreat.

The formation of a “doji” candle in May, with a long upper shadow, signals a classic case of market flirtation — the price was pushed up to a charming $2.65, only to be sternly rejected by the less impressionable bears, bringing it back down near the starting point of the month.

This “doji” bewitches traders into believing the rally from April’s lows of approximately $1.60 hath exhausted its frolic, and hence a turn to the downside may be imminent, much like a season finale that leaves one hoping for an encore.

Notably, some keen traders secured put options strike at $2.40 expiring at the end of May, serving as a wise insurance policy against the dreaded decline — a prudent precaution, no doubt.

The Avant-Garde of Bullish Fantasies: Options Open Interest

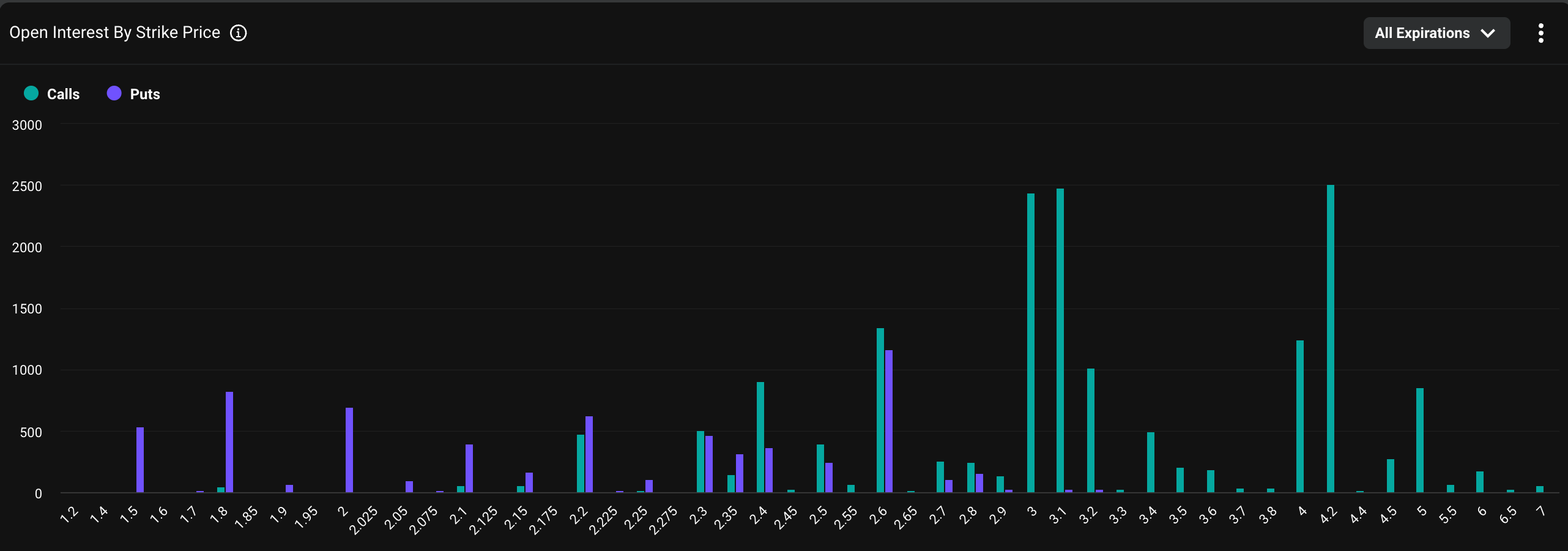

The overall outlook remains bullish — a curious circumstance given the market’s indecision, with the larger share of open interest concentrated on higher strike calls, revealing a fanciful optimism among the investors. These call options grant the holder the hope of handsome gains should the market dance upward, which many believe they shall.

Luuk Strijers, the esteemed CEO of Deribit, informs us that “XRP open interest is climbing steadily, particularly in strikes ranging from $2.60 to over $3.00, indicating ears pricked and eyes gleaming with hope while the spot price lingers at $2.16.”

Most popular among these speculative ventures are the $4 call options, commanding a notable $5.39 million in notional interest, with strikes at $3 and $3.10 each boasting over five million dollars in active contracts. Truly, an investiture reminiscent of a grand ball where everyone hopes to be the first to catch Mr. Market’s eye.

Mr. Strijers further notes, “XRP options are divided across June and September, with a volume approximately between $65 and $70 million, and over 95% of all trading occurs on dear Deribit—a market quite eager to please.” — as if a hundred suitors were vying for the affections of a maiden.

It is most likely that these bullish inclinations owe themselves to XRP’s noble pursuits — as a cross-border payment hero and a contender for a spot ETF in the United States, not to mention its rising popularity as a treasury asset for various enterprises. Surely, this shall be a most engaging season in the world of digital finance!

Ripple, with its XRP, claims to be the remedy for many inefficiencies in the grand, old B2B payment world, foreseeing the market swell to a staggering $50 trillion by the year 2031 — a tantalizing prospect, indeed.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Lost Sword Tier List & Reroll Guide [RELEASE]

- Gaming’s Hilarious Roast of “Fake News” and Propaganda

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

2025-06-01 14:55