In the magnificent kingdom of Corporate High Finances, where every clerk dreams of becoming an oligarch and every oligarch dreams of understanding his own accounting, Strategy—that former MicroStrategy who, as everyone knows, struggled with its identity in more ways than one—has announced, with grandiose flair worthy of a Czar’s decree, the launch of a $21 billion at-the-market common stock offering. The purpose? To acquire even more of that most enigmatic of treasures: bitcoin (BTC). Naturally, this follows a first-quarter net loss of $4.2 billion, or $16.49 per diluted share—because nothing spurs a Russian to make a bold move like losing a fortune in the first act. 🤦♂️

Strategy Hungers for Rubles, Craves Bitcoin

In the immortal tradition of counting your chickens before they’re hacked, the company’s net loss sneaks in a $5.9 billion unrealized loss on its bitcoin stash, courtesy of new “fair value” accounting rules adopted in the foggy bureaucracy of 2025. No matter! Strategy (Nasdaq: MSTR) trumpeted progress in its Noble Bitcoin Crusade, grinning through a 13.7% year-to-date “BTC Yield” and a $5.8 billion “BTC Gain.” At this rate, they will soon be able to pave Red Square with bitcoins (digital ones, of course).

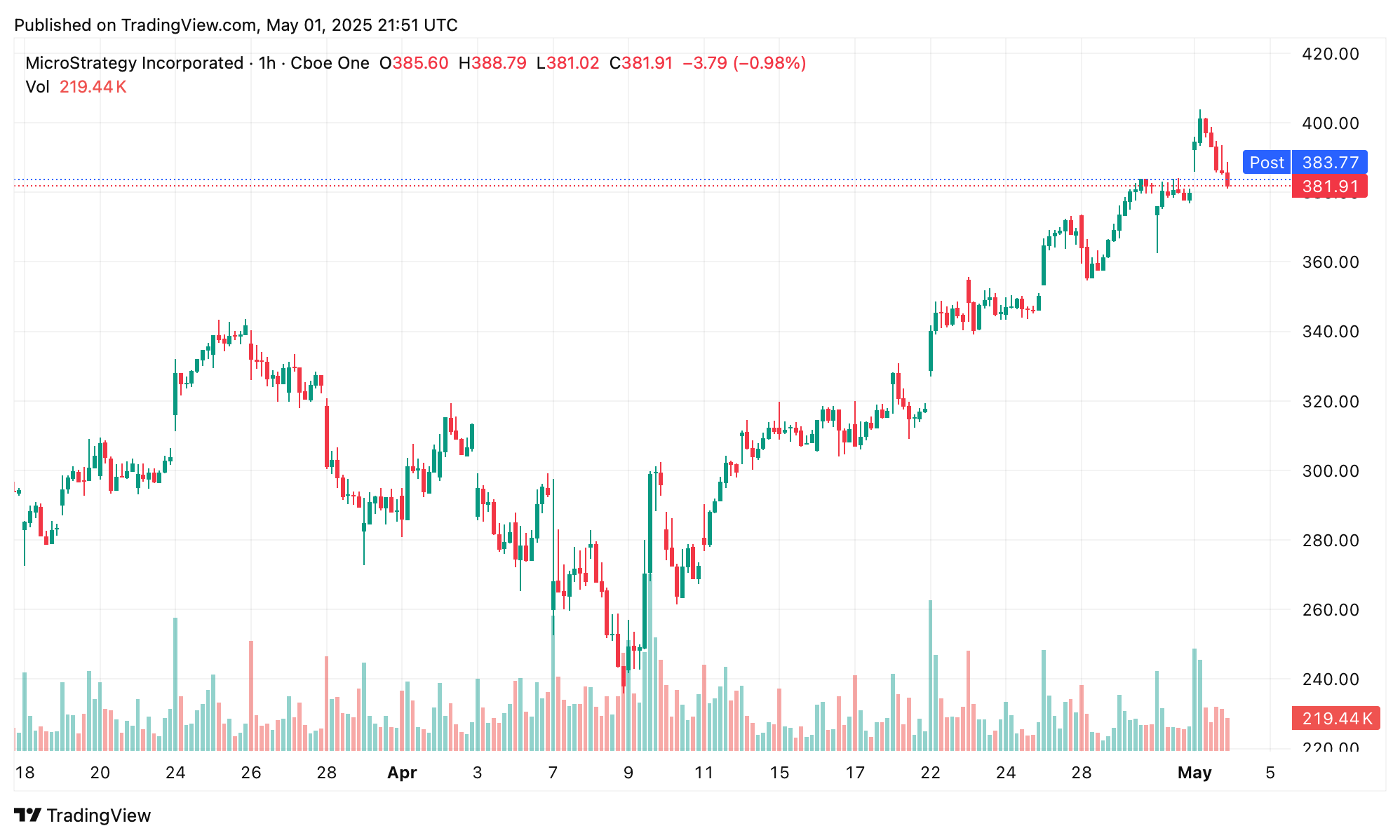

The scrolls were unfurled, and CEO Phong Le declared—before an invisible crowd and a trembling market—the $21 billion ATM offering would permit Strategy to hoard an additional 301,335 bitcoin and, as if by sorcery (or perhaps sheer confusion), raise its stock price by 50% in a single quarter. 🎩✨

“With over 70 public companies worldwide now adopting a Bitcoin treasury standard, we are proud to be at the vanguard,” Le declared, possibly while riding a troika pulled by bear-shaped algorithms. CFO Andrew Kang, perhaps less enthusiastic, pointed out that the fair value accounting had puffed up retained earnings by $12.7 billion, although Q1’s unrealized loss roared menacingly due to Bitcoin’s end-quarter price of $82,445—proof that numbers can both warm you and bite you, like an overfed wolfhound.

To fund these digital dreams, Strategy extracted $7.7 billion in Q1 alone, through issuing everything short of IOUs scrawled on the back of borscht recipes. Shares of Class A common stock also swelled in number to 10.3 billion—nearly enough, one suspects, for every citizen of the Empire to own a piece.

Operating expenses ballooned a staggering 1,976% year-over-year (surely a record, if only for theatrical flair), leaping up to $6 billion, largely thanks to bitcoin accounting adventures. Meanwhile, software revenue tiptoed away by 3.6%, slumping to $111.1 million, while subscription services soared upwards by 61.6%—to everyone’s surprise, especially their own. Their treasury now boasts $60.3 million in cash, up by $22.2 million—loose change in the cushions, really, compared to their Grand Bitcoin Mountain.

The epistolary saga warned that bitcoin volatility, regulation, and liquidity may yet play the trickster, shuffling fortunes like a card sharp at a Petersburg café. At quarter’s end, Strategy clutches $43.5 billion in bitcoin, with each coin now fetching a princely $96,619—though by the time you finish reading, a czar’s ransom may have become a peasant’s purse. 💸👑

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Lottery apologizes after thousands mistakenly told they won millions

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- Umamusume: Pretty Derby Support Card Tier List [Release]

- J.K. Rowling isn’t as involved in the Harry Potter series from HBO Max as fans might have expected. The author has clarified what she is doing

- Mirren Star Legends Tier List [Global Release] (May 2025)

2025-05-02 01:30