Oh, the drama! The recent sUSD depeg debacle from Synthetix has set off alarms, showing that the world of algorithmic stablecoins is still a wild rollercoaster ride—hold onto your wallets, folks! 💸

This latest crisis isn’t the first time we’ve seen algorithmic stablecoins get a faceplant. Between the tech mishaps, the “I-didn’t-sign-up-for-this” regulatory pressures, and trust issues running rampant, it’s clear: survival in this space is like trying to juggle flaming chainsaws. 🔥

The Wild West of Algorithmic Stablecoins

Once upon a time, algorithmic stablecoins were touted as the future of decentralized finance (DeFi). They were the “next big thing”—until they weren’t. Fast forward to April 2025, and according to CoinMarketCap, the total stablecoin market capitalization is a cool $234 billion. Guess how much algorithmic stablecoins make up? Drumroll, please… just $458 million! That’s a measly 0.2%. Yep, tiny. 🙄

This tells us one thing: people are still skeptical of algorithmic stablecoins. Just look at UST/LUNA‘s catastrophic collapse in 2022 and all the regulatory red tape, like the EU’s MiCA framework, which have given these projects a reputation for being the unstable divas of the crypto world.

And now, just to kick us while we’re down, sUSD from Synthetix has officially joined the depeg hall of shame. 🏆

Deep Dive Into Synthetix’s sUSD Trainwreck

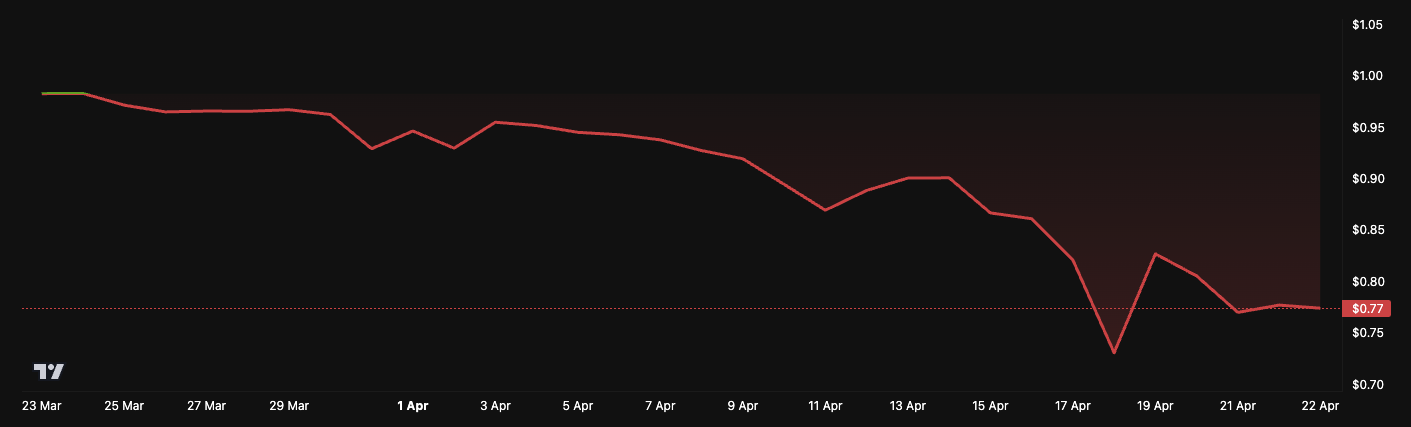

Synthetix, a DeFi protocol that’s no stranger to attention, created sUSD to maintain a steady 1 USD value, backed by the mighty SNX token and Chainlink’s price data. Sounds fancy, right? Well, recently, things took a nosedive. At the time of writing, sUSD was trading at a humble 0.77 USD, a level it’s been stuck at since March 2025. Yikes!

The culprit? One major liquidity provider decided to leave the sBTC/wBTC pool on Curve, and—bam!—massive selling pressure hit sUSD, sending it tumbling down. The domino effect was real. Users were forced to swap other synthetic assets like sETH and sBTC into sUSD, making things even worse. Who could’ve seen that coming? Everyone. 🙄

On April 21, 2025, Synthetix’s Kain Warwick took to X (no, not the “X-Files,” but Twitter) to announce that they had implemented a staking mechanism for sUSD, but… surprise, surprise… it’s manual. No snazzy user interface (UI) yet, folks, but stay tuned. 🕒

“Update on the sUSD depeg. We have implemented an sUSD staking mechanism but it’s very manual until the UI goes live in a few days. Here was my hot take from discord though,” shared Kain Warwick, founder of Synthetix.

Warwick also hinted that if the “carrot” (i.e. incentives) doesn’t work, they might pull out the “stick” (i.e. make life a lot harder for stakers). Don’t worry though, he assures us that with billions in SNX stakers’ net worth, they’ve got the funds to stabilize sUSD. So, uh, no biggie. 😅

Algorithmic Stablecoins: A Graveyard of Dreams?

Before sUSD, there was the infamous UST/LUNA collapse of 2022, where Terra’s algorithmic stablecoin depegged so hard it sent LUNA’s price crashing from $120 to almost nothing. Billions in losses. Trust? Gone. 💔

And just when you thought it couldn’t get worse, even DeFi’s “Godfather,” Andre Cronje, said goodbye to the idea of an algorithmic stablecoin, pivoting from a USD-pegged project to a stablecoin pegged to the UAE dirham. Talk about a change of heart! ❤️

“Pretty sure our team cracked algo stable coins today, but previous cycle gave me so much PTSD not sure if we should implement,” Cronje admitted. PTSD from crypto? Sounds about right. 😬

But hey, it’s not all doom and gloom. Algorithmic stablecoins still have potential. Just ask CampbellJAustin, who thinks a next-gen decentralized algorithmic stablecoin could totally happen—if we learn from our past mistakes. And not just technologically, but economically and risk-wise. So there’s hope. 🤞

“I actually think a next-gen decentralized algorithmic stablecoin is possible. I also think it will not be done correctly by the crypto community because the primary constraints are economic and risk management, not technological,” CampbellJAustin tweeted.

For these projects to thrive, they need to focus on stability, combine algorithms with liquidity protections, and get ready for the regulatory buzzsaw (looking at you, EU!). Transparency, audits, and a little user love might be the ticket to rebuilding trust. 🛠️

If they can pull it off? Well, they might just take over the crypto world. Maybe. But no promises. 😏

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Pacers vs. Thunder Game 7 Results According to NBA 2K25

- League of Legends MSI 2025: Full schedule, qualified teams & more

- Pacers vs. Thunder Game 1 Results According to NBA 2K25

- KPop Demon Hunters: Real Ages Revealed?!

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

- Jeremy Allen White Could Break 6-Year Oscars Streak With Bruce Springsteen Role

2025-04-22 10:48