So, Tether’s CEO, Paolo Ardoino, has waved off the chatter about the stablecoin going public. Because who needs a $500 billion valuation when you can just keep it all to yourself, right? 🙄

Of course, this little gossip bubble popped up right after Circle, Tether’s rival in the stablecoin playground, decided to strut its stuff with an IPO on the NYSE. Talk about stealing the limelight! 💁♀️

Paolo Ardoino Says “No Thanks” to IPO Talks

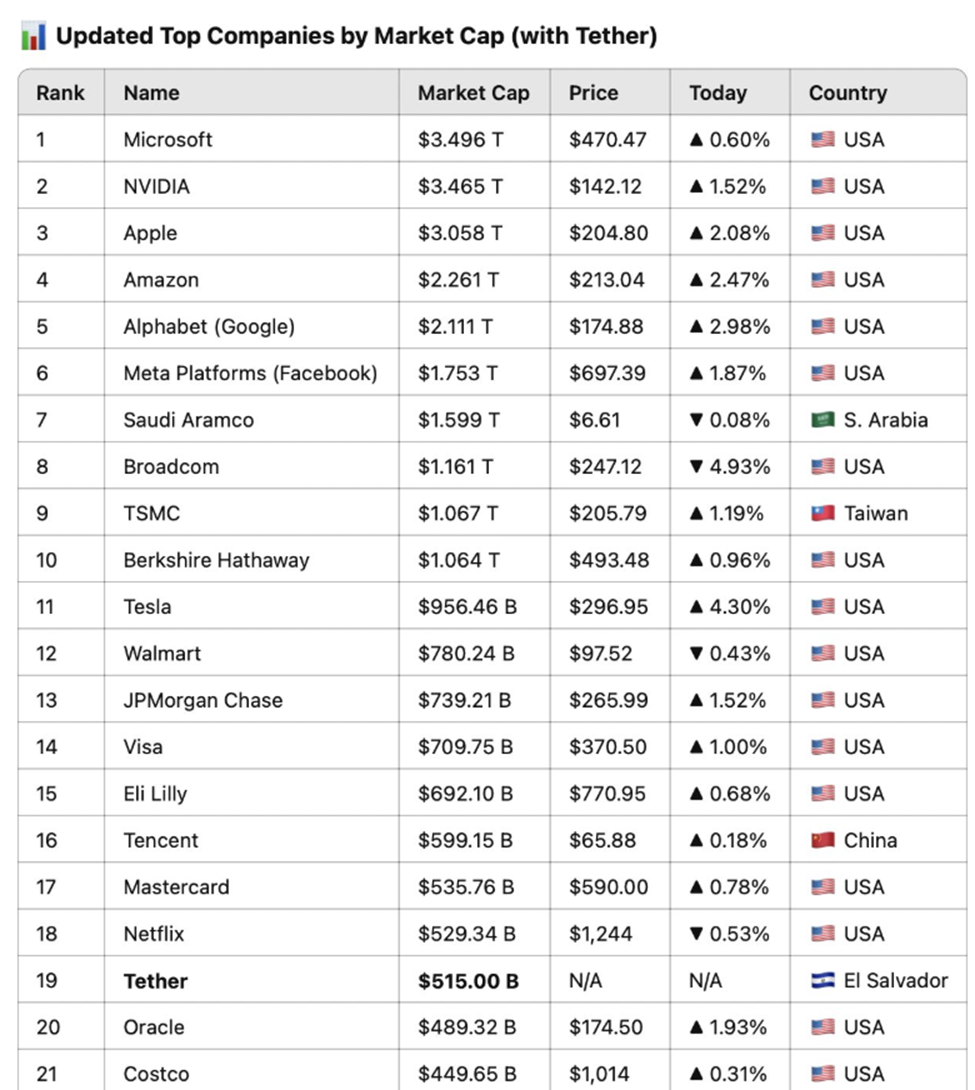

Market analysts are throwing around a $515 billion valuation for Tether, which would make it the 19th most valuable company in the world. Yes, you heard that right! It would even outrank giants like Costco and Coca-Cola. Who knew stablecoins could be so… stable? 😂

“If Tether went public TODAY, Tether would be the 19th largest company in the world at $515 billion. That’s ahead of Costco and Coca Cola,” wrote Ma. Well, that’s one way to make your competitors sweat! 💦

Jon Ma, the financial wizard, calculated that with Tether’s projected $13 billion in net profits for 2024 and an EBITDA of $7.4 billion for 2025, they could strut into the public market with a $515 billion price tag. Talk about a power move! 💪

“Tether valuation at $515 billion is a beautiful number. Maybe a bit bearish considering our current (and increasing) Bitcoin + Gold treasury, yet I’m very humbled. Also truly excited for the next phase of growth of our company,” Ardoino wrote. Humble brag much? 😏

But hold your horses! Despite the glittering projections, Ardoino made it crystal clear: Tether has no plans to go public. In a follow-up tweet, he simply stated, “No need to go public.” Because who needs the scrutiny of Wall Street when you can just chill in your private yacht? 🚤

No need to go public.

— Paolo Ardoino (@paoloardoino) June 7, 2025

Circle’s Wall Street Debut: The Stablecoin Showdown

The buzz really kicked off when Circle, Tether’s closest rival, decided to make its grand entrance with an IPO. Trading under the ticker $CRCL, Circle is offering 34 million shares at $31 each, aiming for an $8.1 billion valuation. First stablecoin on the NYSE? Bravo! 👏

Ma’s model, which is as lofty as it sounds, applied Circle’s 69.3x EBITDA multiple to Tether’s projected earnings. Because why not aim for the stars? 🌟

He also noted that his calculations didn’t even include unrealized gains from Bitcoin and gold, which are like the cherry on top of Tether’s $5 billion profits for 2024. 🍒

Some commentators, like Anthony Pompliano, are dreaming even bigger, predicting a $1 trillion valuation eventually. Jack Mallers of Twenty One Capital is even more optimistic, saying “over $1 trillion.” Someone get these guys a reality check! 🤯

But wait, there’s more! Skepticism is lurking in the shadows. One user pointed out that going public would mean more scrutiny and audits. Yikes! 😬

With ongoing transparency concerns, many are doubtful that Tether will ever go public. Ardoino’s stance just reinforces this skepticism. Despite being worth more than many S&P 500 giants, Tether seems perfectly happy to keep its secrets private. 🤫

Meanwhile, Tether’s USDT stablecoin remains the most traded crypto asset by volume. And let’s not forget, they’ve diversified their balance sheet like a pro! 💼

Recent reports show Tether holds billions in US treasuries, gold, and Bitcoin. So, while the stablecoin space is under the microscope, Tether is determined to grow on its own terms. Will this strategy keep them ahead of public rivals like Circle? Only time will tell! ⏳

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- How to watch the South Park Donald Trump PSA free online

2025-06-08 13:02