Over the recent days, there’s been an increase in trading of Polkadot’s DOT token. Compared to the weekend just passed, it has shown steady and incremental growth.

This action is primarily fueled by increased enthusiasm related to potential regulatory approvals for Decentralized Finance (DeFi) exchange-traded funds (ETFs) in the U.S., with one such decision anticipated on June 11th. As a result, there’s been a significant surge in interest for DOT among market participants.

Polkadot Gathers Steam as ETF Decision Looms

The optimism among investors concerning DOT is escalating, given that the United States Securities and Exchange Commission (SEC) is set to release its conclusive decisions on two significant Exchange Traded Fund (ETF) proposals within this month.

As per a SEC filing dated April 24th, it’s anticipated that a decision about Grayscale’s Polkadot ETF proposal will be made on June 11th. On the other hand, a verdict concerning 21Shares’ Polkadot ETF is slated for June 24th.

DOT is gaining steam ahead of the June 11 decision, with traders betting on a favorable outcome.

The rising optimism is mirrored in DOT’s trading behavior, as it approaches its 20-day exponential moving average (EMA), a crucial sign that shows a change in trend direction. Right now, DOT is slightly below this significant point, but increasing bullish sentiment indicates a possible upward breakout.

As an analyst, I utilize the 20-day Exponential Moving Average (EMA) to gauge an asset’s performance over the preceding 20 days, giving more significance to recent price fluctuations. When the asset’s price surpasses this EMA, it sends a bullish message suggesting that buyers are taking control and a potential short-term upward trend might be emerging.

As a researcher, I find myself observing that surpassing this particular level in the DOT market might signify an increase in optimistic investor sentiment, potentially leading to additional positive price movements.

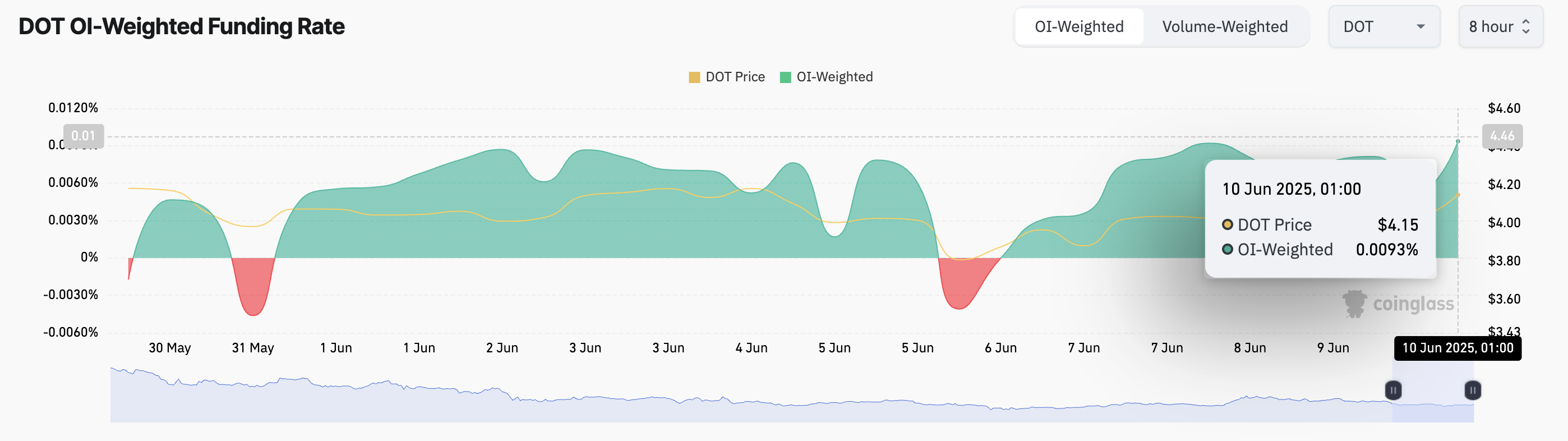

As a researcher, I’m noticing an interesting trend: The funding rate for the digital coin is positive across various derivatives platforms, implying that those holding long positions are ready to pay a premium. This indicates increasing confidence among investors in anticipation of tomorrow’s decision. At this moment, the funding rate stands at 0.0093%, according to Coinglass.

In simpler terms, the funding rate is a recurring charge that long (buy) and short (sell) traders in continuous futures markets pay to each other. This fee ensures that the price of the contract matches the current market value (the spot price). When the funding rate is positive, it means long traders are paying the shorts. This usually implies a bullish outlook in the market, as it suggests a greater appetite for long positions due to optimism about future prices.

DOT Rally Gathers Steam, But SEC Ruling Could Be a Game-Changer

At the moment, a share of DOT is being traded for $4.11, representing a 3% increase in price compared to yesterday. Notably, during this time frame, the daily trading volume has jumped by 76%, reaching an impressive $230 million. This surge suggests robust investor interest fueling the upward trend.

When a financial asset’s cost and transaction activity increase together, it indicates robust market attention towards that asset. Additionally, this synchronous rise validates the potency of the price surge. Such a pattern hints that the upward trend for DOT might be driven by strong demand and could potentially continue with increased momentum.

In this scenario, DOT could break the resistance at $4.13 and climb to $4.37.

In contrast, an adverse decision by the SEC tomorrow might erode investor trust and trigger selling sprees. This could potentially lower the value of DOT, approaching the $3.96 mark.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- KPop Demon Hunters: Real Ages Revealed?!

- Come and See

- Umamusume: Pretty Derby Support Card Tier List [Release]

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

2025-06-10 14:42