As a seasoned researcher who has witnessed the rollercoaster ride that is the cryptocurrency market for the past few years, I can attest to the emotional toll these extreme fluctuations can take on investors. Having lived through multiple market cycles, I have learned that the crypto market is indeed a “mirror of emotions” – reflecting our deepest fears and greed, hope and despair.

In simple terms, during one of its toughest weeks in a while, the digital currency community experienced extreme volatility. On Saturday, Bitcoin was priced at around $100,000, but by Tuesday it had surged to a record high of over $108,000. However, following comments from the Federal Reserve about potential tightening in 2025, its value plummeted by approximately $16,000 to hit a multi-week low of $92,000.

It has regained approximately $7,000 since then and is now approaching $100,000 once more. Beyond triggering billions of dollars in forced sales from overextended traders, these heightened price swings have stirred strong emotions among many investors, leading some to question whether the bull market has concluded.

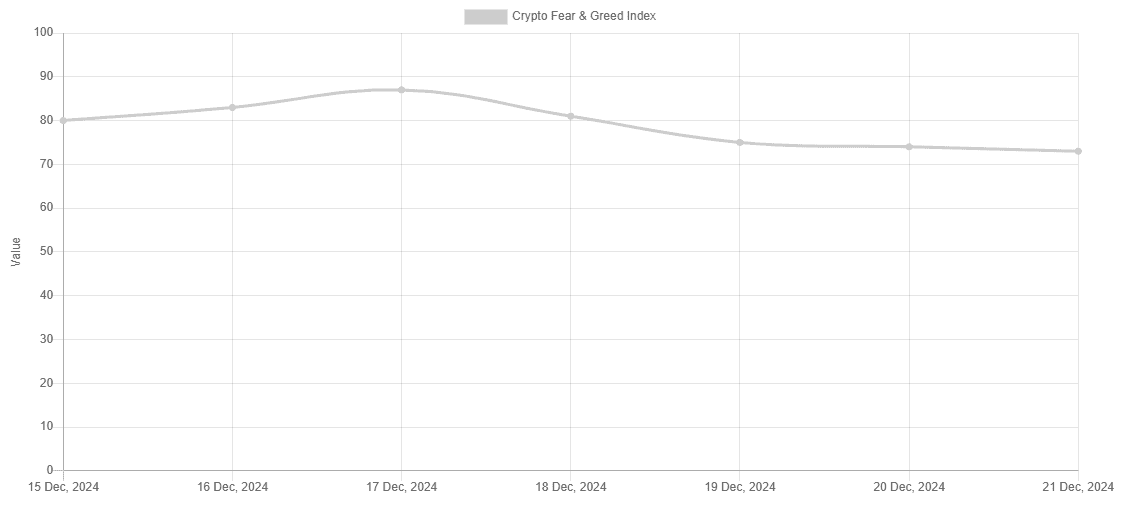

The Crypto Market Sentiment Index, which measures investor feelings towards Bitcoin and other cryptocurrencies, dropped from extremely high optimism (87) to simply high optimism (73) within a few days. This significant shift underscores the emotional aspect of the constantly fluctuating crypto market. However, when we step back and view it in broader terms, it’s all about perception.

The Emotional Part

It’s clear that emotions play a significant role in our lives, making us distinctly human. This is equally true for financial markets, particularly the volatile crypto market, where drastic price swings are commonplace. It’s challenging to suppress emotions when observing substantial fluctuations in one’s portfolio, whether it’s a rapid increase or a steep decline within a short period.

In his latest post on X, Julian Hosp, CEO of Bake, emphasized the significance of both emotions and viewpoint, particularly during market corrections. He asserts that what truly matters in a person’s perspective is the direction, rather than specific numerical values.

“Here’s the crazy thing about crypto: It doesn’t matter if Bitcoin is at 30k, 60k, or 100k – it’s all about the direction. Price goes up? Everyone’s euphoric: 90k to 100k? Amazing. 108k to 100k? Disaster. Same price, totally different vibes.”

Let’s examine the events that occur during significant upward or downward price movements of Bitcoin, commonly known as green or red candles. When Bitcoin’s value rapidly increases toward an unprecedented high, an exuberant mood arises among investors. Recall the incident in 2021 when Bitcoin reached $70,000? People eagerly watched Bitcoin on Twitter with the laser eyes emoji, anticipating its price to reach $100,000. However, what followed was a decline, leading to a prolonged bear market for Bitcoin that lasted over a year.

During that challenging time, fear reigned supreme, particularly as major players like FTX and Celsius collapsed. However, in 2023, the scene shifted dramatically when BlackRock applied for a Bitcoin ETF spot, virtually ensuring the U.S. Securities and Exchange Commission would approve such investments. This was reminiscent of when Donald Trump, who had pledged support for cryptocurrencies during his campaign, won the elections, leading to a surge in BTC prices.

As a researcher, I can’t help but express my astonishment as we crossed into six-digit territory with our asset. The excitement that had been building up started to reach a crescendo when it hit the $100,000 mark. However, it surged even higher to $108,000 before retreating back to $100,000. At this point, the general mood wasn’t as exuberant as one might expect, given that just two years ago, reaching this level seemed unfathomable.

Mirror of Emotions

According to Hosp, the cryptocurrency market reflects people’s emotional states such as greed, fear, and hope; essentially, it’s based on individuals’ perceptions of where the market might be going next.

He noted that the ultimate utility is the price itself, and rationality goes away when that price and trends “dominate over facts.” He added that large green candles “generate more hype than any actual numbers ever could.”

As a crypto investor, I understand that it’s tough to separate feelings from financial decisions, especially with the volatile nature of cryptocurrencies. Yet, during periods of steep corrections like the one we’ve seen this week, it’s crucial to step back and view the bigger picture. Ask yourself: Is my portfolio stronger now than it was a few months or years ago? If the answer is yes, then it’s important to stay composed and continue with your investment strategy. If not, take a moment to evaluate where things may have gone awry and consider what adjustments can be made for future success.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-21 11:18