Ah, the labyrinth of Blockchain and Crypto in China, where the government says “No” to crypto but enthusiastically waves its banners for blockchain. It’s a classic tale – forbid the trade but build infrastructures like a true actor on a stage, huh? 🍿

Now, with Hong Kong donning its flashy crypto market attire, word on the street is that a delightful loophole is beginning to unfurl its wings. What a plot twist!

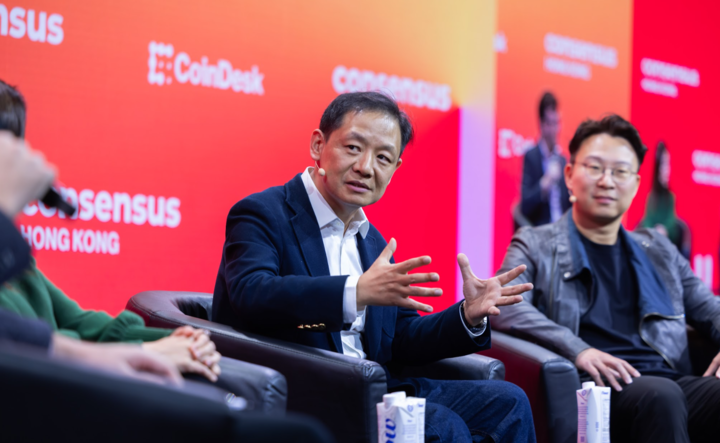

If China can let investors dabble in U.S. stocks via its Qualified Domestic Institutional Investor (QDII) program, then why not allow a little Bitcoin tango? One witty expert, Yifan He, jested at Consensus Hong Kong: “Control is the name of the game, and Beijing seems to have cracked it.” 🎩

In this grand theater, we have not one, but two elaborate scripts for mainland investors to buy and sell stocks beyond the Great Wall. First, the esteemed QDII, permitting a select few privileged souls to venture into U.S. ETFs armed with their precious RMB.

Then there’s the Shanghai-Hong Kong Connect and Shenzhen-Hong Kong Connect, allowing Chinese investors to hop into the Hong Kong stock scene through mainland securities firms – and all in RMB, of course, because why not keep it within the family?

“The secret here, dear audience, is ensuring that capital doesn’t waltz freely out of our beloved China,” He continued, dropping nuggets of wisdom on stage. If only every system could be so neatly packaged, right?

These capital controls are a hearty recipe to prevent currency swings and a mass exodus, all for protecting the noble RMB’s dignity. This is also why Hong Kong’s crypto ETFs, bless their heart, are still waiting at the gates, unable to cross the mainland threshold.

“So what’s the distinction between a Hong Kong-regulated stock and a crypto asset?” He asked, the audience chuckling along. “If there’s a system for buying and selling in RMB, while managing to keep everything inside China, then it appears to be just another shiny investment product.” 🍷

Ah, but wait! This system won’t allow the eager Chinese investors to cradle their crypto like a prized pet. Nope! Purchases will be graciously held by intermediaries like licensed securities firms, because who doesn’t enjoy a little oversight?

“They get to buy crypto, but it’s not like they’re actually *holding* it,” He quipped. “The securities firm is the one getting cozy with your assets.”

This curious model mirrors China’s traditional views on stock and ETF investments, where mainland investors play the game but never get the trophy.

Like adventurous traders dabbling in U.S. ETFs via QDII while never holding the loot in their own hands, they can dip their toes into crypto without ever touching the elusive underlying assets. No money dances across the borders, my friends.

For a country packed with 200 million retail investors eager for a slice of action, this regulated access to crypto through Hong Kong’s sandbox might just be the thrilling compromise that Beijing seeks.

Blockchain vs. Crypto

China has long championed blockchain technology while giving crypto the cold shoulder, like a darting magician avoiding the spotlight.

“We don’t allow guns in China, but we can still forge steel,” He illustrated with some flair. “The tech itself is open for business, enabling all sorts of magical applications. But if something occurs that ruffles the regulatory feathers? Well, that’s an entirely different performance.” 🎭

However, based on his recent tête-à-têtes with financial regulators, a blossom of change may be on the horizon.

“I do see a glimmer of interest from financial regulators,” He shared, sounding almost optimistic. “They’re starting to murmur about Bitcoin, realizing we ought to pay closer attention to digital assets.”

Could this spark a widespread hug for crypto? Just two years back, He would have bet his bottom dollar on ‘zero chance.’

“Now, I’d wager that there’s a better than 50% shot at this in three years,” he concluded, leaving us all on the edge of our seats. 🎉

And those odds? You’ll want to take them to Polymarket!

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Basketball Zero Boombox & Music ID Codes – Roblox

- Umamusume: Pretty Derby Support Card Tier List [Release]

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- League of Legends MSI 2025: Full schedule, qualified teams & more

2025-02-28 01:05