Is Bitcoin Headed to the Moon or Just Flying High? 🤔🚀

As of June 4, 2025, our dear digital gold dances around the $105,779 mark, nudging itself up by a humble 0.40%. The daily voyage remains tighter than a purse string, no wild swings—just the calm before the storm or perhaps just a very polite stroll on the financial boulevard.

Ticking above the $105,000 threshold, Bitcoin seems to wear a slightly mischievous grin, hinting that the long-term bullish charm is flirting back with the market. Institutional investors, those gray eminences of finance, are quietly stocking up, perhaps imagining their future yacht cruises. Meanwhile, retail lovers—those small investors full of hope and FOMO—are still sitting on their hands, waiting for the grand rush that might still be a myth, or maybe just fashionably late.

The current whispering winds suggest a bullish undercurrent, despite a short-term moody attitude. Keep reading, dear reader, for the latest tales of treasure and trepidation!

Binance Spot Volume and LTH Realized Cap — The Big Players Are at Play 🎲

CryptoQuant’s insightful eyes reveal that spot trading volume on Binance has jumped from a mere 26% to an impressive 35%. Someone’s obviously been busy filling their pockets—perhaps with digital coins, perhaps with dreams of riches. The big guns appear to be accumulating Bitcoin like a squirrel gathering nuts for winter.

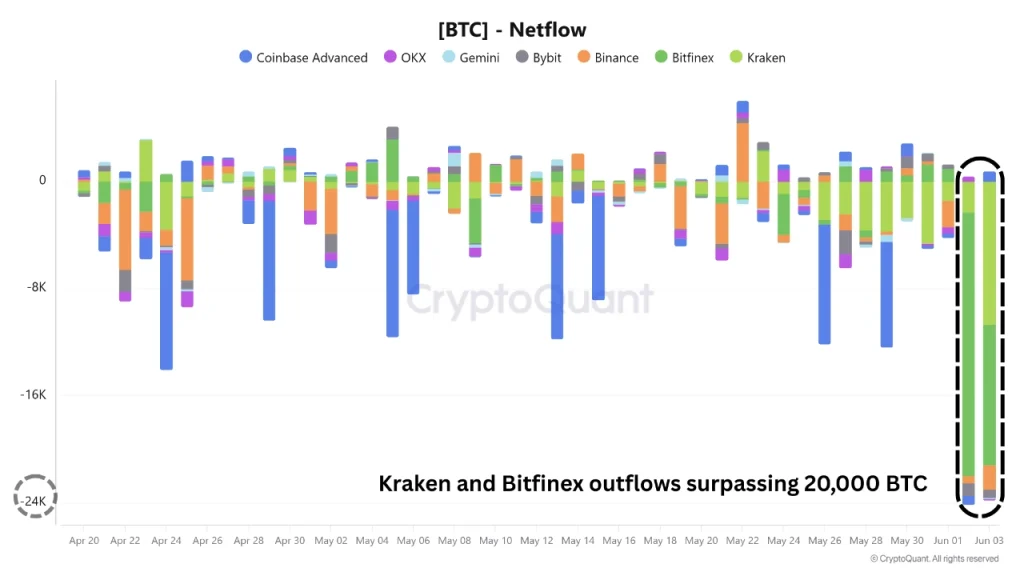

Even more telling, long-term holders (LTH), those hardy souls who have kept their Bitcoin for over 155 days, are not parting with their treasures. The number of wallets with over $20 billion in holdings signals that the smart money is working diligently in the shadows, quietly building a fortress of wealth. Meanwhile, Kraken and Bitfinex have shown some outflows—more than 20,000 BTC leaving the premises—making this year’s market story more dramatic than a Russian novel.

All signs point to a bullish horizon, dear reader! With declining reserves and long-term demand rising, the trend may just be getting started. Who knows, maybe soon we’ll all be sipping cocktails on yachts, or at least chatting about it over tea.

- Also Read:

- California Passes Bill to Accept Bitcoin for Government Payments by 2026

- And perhaps even more exciting, the local bakery now accepts Bitcoin (just kidding, or are they?)

Retail Participation — The Curious Case of the Cautious 🧐

While the institutional titans march forward with confidence, retail investors seem to prefer the shadows—perhaps afraid of another market sneeze. CryptoQuant’s latest findings show transfers under $10,000 have dipped by 2.45% over the past month, as if small investors are all collectively playing hide-and-seek with their wallets.

This reticence might mean we’re still in the early stages of some grand bull run, or perhaps everyone’s still recovering from the Q1 2025 market hangover. Either way, the scene is set for a potential drama.

Retail euphoria has not yet arrived, and on-chain demand is falling

“In the last 30 days, retail demand has fallen by approximately 2.45%, indicating that smaller investors have not yet reached a euphoric dynamic in the current market.” – By @caueconomy

— CryptoQuant.com (@cryptoquant_com) June 4, 2025

So, dear reader, the dichotomy persists: mighty institutional confidence versus retail hesitation. If this dance continues, we might enjoy a gentle upward climb—no wild rollercoaster—perhaps the calm before the next storm or just the market’s way of saying, “Relax, I got this.”

To reach new heights—say, a lofty $120,000—the retail folks will need to join the party. Until then, sit back, enjoy the show, and keep your digital pockets ready.

Never Miss a Beat in the Crypto World! 🎉

Stay in the know with breaking news, shrewd analysis, and all the latest gossip from the world of Bitcoin, altcoins, DeFi, NFTs, and more. Because who doesn’t love a good bubble to watch?

FAQs — Because the Curious Never Rest

What is the Bitcoin price prediction for this month?

With a dash of hope and a sprinkle of luck, BTC might end the month around $110,000—fingers crossed or just wishful thinking? 🤞

How much will 1 Bitcoin cost in 2025?

CryptoKnights suggest a peak of $168,000—enough to buy a small island or at least a fancy dinner—if the bullish winds keep blowing.

How much will 1 Bitcoin be worth in 2030?

Hold on tight: predictions say it could zoom to a staggering $901,383.47, making earlier dreams of riches look like chump change.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- Which Is the Best Version of Final Fantasy IX in 2025? Switch, PC, PS5, Xbox, Mobile and More Compared

2025-06-04 15:20