Support for Bitcoin has remained strong at roughly $90K, causing a modest rebound.

Despite the ongoing optimism, it seems the current upward push may not be strong enough to initiate a significant surge towards a new record high. Instead, there could be a period of stability or sideways movement in this region for now.

Technical Analysis

By Shayan

The Daily Chart

Following a dip in value, Bitcoin has encountered substantial buying interest around the important $90K mark, demonstrating the involvement of purchasers at that price point. This support coincides with the midpoint of its long-term upward trendline, underscoring its importance and validity.

Although a small surge in purchasing activity caused a modest upward swing, the overall energy behind the market movements is still weak, hinting at further consolidation around this support area.

To kick off a fresh surge towards a record-breaking peak, the Bitcoin market needs an increased appetite from buyers and a robust wave of optimistic energy (bullish sentiment).

The 4-Hour Chart

As a crypto investor, I’ve noticed that the $90K mark on my 4-hour chart serves as a crucial defensive barrier. Over the past few months, it has effectively withstood the downward pressure, making me confident that it could potentially hold strong in future price fluctuations.

Recently, the price trend appears to have shaped an upside-down “head and shoulders” pattern around this particular level, which is also accompanied by a period of accumulation. This setup often indicates a possible upturn in the market, suggesting a bullish recovery might be on the horizon.

Yet, for Bitcoin to surge past the substantial $108K barrier, it requires growing market interest and trading activity. Until that happens, it’s expected to hover around the $90K zone, waiting for a clearer indication of its next direction.

On-chain Analysis

By Shayan

U.S. institutions and American investors significantly influence the fluctuations in the market. Understanding their actions could offer beneficial predictions about the immediate future of the market.

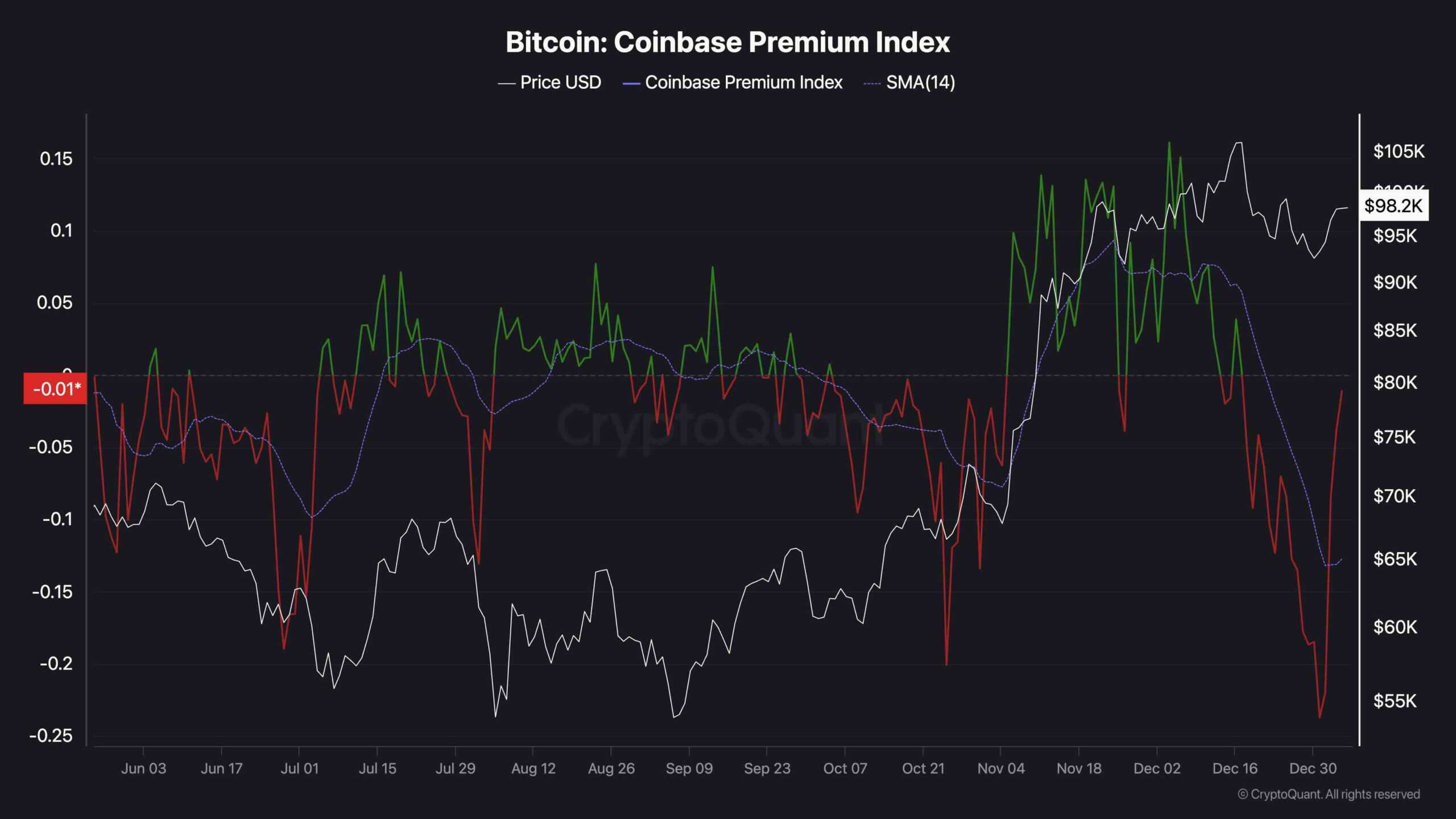

The Bitcoin Coinbase Premium Index serves as an essential indicator by measuring the difference in demand between purchasing and selling Bitcoins on Coinbase, a primarily American-focused trading platform, versus Binance.

The Coinbase Premium Index has experienced a significant surge lately, climbing above its 14-day Moving Average for the first time in a while. This move suggests a change in market dynamics, as U.S.-based buyers appear to be showing renewed enthusiasm and pushing prices upwards. Additionally, the index is getting close to zero, which typically indicates this shift in buyer interest.

If the Coinbase Premium Index consistently stays above its 14-day moving average and turns positive, it might suggest that U.S. investors are increasingly influential in Bitcoin trading. Such a situation could potentially trigger a bullish trend due to increased buying activity from this significant group of market players.

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

- DAG PREDICTION. DAG cryptocurrency

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- New Mass Effect Jack And Legion Collectibles Are On The Way From Dark Horse

- Record Breaking Bitcoin Surge: Options Frenzy Fuels 6-Month Volatility High

- „I want to give the developer €30 because it damn slaps.” Baldur’s Gate 3 creator hopes Steam adds tipping feature for beloved devs

2025-01-05 15:32