In the dusty corners of the digital marketplace, Bitcoin has been lounging around, stubbornly refusing to budge from its cozy spot just below the $100K mark. It’s like a stubborn mule, content to graze on the grass of indecision, while the world watches with bated breath.

But hold onto your hats, folks! Change might just be lurking around the corner, ready to pounce like a cat on a laser dot.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

Ah, the daily chart—a veritable soap opera of price action! Bitcoin has been flopping about like a fish out of water, caught in a sideways dance between the lofty heights of $100K and the murky depths of $92K. A breakout from this waltz could send the asset soaring to new heights or plummeting into the abyss, like a rollercoaster designed by a madman.

But wait! The RSI is waving a little red flag, hinting at bearish momentum. So, don’t be surprised if Bitcoin takes a little dip below $90K, perhaps even flirting with the 200-day moving average around the $80K zone, before deciding to rise again like a phoenix from the ashes.

The 4-Hour Chart

Now, let’s peek at the 4-hour chart, where we find a classic descending channel—a pattern as predictable as a soap opera plot twist. The market has been stuck in this channel for weeks, but a breakout could send Bitcoin rocketing past $100K, igniting a bullish run that would make even the most stoic investor crack a smile.

But beware! If this bullish pattern decides to take a nosedive, it could unleash a wave of bearish momentum that would make even the bravest trader quiver in their boots.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

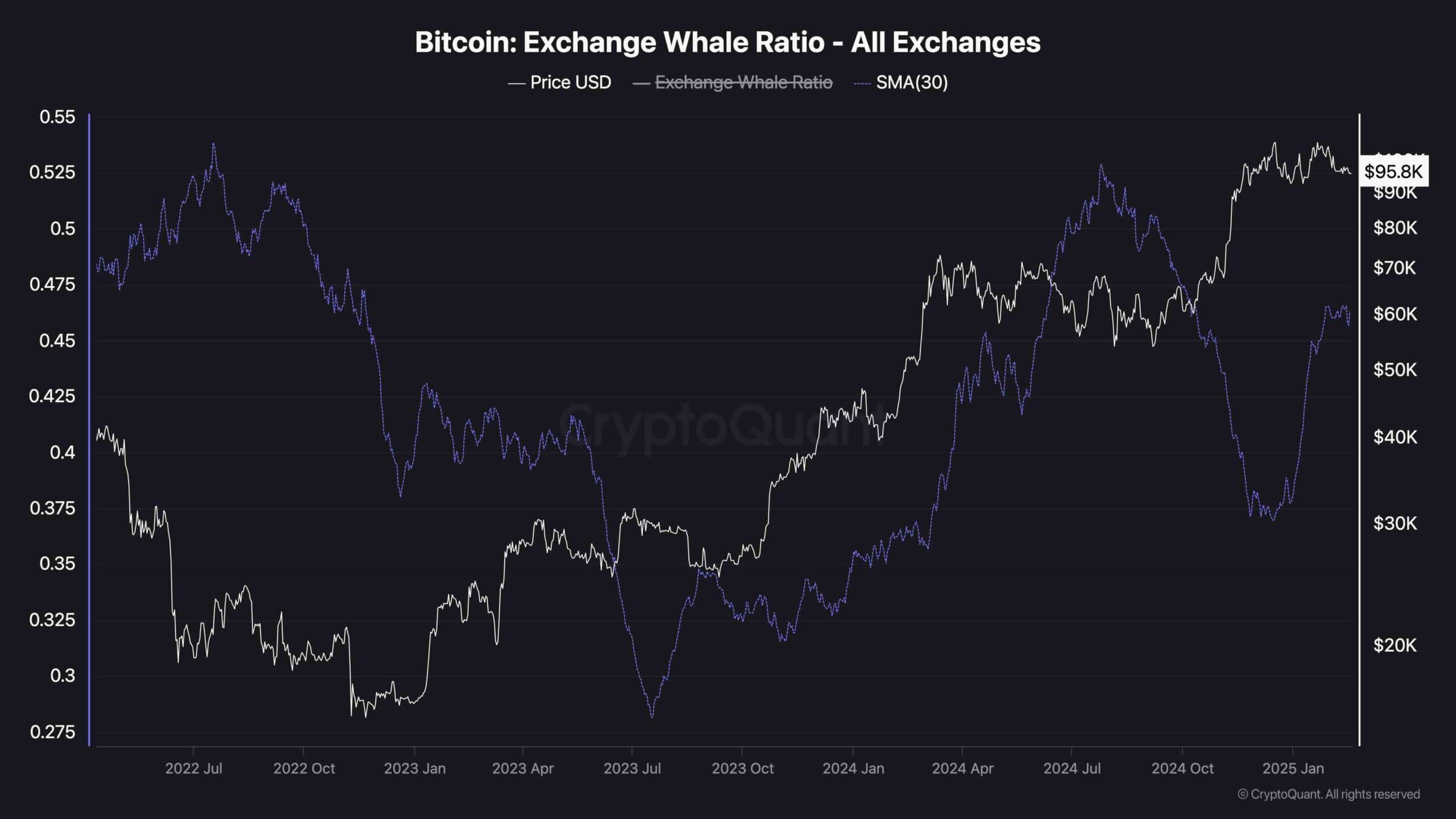

Exchange Whale Ratio

In the grand theater of Bitcoin, a troupe of whales—those hefty investors—holds the spotlight. Their behavior, much like a soap opera villain, can dictate the fate of the market. The exchange whale ratio is our trusty sidekick, helping us decipher the current state of affairs.

This metric measures the ratio of large deposits, likely made by our whale friends, to total exchange inflows. High values signal that these whales are selling off like there’s no tomorrow, which could spell trouble for the rest of us.

Interestingly, while the whale ratio has been on the rise, Bitcoin hasn’t taken a significant tumble. It’s like watching a tightrope walker who’s somehow managing to stay upright despite the odds. This resilience could hint at a more stable future for BTC, which is a comforting thought in this wild west of cryptocurrency.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-02-18 17:02