While gold is basking in the glow of global unease, defense stocks are shamelessly climbing the ladder of profit. Weapons manufacturers, aerospace firms, and military tech companies are loving the surge in global tension—because nothing says “good business” like the looming shadow of conflict.

The War Machine: Cashing in on Chaos While the Stock Market Flounders

Ever since Israel and Iran decided to play a real-life version of “Whack-a-Mole” last week, the world’s been on high alert. And Google has noticed: global searches for the phrase “World War” have shot up like a missile on June 15, peaking at a dramatic score of 85 out of 100. For those obsessed with the latest trends, this is the “must-search” phrase of the season. And it gets better—on June 14, the term hit an almost perfect score of 99, before maxing out at 100 the very next day. It’s safe to say that people are wondering if they need to start stockpiling canned beans.

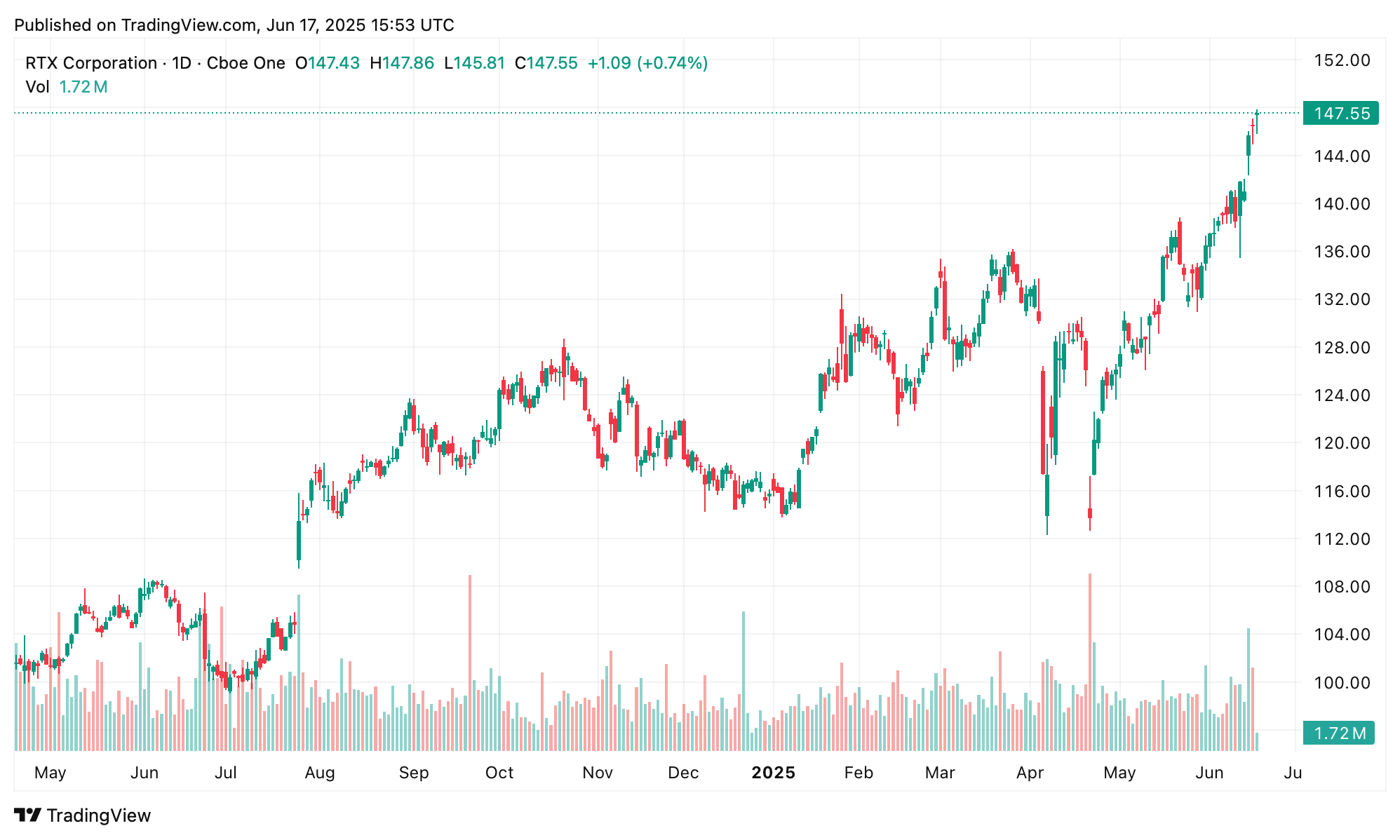

Meanwhile, as the world prepares for its potential *epic* showdown, gold is calmly sitting pretty at $3,385 per ounce on June 17. Stock markets, on the other hand, are having a bit of a tantrum—major U.S. indexes are slipping, and the crypto world just took a 3% tumble. But, not to worry, the defense sector is here to save the day. Take RTX Corp. (the artist formerly known as Raytheon Technologies), for example—its stock has soared 5.91% in the past five days. Talk about cashing in on a crisis!

Lockheed Martin (NYSE: LMT) isn’t far behind, gaining 2% in one day and climbing a total of 2.36% over the past five days. General Dynamics (NYSE: GD) is up 1.33%, while Northrop Grumman (NYSE: NOC) managed a neat 3.67% gain. And Howmet Aerospace Inc. (NYSE: HWM) isn’t far behind with a 1.84% bump. Let’s not forget about GE Aerospace, Leidos Holdings, Curtiss-Wright Corporation, HEICO Corporation, and Huntington Ingalls Industries—all of them are holding steady with solid gains. War may be tragic, but apparently, it’s also profitable. 💰

The surge in defense investments is revealing something bigger: investors are moving their money from riskier bets to the reliable chaos of war-driven industries. It’s like a global reality check, with capital flows now more concerned about geopolitical hedges than, say, anything resembling calm. Because who needs diplomacy when you can have dividends?

So, what’s the takeaway here? The world may be on edge, but the stock market is adjusting in a very particular way. Investors are no longer just nervously speculating about the future—they’re diving right into industries that thrive in uncertainty. It’s not just a reaction; it’s a full-blown recalibration of priorities in a world where stability is a distant memory. As the world spins further into chaos, it’s clear: some people are definitely benefiting from the madness. 😎

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- League of Legends MSI 2025: Full schedule, qualified teams & more

2025-06-17 20:31