In a twist that would make Agatha Christie clutch her pearls, the US Consumer Price Index (CPI) has decided to debut on a Friday this week, like a debutante crashing a formal ball in mismatched socks.

The September inflation report, dropping this Friday like a hot potato, arrives just as the government shutdown turns Washington into a very expensive game of musical chairs. The Federal Reserve, now starved of data, is left nibbling stale donuts and squinting at spreadsheets like a myopic owl.

CPI Steals the Spotlight as Shutdown Curtains Fall on Retail Sales and Jobs Data

With the usual suspects-jobs and retail sales reports-now on strike, the CPI is set to perform a solo recital five days before the Fed’s October 29 policy meeting. Adam Kobeissi, a man clearly in possession of both wits and a sense of drama, quipped: “Something unusual is happening this week… Not only is it 5 days before the October 29th Fed meeting.”

“Something unusual is happening this week… Not only is it 5 days before the October 29th Fed meeting,” wrote Adam Kobeissi, who clearly missed his calling as a bard of understatement.

The CPI, usually as punctual as a Swiss watch (and about as exciting), typically graces us on Tuesdays or Wednesdays. The last Friday release was in January 2018, when millennials still thought Bitcoin was a typo and avocado toast was just breakfast.

Normally, the CPI drops 1-2 weeks before the Fed’s meetings, giving policymakers time to sip chamomile tea and ponder spreadsheets. This time? It’s like serving a five-course meal five minutes before the guests arrive. Chaos!

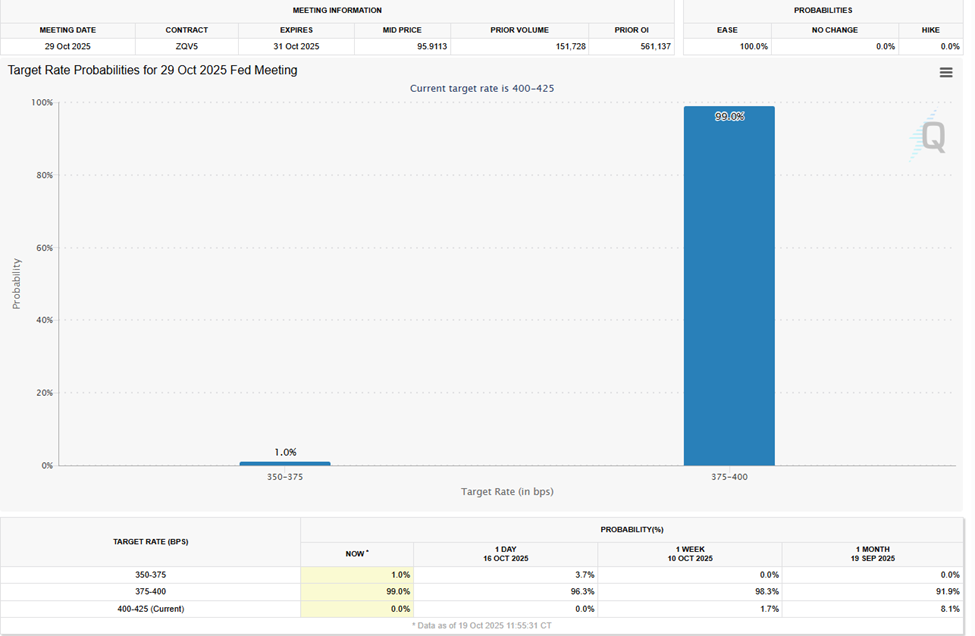

Markets, ever the drama queens, are pricing in a near-certain 0.25% rate cut. But whispers circulate that softer CPI could unleash a 0.5% cut-a veritable economic rollercoaster for the bold (or foolish). As one user mused: “If it comes in lower than expected, the chances of a 0.5% rate cut could increase.” Thrilling stuff!

“Right now, there’s about a 99% probability of a 0.25% cut…If it comes in lower than expected, the chances of a 0.5% rate cut could increase,” one user remarked, clearly the Hemingway of financial commentary.

Inflation, Shutdown, and the Fed’s High-Stakes Game of Jenga

Analysts, those eternal optimists, expect September’s CPI to show inflation cooling like a soufflé in a snowstorm. But the government shutdown? It’s the uninvited guest who’s set fire to the data collection tent.

Policymakers now grope in the dark like a nearsighted mole, relying on stale data as if reading tea leaves. Friday’s report is the lone beacon before the Fed’s decision-a beacon that could either guide them to safety or steer them into an iceberg.

Fed officials, meanwhile, fret over a wobbly labor market like a nervous nanny. But a hotter-than-expected CPI? That’d be the economic equivalent of a pie in the face at a funeral. Inflation’s grand entrance might just force the Fed to juggle flaming torches while riding a unicycle. 🎪

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Gold Rate Forecast

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Mario Tennis Fever Review: Game, Set, Match

- 2026 Upcoming Games Release Schedule

- Every Death In The Night Agent Season 3 Explained

- Beyond Linear Predictions: A New Simulator for Dynamic Networks

2025-10-19 23:23