As a seasoned researcher who has witnessed numerous ups and downs in the cryptocurrency market, I find myself intrigued by Binance‘s latest move to delist several pairs, including PEPE. With my years of experience, I can confidently say that such decisions by major exchanges like Binance can have a significant impact on the underlying cryptocurrencies.

TL;DR

- Binance announced another delisting effort, this time involving PEPE and two other altcoins.

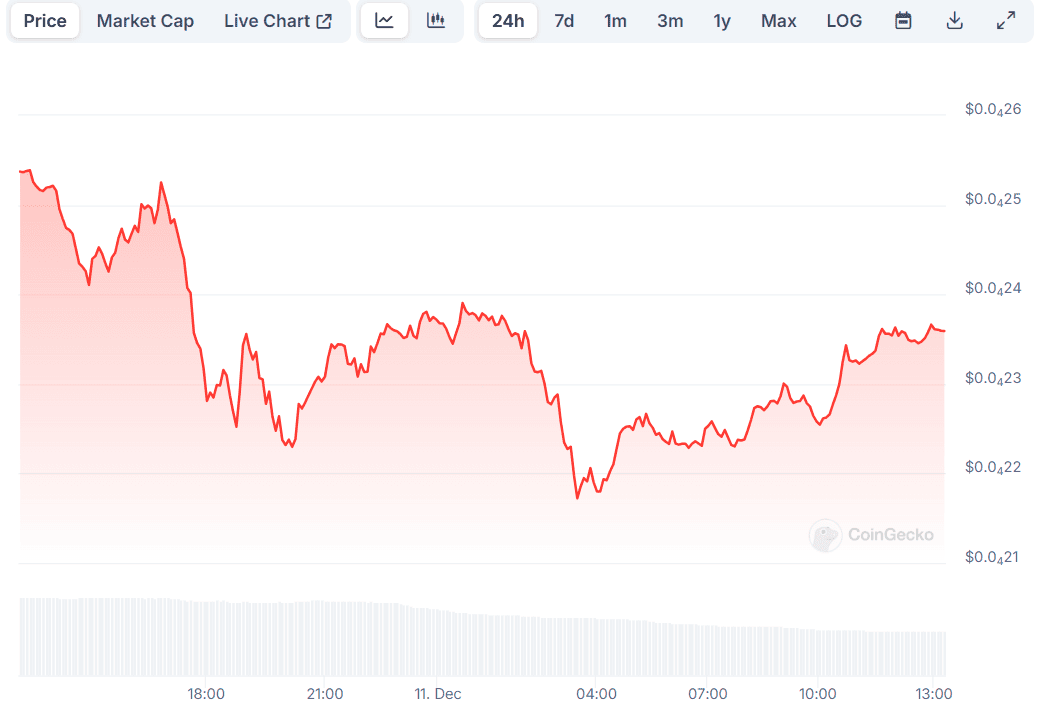

- The price of the frog-themed token has plummeted daily. Its pullback could be a result of Binance’s announcement and the recent bloodbath in the meme coin sector.

Removing These Pairs

Regularly, the global leader in cryptocurrency trading ensures user safety and a top-tier marketplace by examining all listed pairs. Consequently, certain pairs are removed from the platform because of factors like low liquidity and weak trading activity.

According to their recent assessment, Binance plans to discontinue the trading of these pairs as of December 13: PEPE/USDT, DCR/BTC, and ZEN/ETH.

Binance confirmed that removing a trading pair for spot trading won’t prevent users from trading the base and quote tokens in different available pairs. In essence, you can still trade these tokens in alternative spot trading pairs on Binance.

A wave of delisting initiated by a prominent exchange such as Binance often negatively impacts the associated cryptocurrencies. This is primarily due to decreased liquidity, potential damage to reputation, and other factors. For instance, the meme coin Pepe (PEPE) has dropped by 7% over the daily scale, while DCR has fallen by 4%. Interestingly, ZEN has seen a rise of 2%.

It’s important to note that PEPE’s underperformance might be associated with the recent sweep, or “red wave”, that has affected the entire meme coin market.

To put it simply, if Binance had delisted PEPE completely, its price drop could have been even larger. This is because we’ve seen similar significant declines in the prices of coins like Rupiah Token (IDRT), Keep3rV1 (KP3R), Ooki Protocol (OOKI), and Unifi Protocol DAO (UNFI) when Binance stopped supporting them, which occurred back in November.

A price drop similar to the one in February occurred when Binance temporarily halted trading for Monero (XMR) and three other altcoins. Following this announcement, the privacy-focused token saw a decrease of over 20%.

The Opposite Effect

Conversely, when cryptocurrencies get listed on Binance, it frequently results in an upward trend for their prices, thanks to heightened accessibility, a surge in market trust, and various additional factors.

In November, I discovered that the firm had rolled out PONKE/USDT perpetual contracts, offering a potential 75x leverage. Minutes after this announcement, the price of the Solana-backed meme coin PONKE surged by an impressive 15%. This rapid increase in value is quite thrilling as a crypto investor!

In October, the price of Simon’s Cat (CAT) saw a substantial surge after Binance introduced 1000CATUSDT perpetual contracts on their futures trading platform.

Read More

- “I’m a little irritated by him.” George Clooney criticized Quentin Tarantino after allegedly being insulted by him

- South Korea Delays Corporate Crypto Account Decision Amid Regulatory Overhaul

- What was the biggest anime of 2024? The popularity of some titles and lack of interest in others may surprise you

- Destiny 2: When Subclass Boredom Strikes – A Colorful Cry for Help

- Deep Rock Galactic: The Synergy of Drillers and Scouts – Can They Cover Each Other’s Backs?

- Sonic 3 Just Did An Extremely Rare Thing At The Box Office

- Final Fantasy 1: The MP Mystery Unraveled – Spell Slots Explained

- Influencer dies from cardiac arrest while getting tattoo on hospital operating table

- Smite’s New Gods: Balancing Act or Just a Rush Job?

- Twitch CEO explains why they sometimes get bans wrong

2024-12-11 15:52