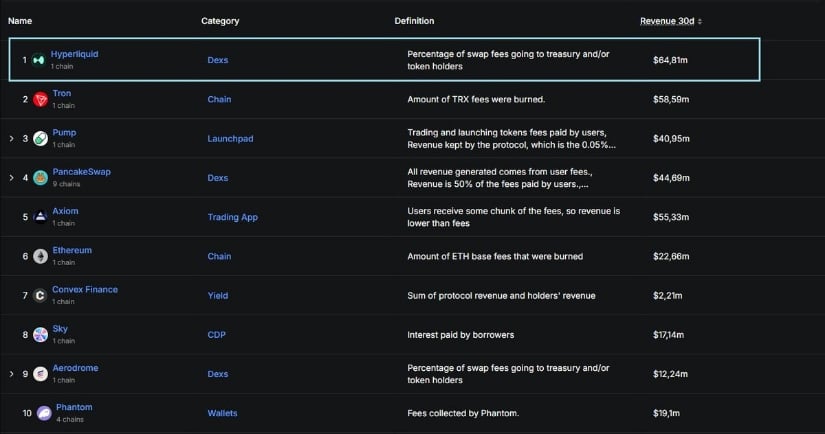

In the whimsical tapestry of the last thirty days, Hyperliquid has danced its way to a staggering $64.8 million in revenue, pirouetting past the likes of Tron and Ethereum with the grace of a prima ballerina. This performance, dear reader, is not merely a number; it is a testament to the fervent activity and insatiable demand of its users. Unlike the majority of its peers, Hyperliquid, in a fit of generosity, allocates a whopping 97% of its revenue to buy back $HYPE tokens, a move that not only benefits its holders but also sets it apart in this chaotic carnival of crypto.

Hyperliquid Tops the Charts in Crypto Revenue

Ah, behold! Hyperliquid emerges, flaunting its impressive figures. In the past month, it has raked in a jaw-dropping $64.8 million, leaving behind the titans of the industry like Tron and Ethereum, as if they were mere shadows in its wake. As the astute analyst Holosas has noted, Hyperliquid is not just leading; it is reigning supreme. Such consistent income speaks volumes about genuine user engagement and an ever-growing appetite for its offerings.

In a world where most protocols squander their earnings, Hyperliquid’s 97% revenue reinvestment into $HYPE buybacks is a rare gem of capital efficiency, transforming protocol growth into tangible value for its holders. A round of applause, if you please! 👏

Hyperliquid Holders Are Holding Firm

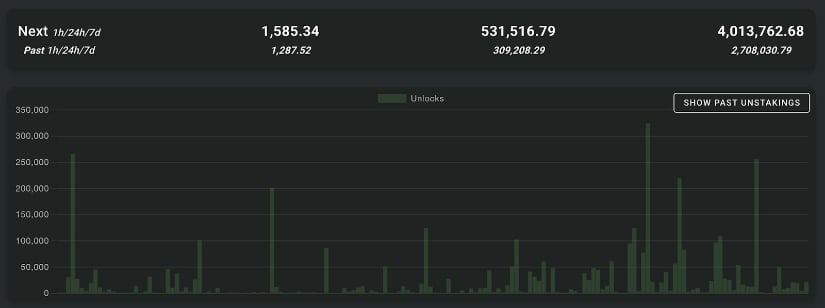

Even as $HYPE soared to $44, the unstaking activity on Hyperliquid has remained as quiet as a library on a Sunday afternoon. According to the ever-watchful MetamateDaz, there’s been no mad dash for the exits—just a calm sea of steady hands and resolute conviction. In a market that often reacts to every tick, this tranquility amidst a price surge is nothing short of remarkable.

This steadfastness reinforces the bullish narrative; after all, with a record-setting $64.8 million in revenue and a commitment to buybacks, the foundation appears as solid as a rock. If the timid holders have already fled and the long-term players are firmly planted, then HYPE is poised for greatness.

On-Chain Strength vs. Technical Caution, A Split Picture for $HYPE

Ah, the duality of on-chain strength and technical caution presents a curious tableau for $HYPE. Recent data showcases impressive fundamentals—$64.8 million in protocol revenue and minimal unstaking activity—yet the technical setup is flashing early signs of weakness. Analyst Sarjana Crypto has pointed out a bearish divergence on the chart, where momentum indicators like RSI are declining even as the price ascends to $44. Such a mismatch often heralds a short-term peak, like a balloon ready to pop! 🎈

From a structural perspective, Sarjana suggests a potential sweep of the Fair Value Gaps, with downside targets lurking near $36 and $30. These zones, marked by previous trading interest, would serve as natural reset points should a pullback occur. Fear not, for this does not spell doom for the broader bullish thesis; rather, it hints that $HYPE may need to cool its jets before embarking on a sustainable ascent.

Retrace Zones Lining Up

After a meteoric rise to $44, $HYPE is now flashing signs of short-term fatigue. The latest 4-hour chart reveals a strong rejection at the highs, followed by a series of bearish candles and a clear loss of upward momentum. The price now hovers near key support around $41, and should this level falter, the next areas of interest lie near $36 and $30.

Crypto analyst Gerlaenco opines that this cooling phase is hardly surprising, given the recent vertical ascent. While Hyperliquid’s on-chain strength remains impressive, with $64.8 million in revenue and 97% funneled into buybacks, the technicals now whisper of a possible retrace.

HYPE Community Not Backing Down

The sentiment surrounding $HYPE is positively electric, with LootbaseX quipping that “every day HYPE is worth $1 more.” This delightful social momentum reflects the broader enthusiasm among holders who have witnessed $HYPE defy the odds of cooldown expectations. Despite the flashing technical warnings, the HYPE community stands resolute, like a fortress against the storm. 🏰

Even if HYPE experiences a technical pullback to fill liquidity gaps near $36 or even $30, such a dip may present a golden opportunity, as the fundamentals remain unscathed. Should momentum persist, the recovery is likely to be as swift as a cat on a hot tin roof!

Final Thoughts

Hyperliquid’s audacious strategy of utilizing nearly all its revenue for $HYPE buybacks distinguishes it from the majority of crypto projects. This model steadily reduces token supply, thereby supporting its value over time. Despite the recent price surge, holders are exhibiting remarkable steadiness instead of rushing to sell, a true testament to their confidence.

Simultaneously, technical signals suggest a potential short-term pullback near $36 or $30, which could offer the market a chance to reset. However, with robust on-chain revenue and low unstaking activity, the overall outlook remains as solid as a rock, and even if HYPE cools off, a swift recovery is anticipated.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- All Songs in Superman’s Soundtrack Listed

2025-06-13 00:22